FOCUS Telecom Technology Quarterly: Summer 2024 Report

OVERVIEW

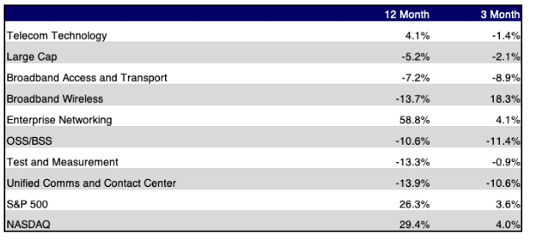

The FOCUS Telecom Technology Index (TTI) returned to negative territory this reporting period as the sector dropped 1.4% over the past three months. This was despite a generally favorable market that pushed the S&P 500 up 3.6% and the NASDAQ up 4.0%. Even with this period’s loss, the TTI still remains in positive territory for the last 12 months with a gain of 4.1%. However, the sector still lagged both the S&P 500 and NASDAQ by a wide margin over the past year. The S&P 500 is up 26.3% over this time frame, while the NASDAQ gained 29.4%.

The Broadband Wireless sub sector had a particularly strong reporting period with a three-month gain of 18.3%. This gain was entirely attributable to a 22.2% gain at Ubiquiti Networks. The only other sub sector in the TTI in positive territory for our summer reporting period was Enterprise Networking. This sub sector gained a more modest 4.1% behind solid increases at A10 Networks and Arista Networks. At the opposite end of the spectrum, the OSS/BSS Software sub sector was the TTI’s worst performing sub sector over the past three months with a loss of 11.4%. The sub sector’s losses were broad-based, with seven of the nine companies in the sub sector in the red for the period.

