The Perils of Customer Concentration in M&A

In the first half of 2025, we had the unfortunate experience of having to withdraw from the market two separate manufacturing businesses while they were in the middle of a sale process. Why? Each lost a major customer, constituting over 50% of revenues. In both cases:

- Little to no warning was given despite strong relationships between our client and their key customer.

- Neither case reflected poor manufacturing performance

- Both customers were respected S&P 500 companies and were financially stable.

For the sellers, the impact was catastrophic, and not only in terms of salability and valuation. Both owners and business operations were immediately stressed, impacting their retirement dreams, their families and next generations as well as the employees.

It is a risk we see often in the M&A world. In a similar vein to my January note about underappreciated geopolitical risk in contract manufacturing, owners generally don’t fully appreciate the risks associated with excess customer concentration, perhaps being just too close to the issue. Independent eyes (most importantly those of potential buyers) see the risk all too clearly.

Understand the Source – and Manage the Impact

Businesses most commonly develop concentration issues by growing alongside a rapidly growing customer, and also by relying on inbound sales inquiries, which often come from the same ecosystem.

To be clear, in the last couple of years, we’ve sold several manufacturing businesses with customer concentrations up to 85%, even at a premium multiple. But no matter how long or well you may have served a customer, things happen:

- The customer gets acquired, and the supply chain shifts to the acquiror’s network.

- The buyer’s decision maker leaves, and the replacement brings his/her own relationships.

- The customer experiences a major disruption (regulatory, legal, financial, tariffs).

- A customer of your customer develops a problem.

- Technology changes lead to obsolescence, or major reduction in market share of a customer’s product.

- One of your own top managers leaves and takes the customer with them.

- Black swan events.

These and many other risks, may be individually low probability events, but cumulatively,the risk exposure of excess concentration is far too common. Buyers, and just importantly, the financial institutions that finance most acquisitions know this. Bankers are very risk averse right now, and without financing, deals are much harder to get done.

The effect on the valuation and/or sale, is usually significant.

- The transaction valuation can be substantially reduced, perhaps 20-35%.

- The number of potential buyers/partners will be significantly lower, reducing the “auction” effect and your choice of partners.

- The terms of the transaction (escrow, earn-outs, warranties etc) will shift to protect the buyer, leaving the owner to effectively insure against future events after the sale.

- The time to close a transaction may lengthen considerably.

Although common, any customer generating in excess of 20% of sales will catch the eye of a buyer and generate a detailed review. Over 30% and more buyers will decline the opportunity outright, and over 40%, the rest of the picture will have to fit really well in a combination to consummate a deal with conventional valuation metrics.

In the Manufacturing team at FOCUS, we have a guiding principle:

Owners should focus on managing the value of the company, not the size of the company.

Typically, in early conversations with an owner, having shared sales and EBITDA figures, the owner will want an estimate of valuation. Important information to be sure. However, M&A advisors know well that there are a dozen (or more) important qualitative metrics that will also determine the salability and ultimate valuation of a company. This is why you often see very wide ranges in transaction multiples within an industry vertical or between seemingly comparable companies.

