Aerospace & Defense Industry Report – First Half 2025

Industry Trends

Budget and Procurement Shifts

US defense spending remains steady (~$892B proposal for FY 2026), but priorities are shifting: the Pentagon is cutting F‑35 procurements (~45–50% fewer jets) in favor of missiles, drones, and next-gen platforms like NGAD and collaborative combat aircraft.

NATO nations continue to ramp up their defense budgets, pledging 5% of GDP by 2035—a trend fueling European defense equities.

Technological Integration & AI

The Pentagon is accelerating partnerships with Silicon Valley and defense-tech outfits, awarding contracts (e.g., OpenAI’s $200 M AI deal), embedding tech execs into military roles, and focusing on autonomy and surveillance systems.

Rapid Growth in Drones & Missile Systems

Missile systems (e.g., Lockheed, RTX) and drones/UAS are top procurement priorities, and companies like AeroVironment are reporting record earnings—+40% YoY sales, backlog jumped from $400 M to $726 M.

Stockholm-based Unmanned tech is widely cited as part of a “War from Home” trend—low-risk, high-tech warfare.

Commercial Aerospace Recovery

In May 2025, U.S. durable goods orders spiked 16.4%, driven by a 230% jump in commercial aircraft orders (303 new orders, largely from Boeing).

Executives expect narrow- and wide-body aircraft deliveries in H1 2025 to match or exceed H1 2024 levels: 83% and 88% respectively.

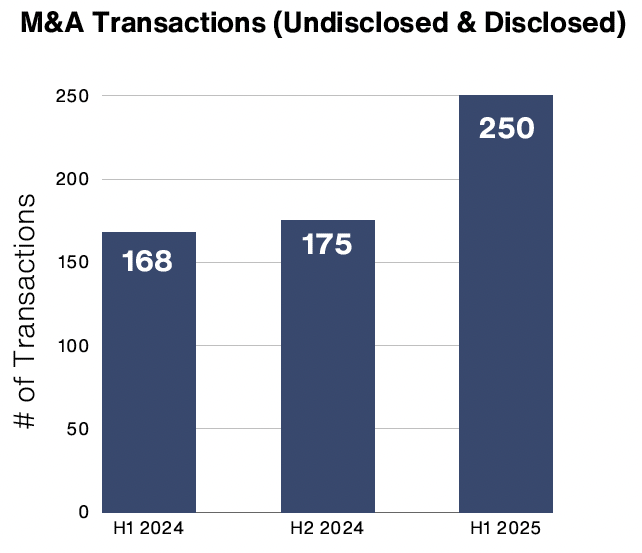

M&A & Investment Landscape

Globally, while overall M&A volume dipped (~9%), A&D deal values rose, bucking broader market trends.

Market & Investment Trends

Defense-tech VC flourished: over 400 firms raised nearly $13 billion in H1 2025—but uncertain exit environments due to flat M&A multiples.

Equity-wise, RTX hit record highs backed by over $200 B in combined backlog (commercial + defense).

ETFs like Select STOXX Europe A&D (EUAD) climbed ~78% in 2025, propelled by European defense spending.