PUBLIC MARKETS SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

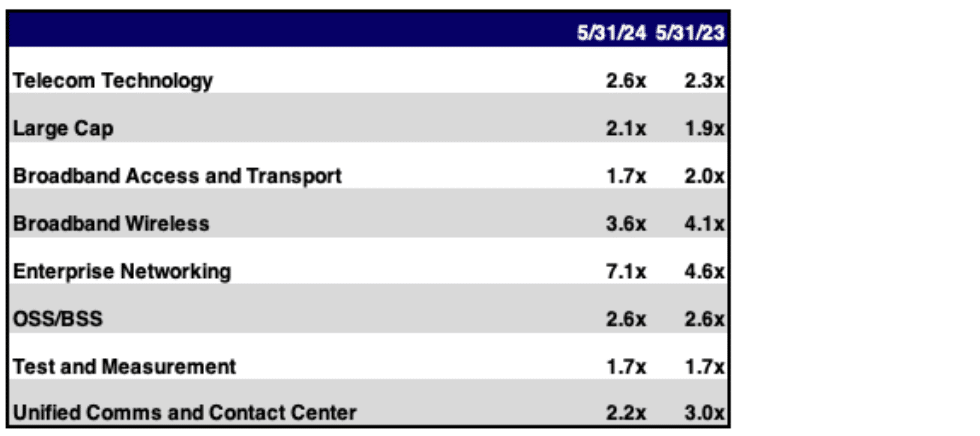

Sector and Sub Sector Revenue Multiples

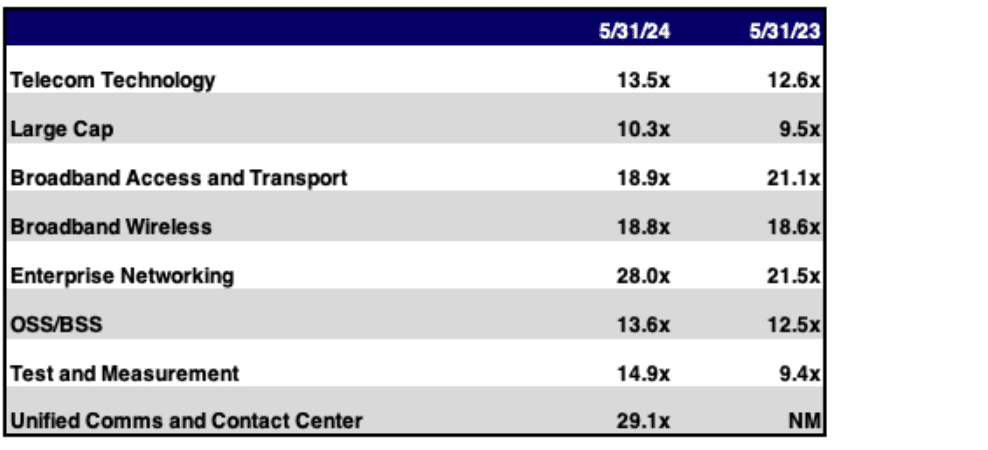

Sector and Sub Sector EBITDA Multiples

M&A ACTIVITY

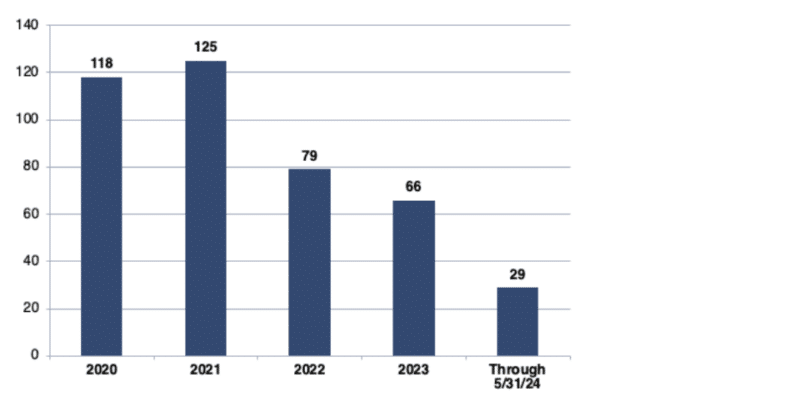

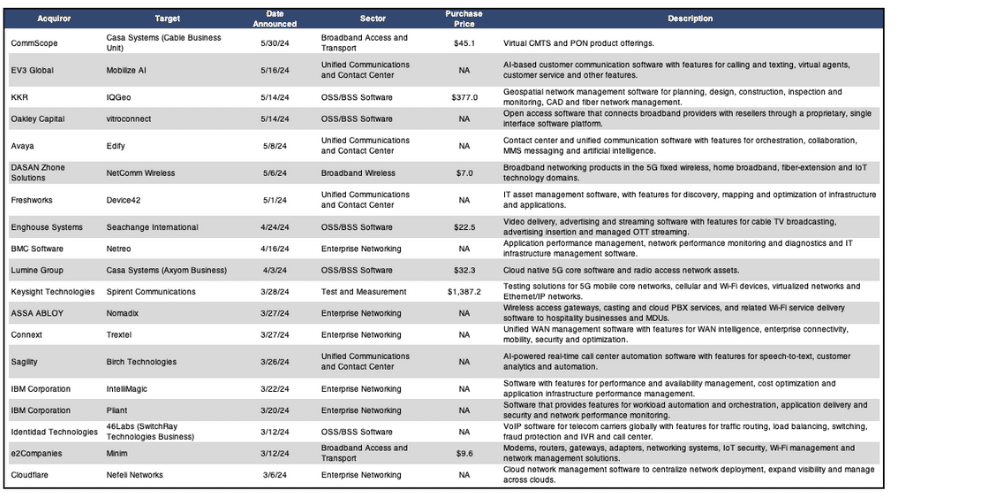

The level of M&A activity in the Telecom Technology sector picked up nicely with 19 announced transactions over these past three months. Much of the pickup in M&A activity was the result of the Enterprise Networking sub sector, which tallied six transactions this period. Total announced transaction dollar volume was also strong, coming in at a total of $1.9 billion.Through the first five months of 2024 we have now tracked a total of 29 transactions.

