Telecom U.S. Communications Service Provider: Spring 2025 Report

Overview

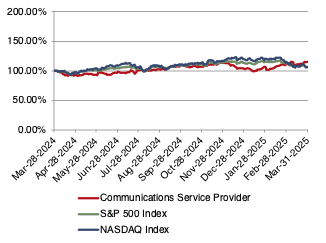

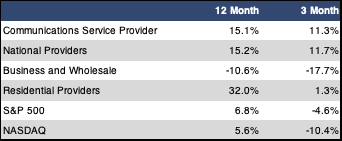

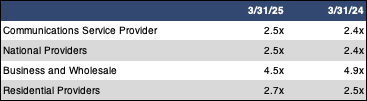

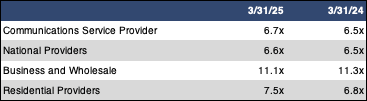

The FOCUS Communications Service Provider Index (CSPI) rebounded nicely in the first three months of 2025, shooting up 11.3% for the period.This was particularly impressive given that the broader indices were both in negative territory over the corresponding time frame. The CSPI also outperformed the broader indices over the 12-month period. The CSPI is up 15.1% compared to this time last year, while the S&P 500 is up 6.8% and the NASDAQ is up 5.6%. Sector multiples also edged up slightly higher than they were in the year-ago period. The revenue multiple inched up from 2.4x to 2.5x, while the EBITDA multiple went from 6.5x to 6.7x.

The National Providers sub sector was the driver of the CSPI’s outperformance this period with a three-month gain of 11.7%.AT&T and Verizon were the top performers with increases of 24.2% and 13.4%, respectively. On the other end of the spectrum, Lumen plummeted 26.2%. The Business and Wholesale sub sector was the CSPI’s worst performing sub sector with a three-month loss of 17.7%. All three stocks in the sub sector traded lower this period, with both Bandwidth and Cogent Communications falling more than 20%. Finally, the Residential Providers sub sector came in somewhere in the middle as it posted a modest gain of 1.3%. Altice and Telephone and Data Systems were the best performing stocks in the sub sector as both posted double-digit gains.

Public Markets Summary

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A Activity

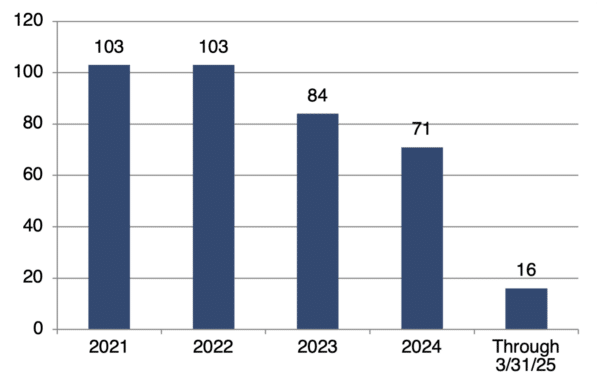

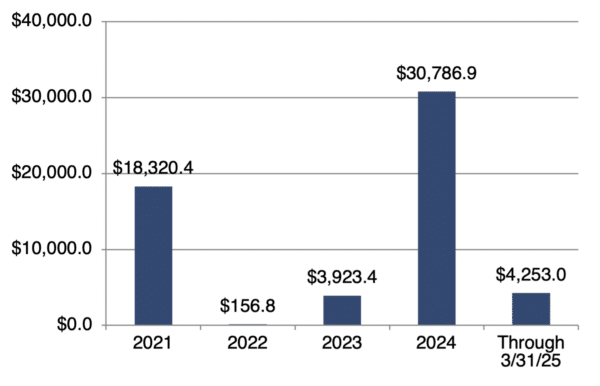

The Communications Service Provider sector started off 2025 in relatively solid fashion. While the 16 total transactions over the past three months lags a shade behind where we typically see activity, the total announced transaction dollar value of nearly $4.3 billion was strong. This means that at least as of now 2025 is continuing the trend of 2024 that combined fewer total transactions with enough larger transactions to keep total announced transaction dollar value at relatively elevated levels.

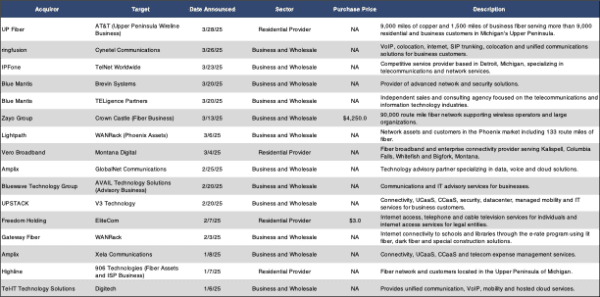

The Business and Wholesale sub sector dominated transaction activity this period, accounting for 12 of the 16 total transactions. Far and away the most noteworthy transaction in this sub sector was Crown Castle’s long-awaited divestiture of its fiber assets.Zayo ultimately emerged as the purchaser of this business for a price tag of $4.25 billion. In another notable development, WANRack was involved in two sell side transactions this period. In addition to merging with fellow CBRE portfolio company Gateway Fiber, they also sold their fiber network in Phoenix to Lightspeed. We also noted a continued high level of activity in the acquisition of telecom advisory firms. Amplix and Blue Mantis both inked two acquisitions apiece, while Bluewave Technology Group and UPSTACK each had an acquisition as well. In the Residential Provider sub sector, Michigan’s Upper Peninsula was a hot bed of activity with two transactions in the region. These were Highline’s acquisition of the fiber assets of 906 Technologies and UP Fiber’s purchase of network assets from AT&T. The only other two transactions in the Residential Provider sub sector were Vero Broadband’s acquisition of Montana Digital and Freedom Holdings’ purchase of EliteCom.

There were no transactions with announced multiples this period.

Number of Transactions

$ Value of Transactions in Millions

Announced Transactions (1/1/25– 3/31/25)

Announced Transactions with Revenue Multiples (4/1/24 – 3/31/25)

DOWNLOAD THE FULL REPORT HERE.