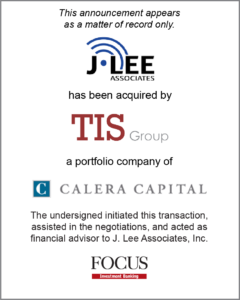

J. Lee has a nearly 20-year history of servicing wireless companies in the New England market. From its start as a professional services company providing project management and site acquisition services, J. Lee expanded into the construction industry and has since grown to become one of the leading providers of wireless construction services in the region. The company’s customers consist primarily of nationwide wireless network operators as well as several of the industry’s leading tower companies. The acquisition provides TIS with a strong foundation for growth in the New England market. J. Lee President James Van Sicklin will continue to oversee the J. Lee operations.

“J. Lee has enjoyed rapid growth over the last few years,” said Mr. Van Sicklin, “and this growth brings both opportunities and challenges. Because of this, I felt that the time was right for J. Lee to become part of a broader entity that could help us scale to meet the growing needs of our customers. The team at FOCUS helped us navigate the entire transaction process, and their deep knowledge of our industry was critical to identifying the right partner for J. Lee and achieving a successful close. We are excited to begin the next chapter in our history and believe that TIS is an excellent home for both J. Lee and its employees.”

“Jim has done a great job of building J. Lee into a very desirable company, and he has attracted a highly talented group of employees that have helped him make the company successful,” said Rich Pierce, FOCUS Managing Director and Telecom Technology & Services Team Leader. “We believe the company’s combination with TIS will give it the resources to continue its rapid growth. We were honored to have the opportunity to work with J. Lee on this transaction.”

Tim Luden, CEO of TIS subsidiary American Cell Enterprises (“ACE”), commented, “I am very excited to be working with Jim and his team. J. Lee brings new capabilities to ACE with a new geography. This will give us another great opportunity to expand the ACE footprint.”

About J. Lee Associates

Located in Marlborough, MA, J. Lee, a veteran-owned company, was formed in 2003 to provide network development consulting and contracting services to the wireless industry. J. Lee’s proven and successful delivery of professional consulting services as well as general contracting services give it the ability to provide a single service, or a comprehensive end-to-end solution, depending upon customer needs. J. Lee is staffed with local, experienced full-time professionals organized into two distinct service offerings, Professional Services and Field Operations.

About Thayer Infrastructure Services

Thayer Infrastructure Services Group consists of Thayer Power & Communication, LLC; LeCom Utility Contractors, Inc.; and American Cell Enterprises, LLC. All three operating companies are leading providers of mission-critical infrastructure repair, maintenance, upgrade, and construction services for the electrical utility, wireline, and wireless communications industries. American Cell Enterprises is the TIS group operating company dedicated to providing the full range of turnkey wireless infrastructure solutions. The TIS family of companies has a deep understanding and strong track record of delivering exceptional day-to-day safety, quality, and service. Acquired by private equity firm Calera Capital in 2020, the company is based in Warren, Michigan, and offers its services across a large regional area including the Central Midwest, Northeast, and Southeast United States.

About FOCUS Investment Banking

With more than three decades of experience, FOCUS Investment Banking is a trusted name in middle market M&A advisory services worldwide. Whether helping to sell, buy, or raise capital, FOCUS strives to maximize the value of every transaction for the benefit of its clients. Securities transactions conducted by FOCUS Securities LLC, an affiliated company, registered Broker Dealer member FINRA/SIPC. For more information, visit www.focusbankers.com.

*These testimonials may not be representative of the experience of all clients; testimonials are not a guarantee of future performance or success.