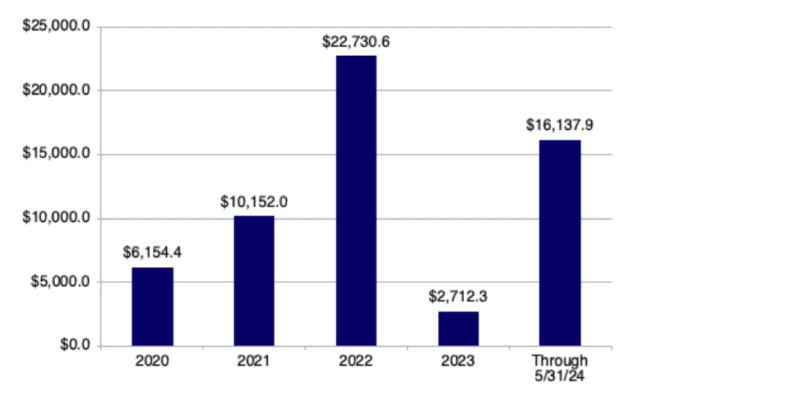

This pace puts us roughly on par with M&A activity levels from 2023, but still well below the levels of activity we saw in 2021 and 2022. On the plus side, total announced transaction dollar value so far this year stands at $16.1 billion, which is already well above any year in the last five with the lone exception of 2022. In fact, this period saw another billion dollar transaction with the acquisition of Spirent Communications by Keysight Technologies for $1.4 billion.

Number of Transactions

$ Value of Transactions in Millions

ANNOUNCED TRANSACTIONS (3/1/24 – 5/31/24)

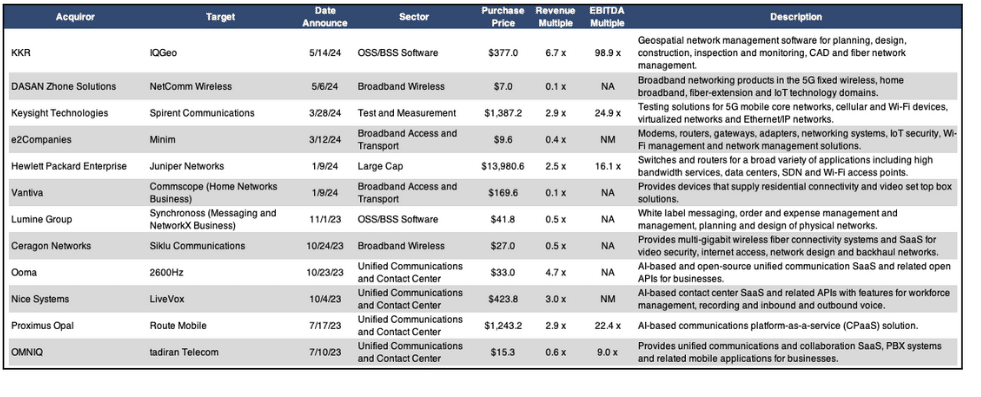

M&A TRANSACTIONS WITH ANNOUNCED MULTIPLES (6/1/23 – 5/31/24)

We had four transactions with announced multiples this period. The period’s largest transaction by a wide margent was the aforementioned Keysight/Spirent transaction. This deal had multiples of 2.9x revenue and 24.9x EBITDA. The next largest transaction was in the OSS/BSS Software sub sector. This was the take-private transaction for IQGeo by KKR for $377 million.

This was the highest multiple transaction for the period, weighing in at 6.7x revenue and 98.9x EBITDA. The remaining two transactions with multiples were both significantly lower. Home networking company Minim got purchased by e2Companies for a multiple of 0.4x revenue, while DZS acquired Casa Systems’ NetComm Wireless division out of bankruptcy for an even lower revenue multiple of 0.1x.

DOWNLOAD THE FULL REPORT HERE.