FOCUS Telecom Business Services Quarterly: Spring 2025 Report

FOCUS Telecom Business Services Quarterly: Spring 2025 Report

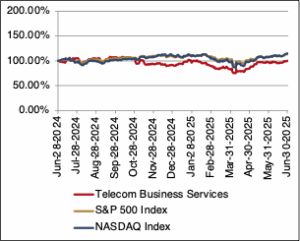

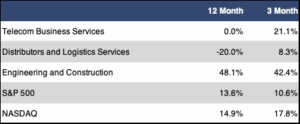

The FOCUS Telecom Business Services Index (TBSI) rebounded from the poor performance in our last report and rocketed up 21.1% in the past three months. This was nearly double the 10.6% return of the S&P 500 and even well ahead of the 17.8% gain in the NASDAQ over the same time period. When measured over a full twelve-month time frame, this period’s gains were strong enough to bring the TBSI back from well underwater in our last report to breakeven.Unfortunately, this still places the sub sector well behind both the S&P 500 (up 13.6% year-over-year) and the NASDAQ (up 14.9% year-over-year). Sector multiples have not changed dramatically from year-ago levels.The sector revenue multiple held steady at 1.1x, while the sector EBITDA multiple dipped from 11.8x to 11.2x.

The TBSI’s two sub sectors both showed strong gains this period. The Engineering and Construction sub sector was clearly the strongest performer with a three-month increase of 42.4%. Gains were broad-based, as every single stock in the sub sector showed a positive gain.This included increases of 20% or more at four of the sub sector’s five stocks. Dycom and Mastec were the two top performers with gains of 60.4% and 46.0%, respectively. Engineering and Construction sub sector multiples also showed a nice increase with the revenue multiple going from 0.9x to 1.1x and the EBITDA multiple increasing from 7.5x to 9.4x. As for the TBSI’s other component, the Distributors and Logistics Services sub sector had a much more modest gain of 8.3%. CDW and ePlus both boasted double-digit increases, while Insight was the only company in the sub sector in negative territory with a loss of 7.9%. Multiples for the Distributors and Logistics Services sub sector closed out the period at 1.1x revenue and 13.1x EBITDA. Both of these compare unfavorably to year-ago multiples of 1.3x revenue and 15.8x EBITDA.

PUBLIC MARKETS SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A ACTIVITY

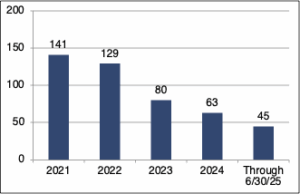

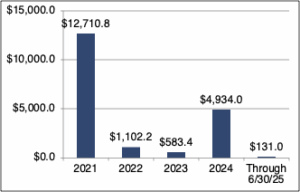

Deal volume in the Telecom Business Services sector continued its upward trend with 24 announced transactions in the past three months. However, the total announced dollar value of transactions was low for the second straight reporting period at slightly more than $120 million. For the first half of 2025, the 45 total transactions year-to-date put the year on pace to be the highest since 2022 in terms of the number of transactions. The total announced dollar volume of transactions thus far this year remains anemic at only $131 million.

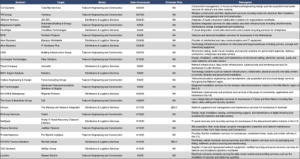

Activity was very strong in the Telecom Engineering and Construction sub sector with 13 deals for the period. Significantly, we saw several deals in the wireless space in the U.S. as CCI Systems acquired Total Site Services, TW Group acquired Techisco and KCI Technologies purchased Advanced Telecommunications Solutions of Virginia.Wireless transactions in the U.S. market have been few and far between over the last two years, so it was good to see a pickup in the level of activity. In addition, we also noted a number of transactions involving structured cabling and electrical contractors. When we look at activity in the Distributors and Logistics services sub sector, we highlight the TXO acquisition of secondary market telecom equipment supplier AirWay Group. The IT Asset Disposition space was also active with transactions involving CloudBlue Technologies and the Telecom division of Firefly IT Asset Recovery. Finally, we noted that ITOCHU entered the market for refurbished cellular phones with its acquisition of We Sell Cellular for $60 million.

There were two transactions with announced multiples this period. The aforementioned acquisition of We Sell Cellular by ITOCHU had a multiple of 0.8x revenue. The period’s other transaction with an announced multiple was the Infosys acquisition of network hardware and maintenance services provider The Missing Link Network Integration. This transaction had a much higher multiple of 2.3x revenue.

Number of Transactions

$ Value of Transactions in Millions

ANNOUNCED TRANSACTIONS (4/1/25 – 6/30/25)

ANNOUNCED TRANSACTIONS WITH REVENUE MULTIPLES (7/1/24 – 6/30/25)