Building & Infrastructure Services 2Q 2025 Report

While macroeconomic conditions have remained relatively stable, business owners are navigating operational challenges. However, deal flow and buyer interest remain strong across a range of subsectors. Demand for infrastructure improvements—particularly in transportation, utilities, environmental remediation, and specialty construction—remains high, fueled by public and private investment. In this environment, well-run companies are in high demand and often able to command premium valuations.

In Q2, we’ve observed sustained buyer interest in infrastructure services firms, especially those with recurring revenue models, strong customer relationships, and exposure to government or utility-related projects. Strategic buyers and private equity sponsors alike are actively seeking acquisition targets with scalable operations and skilled labor—critical differentiators in today’s market.

Owners are balancing rising input costs, persistent labor shortages, and increased competition, all while trying to meet growing customer demand and regulatory complexity. Many of the business models in these sectors—recurring service contracts, strong regional market share, and critical infrastructure or compliance-driven offerings—are exactly what today’s buyers are targeting. If you’re thinking about a future transition, knowing what drives valuation in your specific niche and how to position your business accordingly is essential.

Market Activity

Building & Infrastructure Services M&A Activity

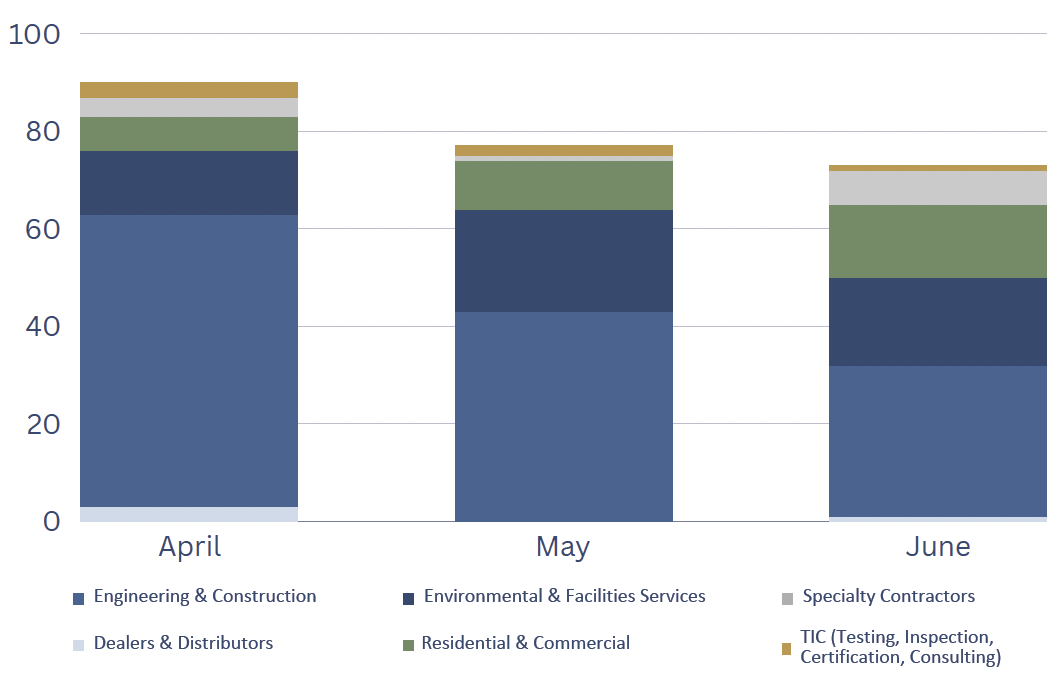

- Building and Infrastructure Services saw a significant amount of activity in the second quarter of 2025. Engineering and Construction and Environmental

and Facility Services made up 78% of transactions with a total of 240 for the quarter. Residential and Commercial Service business made up 13% of transactions while Specialty Contractors 5% and Testing, Inspection and Certification Consultants (TIC) comprised 2.5%.

- Strategic acquirers in the Engineering and Construction subsector continue to be active with a number making multiple acquisitions of mechanical, electrical and plumbing companies.

- Azuria Water Solutions, a provider in infrastructure maintenance and waste water solutions, completed three acquisitions – Am-Liner East in Virginia, C.K. Masonry Company in Tennessee, and BLD Services in LA to further expand its reach into the SE.

- The Waldinger Corporation purchased two mechanical and plumbing contracting companies – Project Design and Piping and Summit Electric expanding their offering in the mid-west.

- The SEER Group purchased three HVAC, electrical and plumbing instillation companies, bringing their total acquisitions to 15 in the last 6 years.

- Verdantas, who provides consulting solutions for the environment, water, and energy transition markets backed by Sterling Investment Partners, completed five strategic acquisitions — Horizons Engineering, Inc., Aqua Engineering Inc., Advanced Earth Sciences, Inc. (AES), Atlantic Resource Consultants, LLC (ARC), and Atlantic Environmental Consulting Services, LLC.

