Telecom Business Services: Winter 2026 Report

The FOCUS Telecom Business Services Index (TBSI) dipped into negative territory at the end of 2025, dropping 2.1% in the past three months. This compared unfavorably to both the 2.3% gain in the S&P 500 and the 2.6% gain in the NASDAQ over the corresponding time period. Even with this period’s decline, the TBSI is still up 11.4% compared to this same time last year. However, the sector still lagged the broader indices over the full year period, as the S&P 500 gained 16.4% and the NASDAQ gained 20.4% over the course of the past year.Sector multiples increased slightly over the past 12 months. The sector revenue multiple went from 1.0x a year ago to 1.1x currently, while the EBITDA multiple increased from 10.5x to 10.7x.

For the second straight reporting period, the Distributors and Logistics Services sub sector suffered a double-digit loss as it fell 13.3% in the past three months. The sub sector’s losses were broad-based, with ePlus the only company to deliver a positive return. Sub sector multiples closed out the period at 0.8x revenue and 10.4x EBITDA. Both of these are significantly lower than year-ago multiples of 1.1x revenue and 13.0x EBITDA. The Telecom Engineering and Construction sub sector fared significantly better than its TBSI counterpart. While its performance cooled off somewhat from what we have seen in our last few reports, it still turned in a very respectable three-month gain of 8.4%.Four of the five companies in the sub sector had double digit increases, including a 50%+ gain at Baran Group.However, a 2.1% gain at MasTec helped bring down the sub sector’s overall return. Sub sector multiples also showed a strong increase. The revenue multiple jumped up from 0.9x a year ago to 1.3x currently, while the EBITDA multiple showed an equally impressive increase as it went from 8.0x to 10.9x.