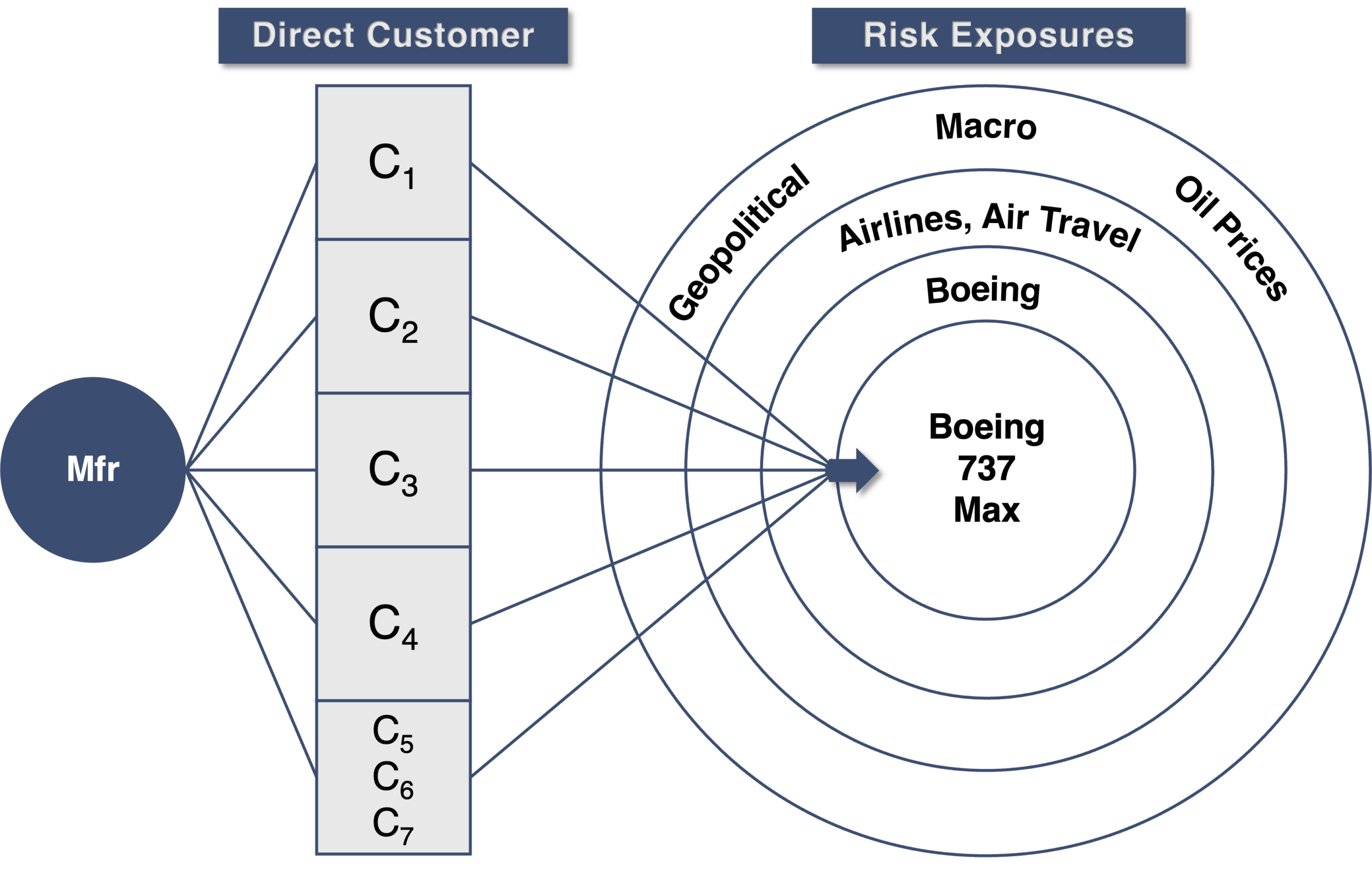

Customer concentration is one of the fundamental drivers of business value and it requires significant management attention. We advise owners to track and manage concentration exposures. This entails identifying the true end customer and market for everything produced, the intermediaries between you and that endpoint, and the strength each of those connections. Consider these two examples of direct customer concentration.

The Boeing supply chain has 1000’s of suppliers across multiple tiers, but all serving a concentrated set of platforms.

The halting of the 737 Max production caused severe financial distress throughout the supply chain.

Macro risks can have equally devastating consequences. A $150/bbl oil price (not a small probability) is highly recessionary, affecting air travel demand and airline economics.

Diversity across direct customers may mask true exposure.