- Environmental and Facility Services subsectors remained active in the second quarter with 52 transactions including Visterra Landscaping Group that acquired two companies – Herzog Landscape Solutions and H&M Landscape Solutions.

- Residential and Commercial Service subsector recorded 32 transactions with security and alarm services continuing the consolidation movement from 2024. Pye-Barker Fire and Safety is still very active in its acquisition strategy with their four acquisitions – Extreme Fp Holdings, Arrow Fire Protection, Alarm Engineering and T&T Moor Enterprises Corp.

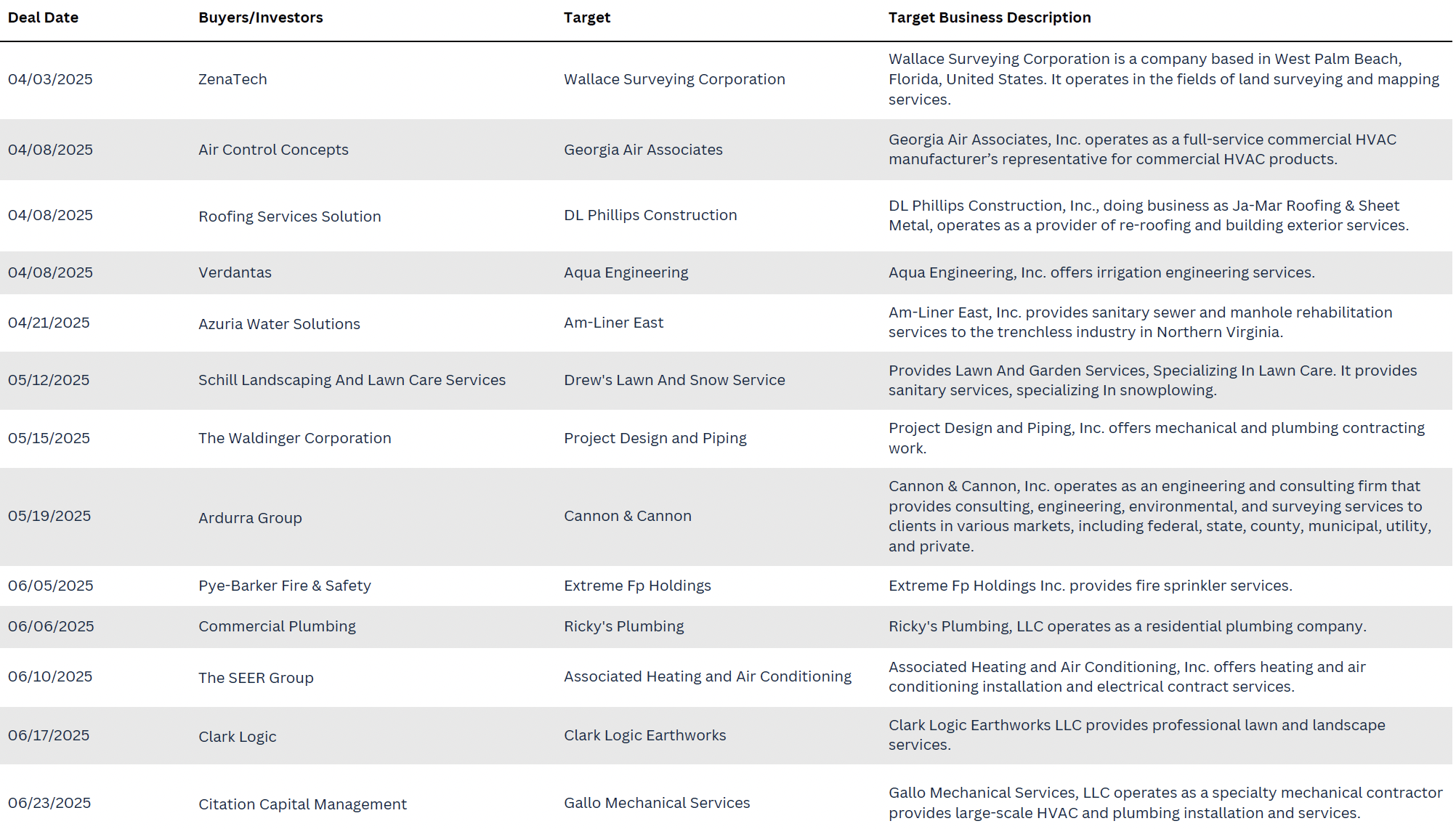

Select M&A Transactions

and Facility Services made up 78% of transactions with a total of

and Facility Services made up 78% of transactions with a total of