PUBLIC MARKETS SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A ACTIVITY

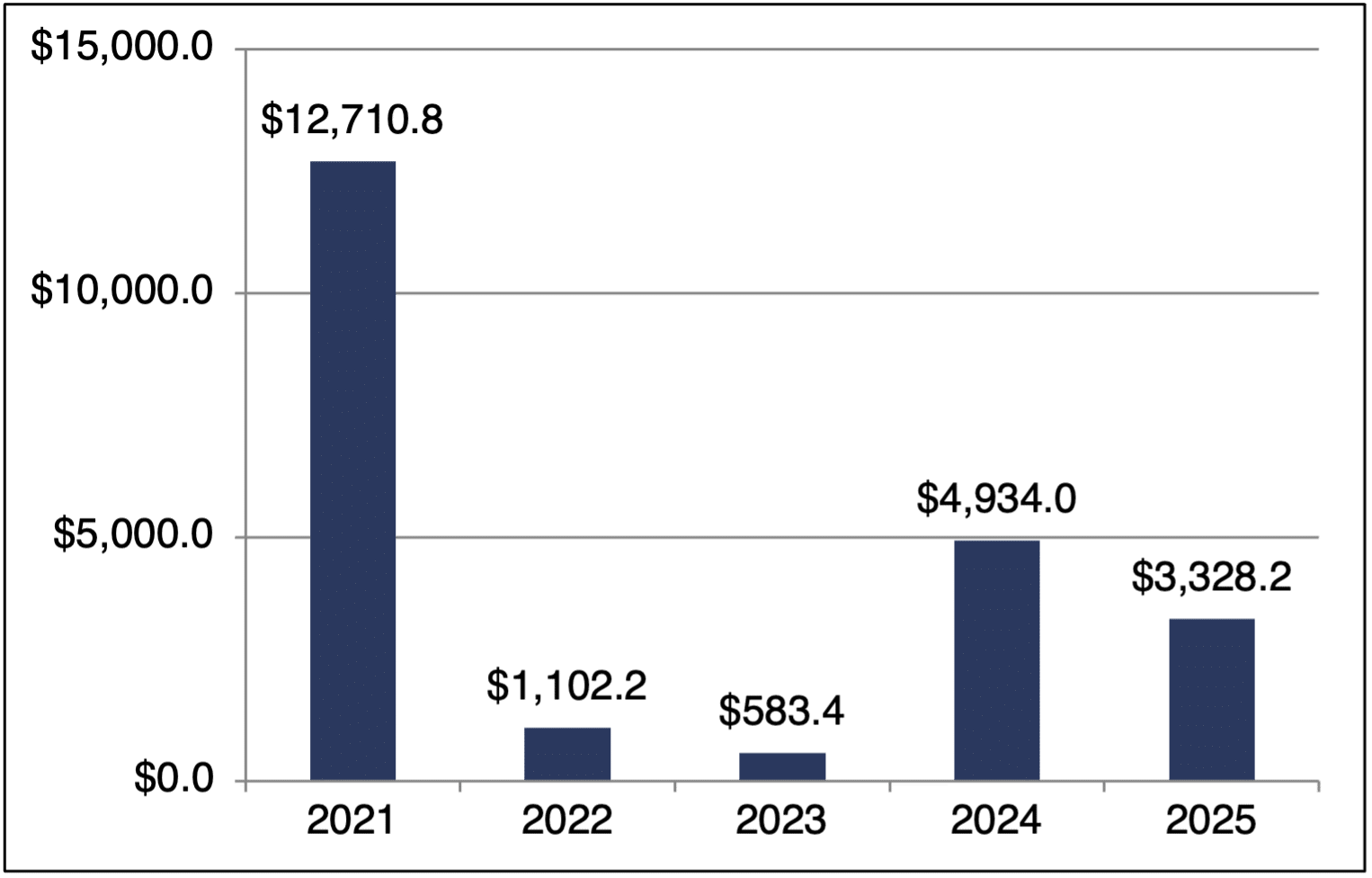

The number of M&A transactions in the Telecom Business Services sector dropped significantly with only 14 transactions in the past three months. However, with nearly $3.2 billion in total announced transaction dollar value, the period was extremely strong based on this metric. In fact, total announced transaction dollar value was much higher in the last three months of the year than it was for the first nine months of 2025 combined. Overall, 2025 was a very solid year for M&A activity in the Telecom Business Services sector. The sector’s 85 transactions represented more than a 30% increase compared to 2024, although it was still far lower than what we saw back in the boom years of 2021 and 2022.The $3.3 billion of total announced transaction dollar value for 2025 was lower than what we saw in 2024 but was still respectable compared to the levels we have seen in other years. All in all, while we would certainly not call the Telecom Business Services M&A market frothy, it did appear to rebound to more normalized levels in 2025.

The Telecom Engineering and Construction sub sector dominated M&A activity this period, accounting for 11 of the 14 total transactions. This included the two largest deals in terms of announced transaction dollar value for both this period and all of 2025. The first of these was Dycom’s acquisition of electrical contractor Power Solutions for nearly $2 billion. In addition, CBRE Group acquired engineering and maintenance services provider Pearce Services for $1.2 billion. Overall, we noted that a lot of the M&A activity in the Telecom Engineering and Construction sub sector this period was related to the data center space. In addition to the Dycom acquisition of Power Solutions, other data center-related transactions included the Hexatronic acquisition of Communication Zone, the Accenture acquisition of DLB Associates, the Nscale acquisition of Future-tech and the Salute Mission Critical acquisition of Northshore Services. We also noted that TAK broadband made another acquisition as it acquired last-mile construction company Gulbranson Services. In the Distributors and Logistics Services sub sector, two of the period’s three transactions involved reverse logistics and maintenance services.These were the Ivy Technology acquisition of PureWrx and the Renewtech acquisition of Intelligent Servers. In the sub sector’s final transaction this period, Atomic Data acquired distributed antenna systems integration firm Venue Wireless.

We had three transactions with announced multiples this period. The largest of these was the Dycom acquisition of Power Solutions with multiples of 2.0x revenue and 9.7x EBITDA. In the period’s other large transaction, the multiples for CBRE Group’s acquisition of Pearce Services came in at 1.8x revenue and 13.3x EBITDA.Finally, Hexatronic Purchased Communication Zone at multiples of 1.2x revenue and 6.0x EBITDA.

Number of Transactions

$ Value of Transactions in Millions

Announced Transactions (10/1/25 – 12/31/25)

Announced Transactions with Revenue Multiples (1/1/25 – 12/31/25)