FOCUS Telecom Business Services Quarterly: Winter 2025 Report

Overview

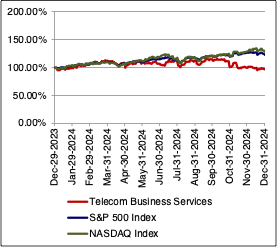

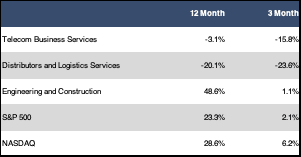

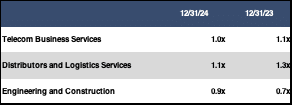

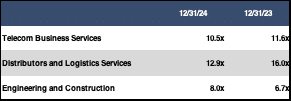

After posting a strong performance in our fall reporting period, the FOCUS Telecom Business Services Index (TBSI) plummeted nearly 16% over the past three months. This significantly underperformed the returns of both the S&P 500 (up 2.1%) and the NASDAQ (up 6.2%) over the corresponding time frame.When viewed over the past 12-months, the TBSI is down 3.1%. Once again, this compares unfavorably to the broader indices. The S&P 500 is up 23.3% over the past year, while the NASDAQ is up 28.6%. Sector multiples closed out the period at 1.0x revenue and 10.5x EBITDA. Both of these are lower than year-ago multiples of 1.1x revenue and 11.6x EBITDA

The Distributors and Logistics Services sub sector was the culprit in the poor performance of the TBSI this period. The sub sector dropped 23.6% over the past three months, with every single stock in the sub sector in negative territory for the period.The sub sector is also down 20.1% year-over-year. Over this time frame, multiples fell from 1.3x revenue and 16.0x EBITDA down to 1.1x revenue and 12.9x EBITDA. In comparison, the 1.1% gain in the Telecom Engineering and Construction sub sector looked strong. Baran Group and MasTec both delivered double digit returns to push the sub sector into positive territory, while the other stocks in the sub sector traded down.The sub sector is also up nearly 50% over the past year. Sub sector multiples rose from 0.7x revenue and 6.7x EBITDA a year ago to 0.9x revenue and 8.0x EBITDA currently.

PUBLIC MARKET SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A Activity

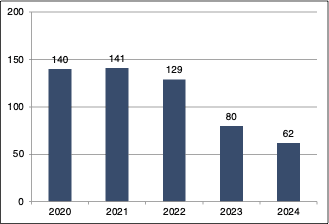

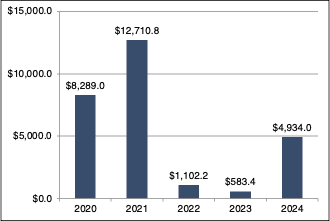

The Telecom Business Services sector ended 2024 with a bang as the sector notched 24 total transactions for the period. This was nearly 40% of the total transactions for the entire year. On the downside, the total announced dollar value of transactions was relatively low at only $410 million. The Telecom Engineering and Construction sub sector accounted for only five of the period’s transactions, while the remaining 19 were in the Distributors and Logistics Services sub sector. For all of 2024, we counted a total of 62 transactions with $4.9 billion in total announced transaction dollar value. This meant that 2024 had fewer total transactions than any year in the last five. Total announced transaction dollar value was better than the reduced levels we saw in 2022 and 2023, but not nearly as strong as the levels that we saw in 2020 and 2021. We noted that there were a number of transactions in these past three months for companies that repair and refurbish telecom equipment. This included the acquisition of cell phone logistics company Likewize by Genstar Capital, as well as acquisitions of Basket Materials, Northern Technical Group, Relectro and Sunny Communications.

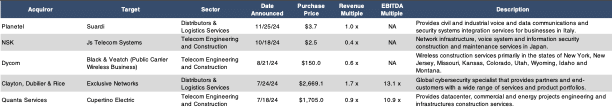

The two transactions this period with announced multiples were both small. The $3.7 million acquisition of Suardi by Planetel had a multiple of 1.0x revenue.In addition, the $2.5 million acquisition of Japanese telecom construction company Js Telecom Systems had a multiple of 0.4x revenue. Neither transaction had an announced EBITDA multiple.

Number of Transactions

$ Value of Transactions in Millions

Announced Transactions (10/1/24 – 12/31/24)

Announced Transactions with Revenue Multiples (1/1/24 – 12/31/24)

DOWNLOAD THE FULL REPORT HERE.