Telecom Technology: Summer 2025 Report

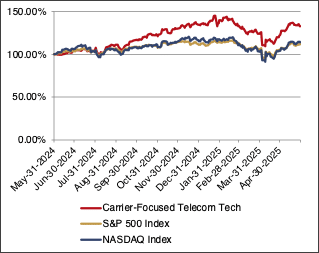

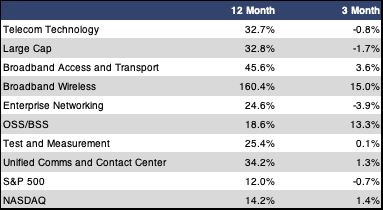

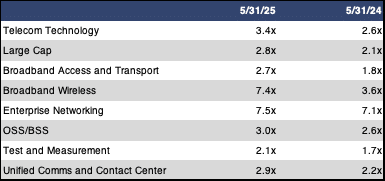

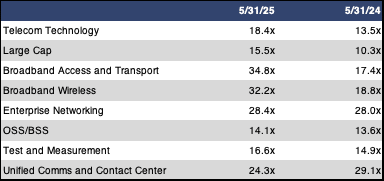

The FOCUS Telecom Technology Index (TTI) suffered a slight decline of 0.8% over the past three months. This decline was essentially on par with the S&P 500, which dropped 0.7% over the same time frame. However, it lagged the performance of the NASDAQ, which increased by 1.4%.Over the past twelve months, the TTI remains in strongly positive territory with a year-over-year gain of 32.7%.This outperformed both the S&P 500 (up 12.0%) and the NASDAQ (up 14.2%) by a wide margin. Multiples for the sector are also up considerably compared to last year. The sector revenue multiple increased from 2.6x a year ago to 3.4x currently, while the sector EBITDA multiple jumped from 13.5x to 18.4x.

Broadband Wireless was the top performing sub sector this period with a three-month gain of 15.0%. This was largely due to a 15.7% increase at Ubiquiti Networks, which counterbalanced a more than 60% decline at Cambium Networks. Not far behind, the OSS/BSS Software sub sector enjoyed a healthy gain of 13.3%. Lumine Group was up 32.2%, while the only other company in the sub sector with a double-digit gain was Radcom with a 10.6% increase. Three more sub sectors turned in a positive return this period.These were Broadband Access and Transport (up 3.6%), Test and Measurement (up 0.1%) and Unified Communications and Contact Center (up 1.3%). The TTI also had two sub sectors in the red this period. The Large Cap sub sector dropped 1.7% as ZTE plummeted 18.7% and Cisco experienced a more modest decline of 1.7%. The Enterprise Networking sub sector was the hardest hit sub sector in the TTI with a three-month drop of 3.9%. Double digit losses at A10 Networks, Aerohive Networks and Unizyx Holding all contributed to the sub sector’s poor performance.

Public Markets Summary

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A Activity

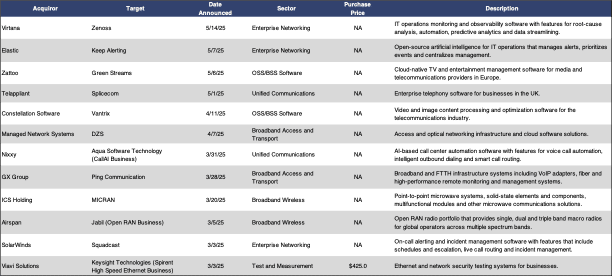

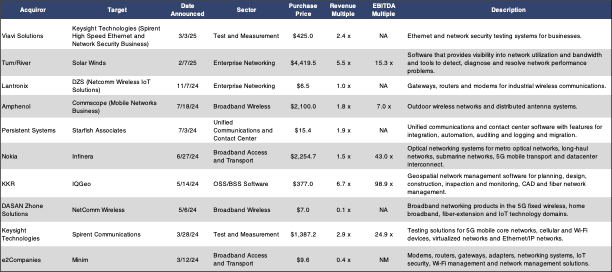

M&A activity in the Telecom Technology sector picked up somewhat in our summer reporting period with a total of 12 announced transactions. Even so, this is still on the lower end of the spectrum based on typical historical levels of transaction activity. The total announced dollar value of transactions for the period was also low at only $425 million. M&A activity this period was spread out amongst the various sub sectors, with no single sub sector dominating activity. The Test and Measurement sector had the largest announced transaction dollar value with the Keysight divestiture of the High Speed Ethernet business that it acquired from Spirent. This transaction had a value of $425 million, meaning that it accounted for all of our total announced transaction dollar value for the past three months. We also noted that FTTH and optical transport vendor DZS was acquired out of bankruptcy. In another notable transaction, SolarWinds made its first acquisition since it was taken private by Turn/River. This was the purchase of alerting and incident management software company Squadcast.

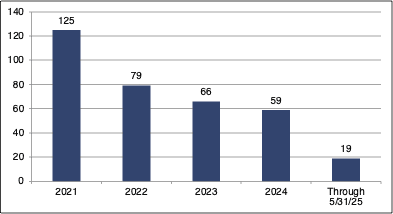

Through the first five months of 2025, we count a total of 19 total transactions in the Telecom Technology space. This means that the level of deal activity is well behind what we have seen in previous years. Total announced transaction dollar value thus far in 2025 is relatively healthy at $5.0 billion. While this metric lags the higher levels of activity that we saw in 2022 and 2024, it still represents a reasonably normal level of deal flow.

The lone transaction with an announced multiple this period was Viavi’s acquisition of the Spirent High Speed Ethernet business from Keysight Technologies. This transaction had a revenue multiple of 2.4x. There was no publicly announced EBITDA multiple for this transaction.

Number of Transactions

Number of Transactions

Announced Transactions (3/1/25– 5/31/25)

M&A Transactions with Announced Multiples (6/1/24 – 5/31/25)

DOWNLOAD THE FULL REPORT HERE.