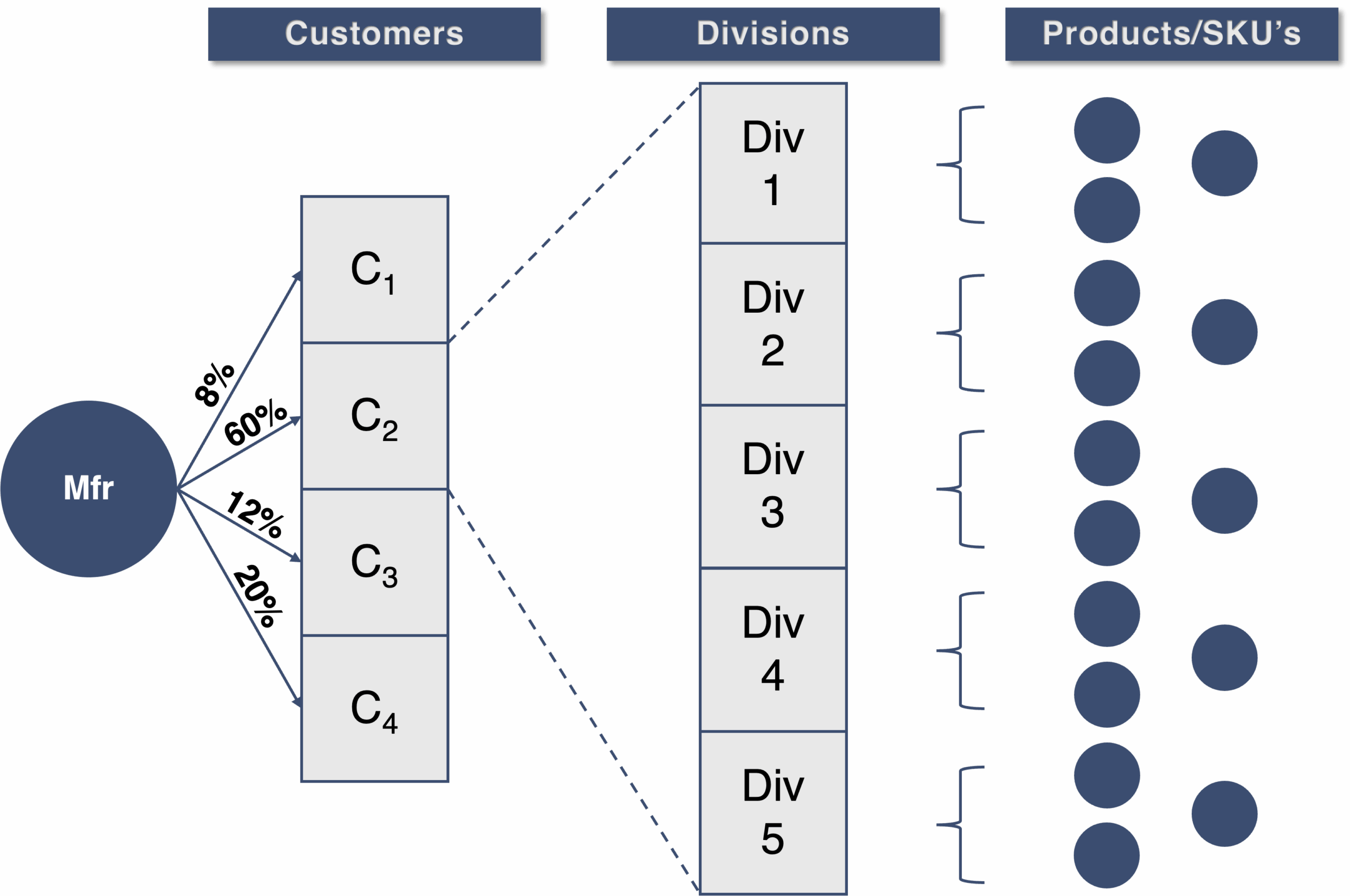

Compare this to a different set of circumstances.

A deeper dive into the profile of a PCBA manufacturer, with a 60% customer operating in the medical device market, may have less risk than first appears.

This manufacturer serves multiple divisions, with multiple decision makers and locations, and provides multiple SKU’s addressing diverse medical markets, with less overall macroeconomic variation.

This is the kind of nuance buyers will want to understand well before deciding on what an appropriate offer for the company may be.

Once your exposure profile is well understood, diversification is the key:

- Be very proactive with sales/marketing to broaden your customer base. Set goals.

- Within a customer, diversify relationships where possible across buyers, divisions and product lines to reduce individual exposures.

- Diversify sales across industry verticals (automotive, defense, telecom, medical etc.).

- Consider diversification by acquisition (product mix, customers, geography etc).

- Use long term contracts where possible.

- Establish or deepen multiple relationships with the customer in your firm, ensuring continuity if you, or your relationship manager, move on.

Actions that are effective and practical will vary by company and circumstance. Longevity of existing customers is a valuable attribute. However, demonstrating you can seek out and win new customers, particularly in new markets, will also be valued, even if it’s a work in progress.

If this subject interests you, know that our Manufacturing team at FOCUS is here to work with you. We can provide an independent, complimentary and confidential review of your company from the perspective of maximizing owner’s equity and marketability.

Whether you intend to pursue a sale or partnership transaction in the near future or not, mitigation of concentration risks will help add to the stability of the firm for both you and your employees, as well as add to your valuation. It may also help you sleep better at night.