Building & Infrastructure Services Q3 2025 Report

The infrastructure sector continues to experience rising capital costs, accelerating energy transition, and expanding digital connectivity, while remaining focused on sustainability, resilience, and mid-market investment opportunities. As we move through the second half of 2025, the infrastructure sector stands at a pivotal crossroads. Global investment momentum remains strong, but the environment in which projects are financed, built, and acquired has changed dramatically. Rising capital costs, persistent inflationary pressure, and tighter monetary policy have reshaped deal structures and return profiles. Even in a more disciplined market, opportunities are plentiful particularly in the middle market. The story of infrastructure today is one of adaptation: re-evaluating fundamentals while embracing new technologies, financing models, and sustainability imperatives. Middle-market companies are experiencing opportunity and complexity: projects are smaller in scale but rich in strategic value.

At the same time, competition for capital is intensifying. Institutional investors are becoming more selective, prioritizing proven developers, transparent cash flows, and credible ESG integration. Lenders are tightening underwriting standards, while equity investors demand stronger operational performance and downside protection. For sponsors, operators, and founders of mid-sized platforms, these shifts underscore the importance of robust financial planning, accurate valuation, and disciplined execution. Well-structured partnerships and creative financing solutions—often blending private equity, credit, and strategic capital—are key to unlocking value in this environment.

Market Activity

Building & Infrastructure Services M&A Activity

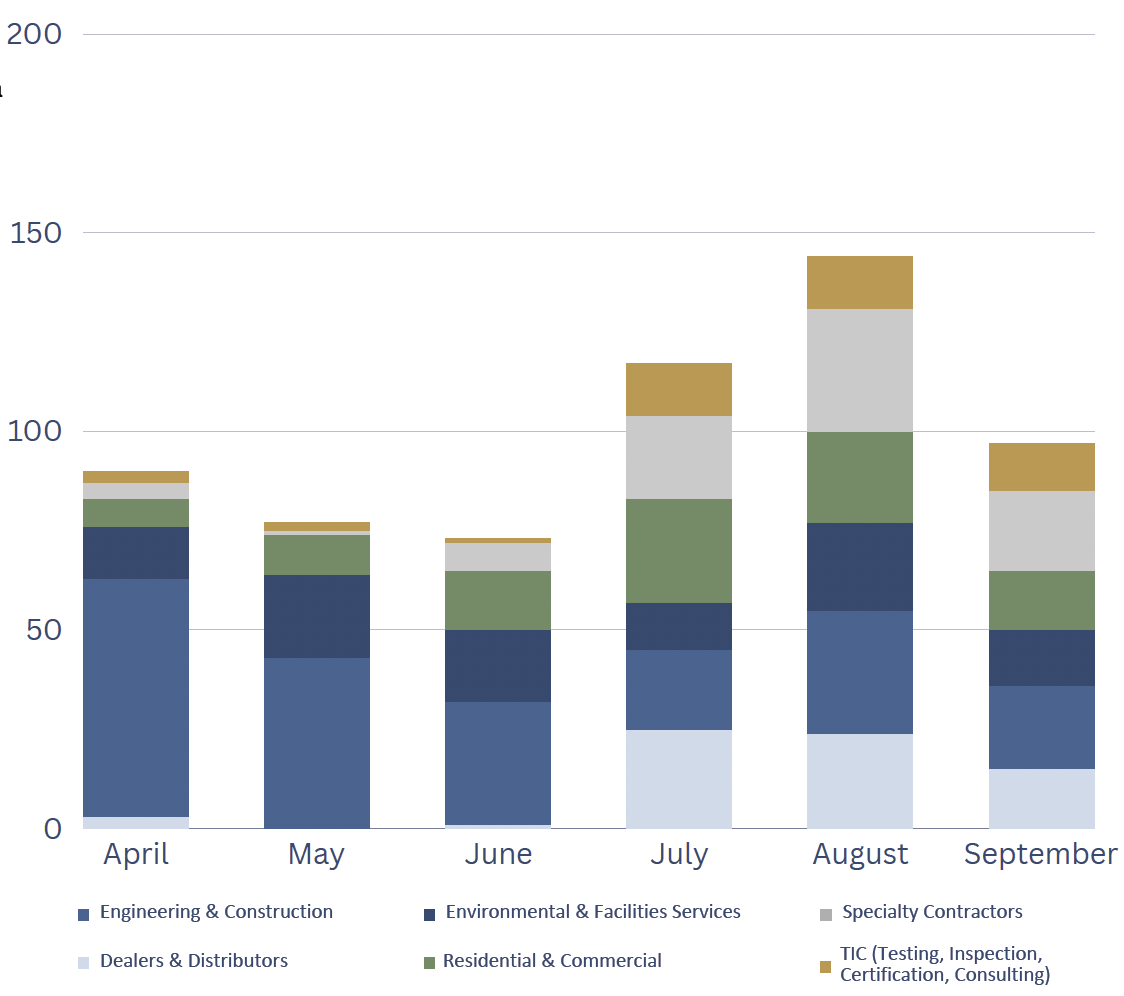

- The total number of transactions for infrastructure services increased by 33% in the third quarter over the second quarter with a total of 358 transactions. Bolstered by the continued investment in infrastructure, data centers and MEP, both general contractors and specialty contractors saw a increase in backlog. There was a significant increase in almost every category with the largest shifts in engineering & construction (E&C) and specialty contracting making up 40% of the total number of transactions.

- E&C opportunities for MEP (mechanical, electrical and plumbing) engineering companies, civil engineering and earthwork companies continues to drive activity in the construction industry.Large providers like Limbach Holding, Granite Construction Inc., Aecon Group and Nexcore made acquisition for thier portfolio companies in Q3 2025. Additionally, financial investors continue to increase their investment in E&C companies with private equity firms like Citation Capital, GHK Capital Partners and OEP Capital Advisors all making acquisitions.

- Specialty Contractors that dominate the subcontracting space with a highly skilled workforce are increasingly desirable and had 72 transactions in the third quarter. Roofing, fire and safety, flooring, masonry, elevator and door and window contracting show significant activity.

- The increase in M&A activity in commercial landscaping, pest control, security, HVAC services, plumbing services isn’t showing any signs of slowing down and were a significant portion of the 64 residential and commercial transaction makeup of the third quarter. This trend is likely to continue as the number of portfolio companies in the space continues to grow. Pye-Barker Fire & Safety, PremiStar, LawPRO and Blackstone Inc. continue to make multiple investments annually in the space.