Telecom Technology: Fall 2025 Report

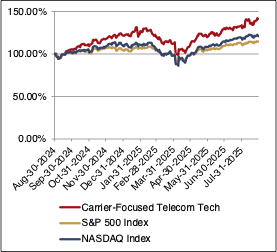

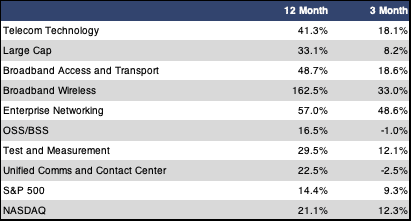

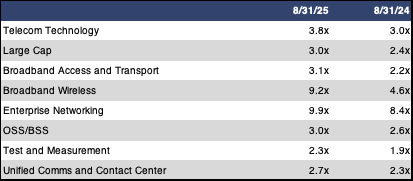

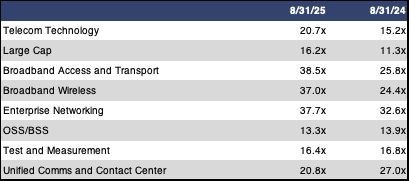

The FOCUS Telecom Technology Index (TTI) enjoyed an extremely strong performance over these past three months. Not only did the index shoot up 18.1%, but it handily outperformed both the S&P 500 (up 9.3%) and the NASDAQ (up 12.3%). The sector’s ability to outpace the market is even more pronounced when viewed over the last year. The TTI is up more than 40% over this time frame, while the S&P 500 and NASDAQ delivered returns of 14.4% and 21.1%, respectively. Sector multiples are also meaningfully higher than they were at this time last year. The sector revenue multiple closed out the period at 3.8x (up from 3.0x a year ago) and the EBITDA multiple ended up at 20.7x (up from 15.2x a year ago).

The Enterprise Networking sub sector assumed the mantle of the TTI’s top performing sub sector as it shot up nearly 50% in the last three months. This gain was in no small part the result of gains on the order of 60% at both Aerohive Networks and Arista Networks, while Extreme Networks also gained more than 35%.The Broadband Wireless sub sector continued its meteoric ascent with a three-month gain of 33.0%. This puts the sub sector’s year-over-year return in excess of 150%, which easily makes it the best performing sub sector in the TTI over the last 12 months. While the Broadband Access and Transport sub sector did not have nearly as strong a performance as the TTI’s two leading sub sectors, it still notched a very respectable three-month gain of 18,6%. Calix was the top performing company in the sub sector with a gain of 28.6%. In addition, ADTRAN and CIENA both delivered gains of 16.8% and 17.4%, respectively. Finally, we noted that the 1.0% decline in the OSS/BSS Software sub sector made it one of only two sub sectors in the TTI to deliver a negative return this period. This was due to a 6.7% drop at Amdocs as well as double digit declines at both Subex and Synchronoss.

PUBLIC MARKETS SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A ACTIVITY

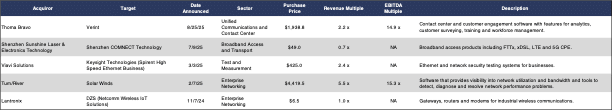

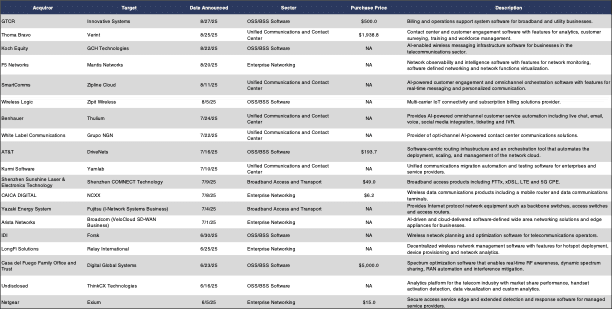

After a slow start to the year, the level of M&A activity in the Telecom Technology sector continued to pick up momentum.There were 19 total transactions over the past three months, which is well above the typical level of activity that we have seen in the past few years. Even more impressively, the total announced transaction dollar value of these transactions was $7.7 billion. Activity in the OSS/BSS Software sub sector was strong. The sub sector accounted for seven total transactions, including the $5 billion acquisition of Digital Global Systems by Casa del Fuego Family Office and Trust. In addition, we saw private equity firm GTCR add a new platform with their acquisition of Innovative Systems for $500 million. Innovative Systems provides billing and other software for smaller broadband operators. The Unified Communications and the Contact Center sub sector also saw quite a bit of activity with five total transactions over the past three months. This sub sector was also able to boast of a large transaction, in this case the $1.9 billion take private acquisition of Verint by Thoma Bravo.Finally, the Enterprise Networking sub sector also saw five total transactions, but all of these were comparatively small.

