Supply Chain Technology and Logistics Index – First Half 2025

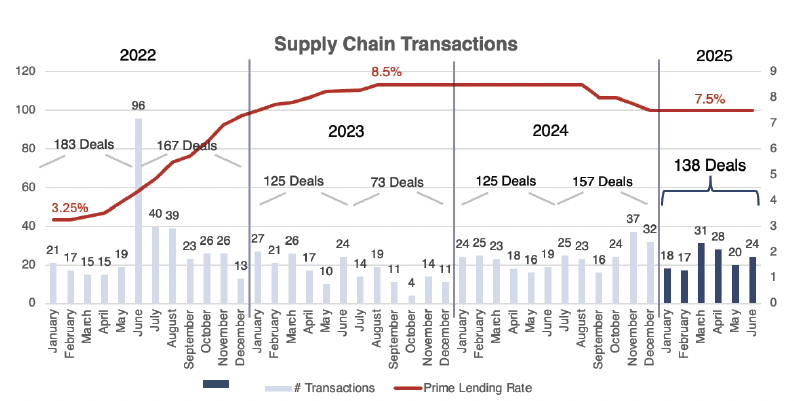

Supply Chain Technology and Logistics M&A Report – First Half 2025 – Logistics company valuations decline and private equity backs off with 34% less transactions vs. 2nd half of 2024. In our First Half 2025 report we discuss some of the major trends we are seeing in the market, and report on the M&A activity in the overall Supply Chain market. Included in this report is the list of 138 North American Supply Chain M&A transactions. They are categorized into strategic, private equity, technology, and logistics backed transactions.

Investment Banking and Advisory Services

FOCUS Investment Banking is a leading investment bank with specialized supply chain industry expertise, concentrating on providing highly tailored services to emerging middle market and larger organizations in this sector:

- Mergers & Acquisition Advisory

- Corporate Development Consulting

- Strategic Partnering & Alliances

- Capital Financing, Debt & Equity

- Corporate Valuations

Logistics Company Valuations Were Down Over 11% as of June 30, 2025

- Aggressive U.S. tariff policies—particularly under President Trump—have created deep uncertainty as trade volume and margin fluctuations continue resulting in lower values for public companies in this market. The 14 companies covered in this report were down over 20% at the beginning of April, 2025 (see page 5).

- As the dust settles on just who will bear the costs for the tariffs (suppliers, consumers or end users), we expect less volatility over time.

Technology & AI Transactions Decline

Only 27 technology-related supply chain transactions closed in H1 2025. This marks a sharp 57% drop from the second half of 2024, reflecting an interesting growing caution around AI and software-driven plays.

Deal Volume is Down and Deal Delays are up

- Industries most exposed to tariffs—automotive, manufacturing, pharmaceuticals—experienced sharp declines in deal volume and value as huge international supply chains that are being disrupted as they wait for less volatile times.

- Trade uncertainty has led dealmakers to hesitate, with many exploring or initiating deals only to pause them indefinitely.

Private Equity Hesitation

Private equity firms are facing growing exit challenges due to macro instability and stalled fundraising. A staggering $3.6 trillion in assets remain unsold, creating a backlog in exits. In addition, one study found that out of the $3.3 billion in new capital being raised by PE firms only one third of that amount is in the current allocations by institutional investors. This results in deals being paused or abandoned as Private Equity is more selective with new investments. Private equity transactions dropped from 92 in the last half or 2024 to 61 in the first half of 2025.