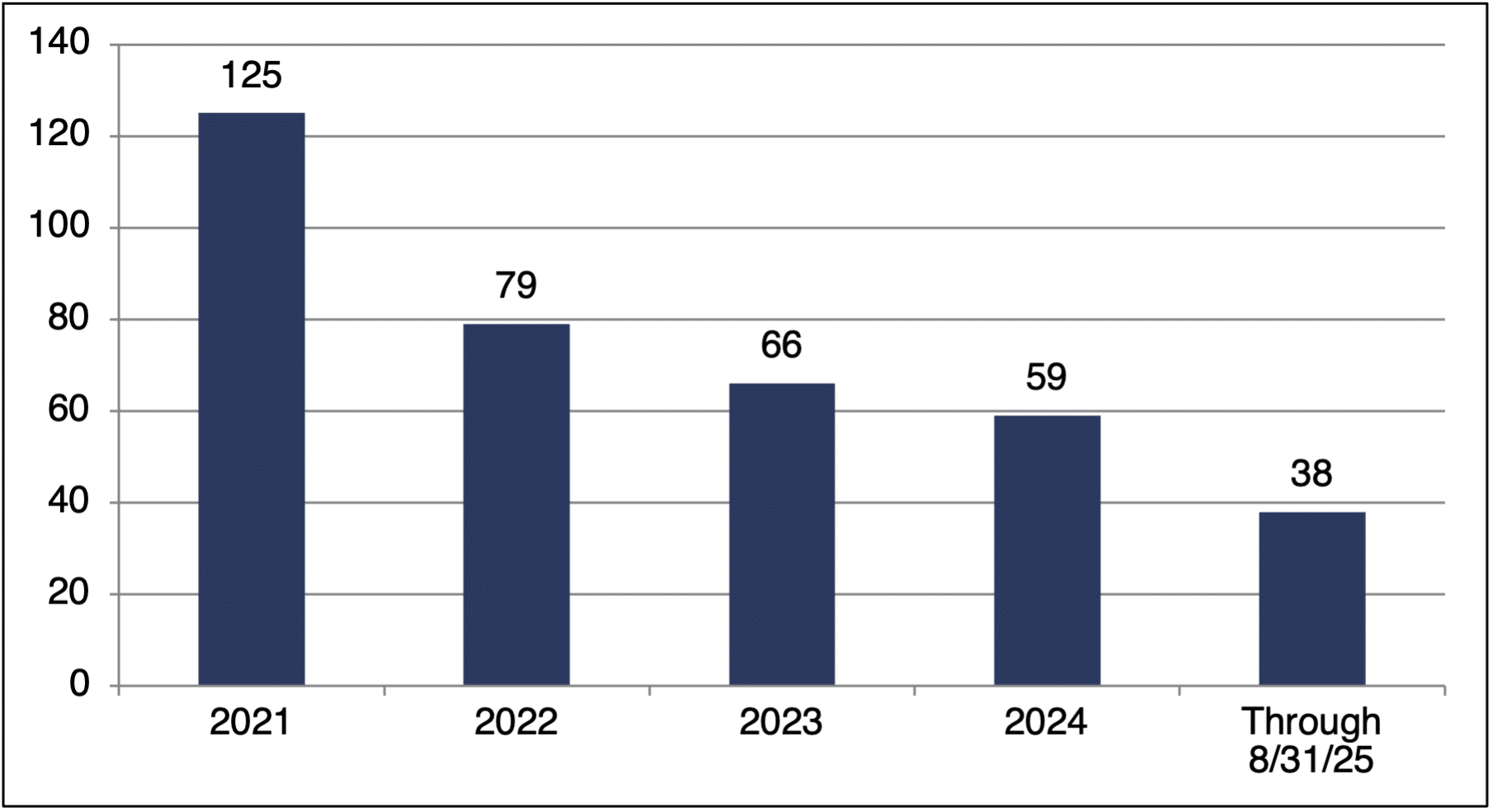

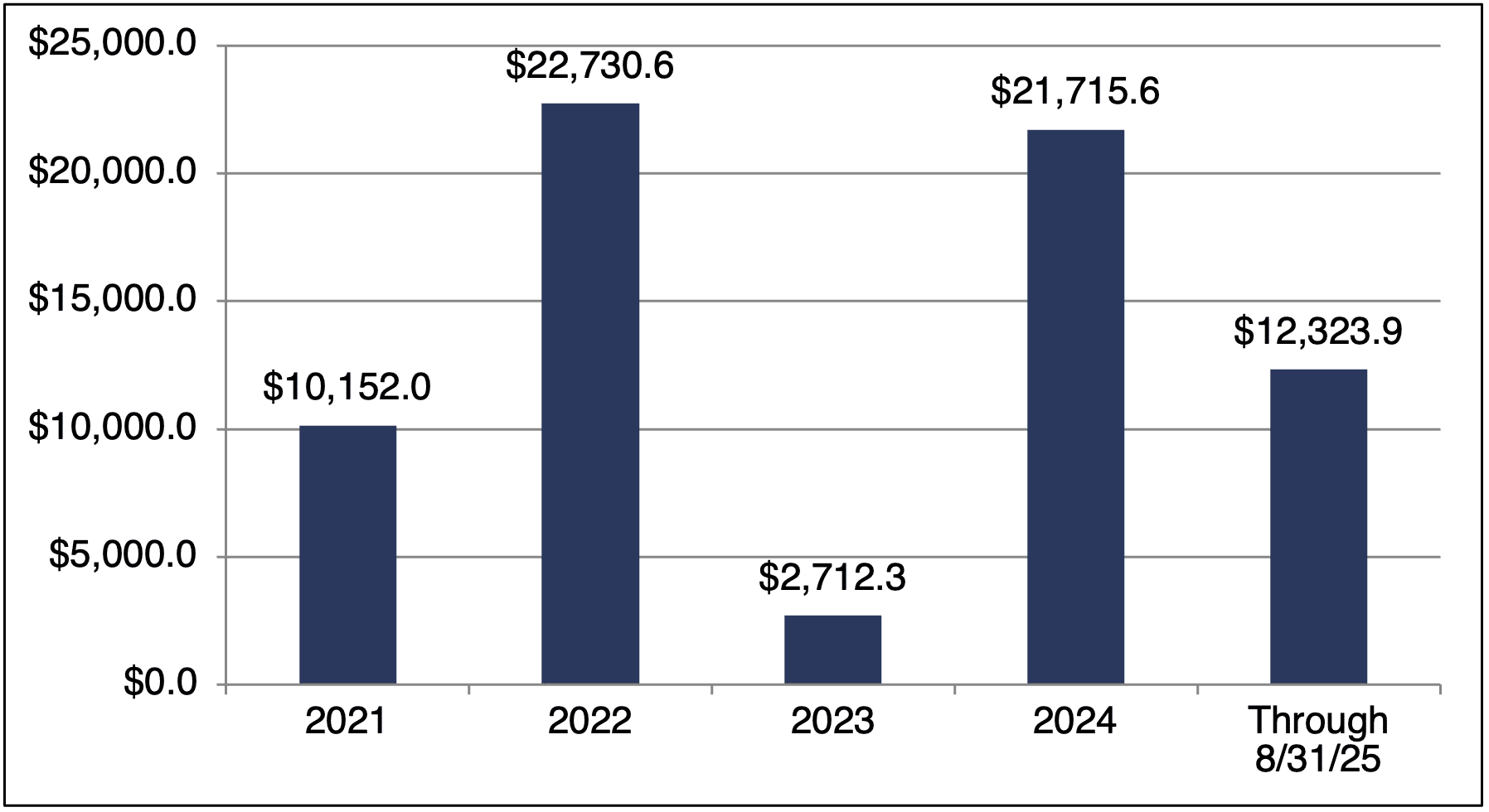

With eight months of 2025 in the books, the Telecom Technology sector has seen 38 transactions for a total announced transaction dollar value of $12.3 billion. Both of these metrics are trending somewhat below 2024 levels.However, the strong level of activity in our fall reporting period definitely helped bring 2025 much more in line with historical levels of M&A activity.

There were two transactions with announced multiples this period. The Thoma Bravo acquisition of contact center software company Verint was done at multiples of 2.2x revenue and 14.9x EBITDA. The other announced multiple was for a transaction involving China-based broadband access company Shenzhen COMNECT Technology. This transaction had a revenue multiple of 0.7x. The EBITDA multiple was not made public.

Number of Transactions

$ Value of Transactions in Millions

Announced Transactions (6/1/25– 8/31/25)

Announced Transactions with Revenue Multiples (9/1/24 – 8/31/25)