Food Distribution is Ripe for M&A

In this article, which joins our ongoing coverage of the Food & Beverage industry, we introduce an overview of M&A activity in food distribution with a focus on fresh food. Our upcoming articles will cover a range of topics, from CEO interviews on navigating growth opportunities and industry challenges to profiles of companies shaping the future of food.

Constantly changing but in no danger of becoming obsolete, the Food & Beverage sector underpins economies locally, regionally, nationally, and globally. The pandemic accelerated innovation at all levels as it spotlighted weaknesses and systemic inefficiencies, particularly in food distribution. Longer term industry and technology trends, like the rising demand for fresh foods and the introduction of AI, demand that companies adapt, and adapt quickly. M&A activity flourishes in large industries undergoing growth and stress, making food distribution ripe for dealmaking.

Dependability, Resiliency Attracts Buyers

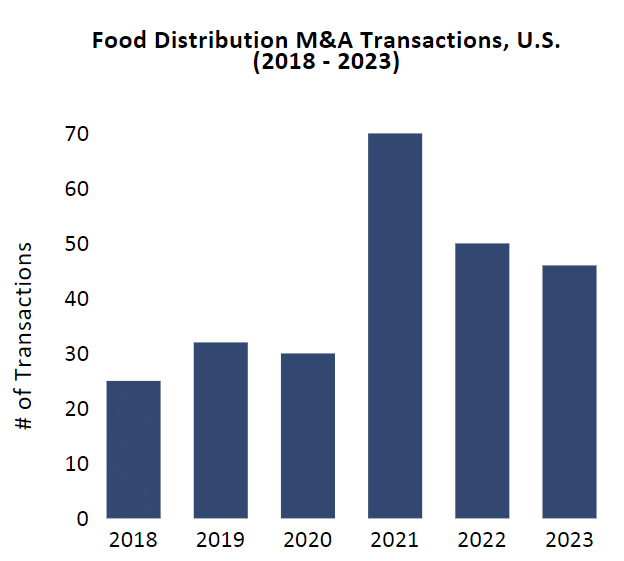

Source: S&P Capital and FOCUS research (April 2024)

Food distribution has always had its place in the M&A market. Large corporates have pursued acquisitions to increase their market share, grow their customer base, and/or expand their footprint. Financial acquirers have been drawn to the sector’s stable cashflows and opportunities for consolidation. Between 2013 and 2019, food distribution generated a steady flow of deals with strategics driving the majority of activity. During the same time, private equity firms started betting on the sector, particularly in specialty segments. Yet food distribution still had momentum to gain from an M&A perspective.

With the arrival of 2020 and the global pandemic, niche categories like fresh and specialty foods emerged as long-term trends. Consumers turned to fresh fruits and vegetables as they prioritized health and wellness. Large corporates turned to regional suppliers to stabilize supply chains. And private equity firms saw untapped growth potential in food distribution, especially in the produce segment.

Across Buyer Types, a Focus on Fresh

Recent years have shown an uptick in fresh food deals as companies responded to the heightened consumer focus on healthy food, while also pursuing acquisitions to reshape their product portfolios, strengthen their supplier base, create operational efficiencies, or shorten their food miles. Private equity platforms have also emerged as legacy businesses look to partner on growth opportunities, particularly through an M&A strategy.

Buyer

Select Acquisitions

Notes

What’s Ahead?

We expect dealmaking to continue in 2024 and beyond, as active buyers signal expected growth for the sector. Just a few months into the year, several transactions have closed, and key players have announced that M&A is part of their recipe for growth. This doesn’t come as a surprise, as companies in food distribution have experienced a tempering in revenues and earnings after enjoying a favorable pricing environment in 2022. In its recent earnings release, Sysco shared its plans to pursue M&A and indicated that it has a “strong pipeline of tuck-in acquisitions focused on broadline, specialty, and cuisine-type opportunities.” U.S. Foods, also in its recent earnings release, announced agreement to purchase IWC Foodservice, a broadline distributor serving the Nashville area, in addition to prioritizing accretive tuck-in M&A opportunities. Financial buyers, equally as important to M&A markets and sitting on trillions of dollars of dry powder, will also look to resilient sectors like food distribution to deploy capital.

Who Are the Buyers in Food Distribution M&A?

A disciplined M&A process involves targeted outreach to a broad buyer universe, which sets the stage for a competitive auction. The benefit to a seller? Greater competition can bring increased value to a deal.

Strategic: Typically public companies or large corporations that operate in the same or closely adjacent industry. They can be foreign or domestic; or they may a supplier, customer, or competitor.

Financial: Private equity groups seeking to acquire a company as an investment. These buyers acquire businesses, grow them, and then typically sell them at higher price than initially paid to achieve a return.

Sponsor-backed Strategic: Companies that are majority/fully-owned by a financial sponsor. The sponsor acquires the business, creating a “platform”, and then pursues add-on acquisitions to drive rapid growth.

Active Buyers, Attractive Valuations Offer Opportunities to Sellers

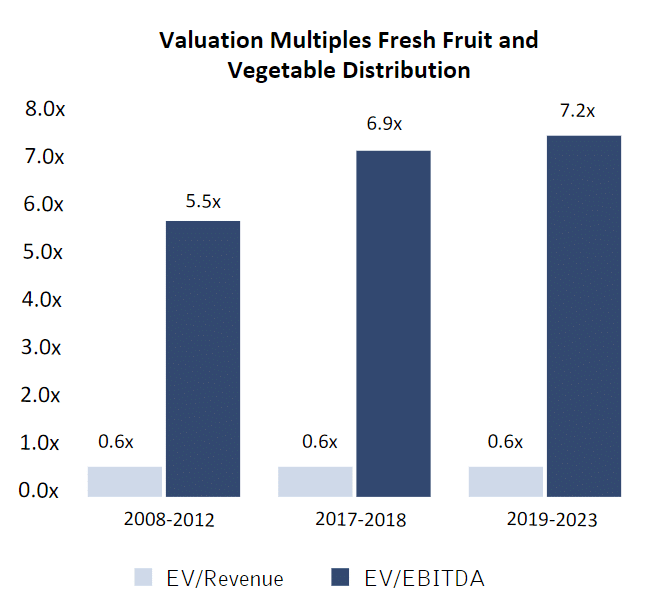

Source: GF Data; these statistics cover a subset of private equity-involved deals

With large companies expanding their positions via acquisitions, operators of regional and/or specialty distribution businesses may be interested in taking a closer look at their options, whether it’s pursuing growth opportunities or moving towards an exit. Along with greater buyer interest in recent years, valuations have also experienced an upswing with EV/EBITDA multiples steadily increasing since 2013.

Taking an “outside in” approach in assessing the strengths and weaknesses of the business can put owners in a stronger position as they begin the M&A process. For owners considering a sale, prioritizing key business and financial attributes can enhance a company’s position in the market and increase its valuation. While no deal looks the same, these attributes along with other considerations like market conditions often inform what a buyer will pay.

Target Attributes Driving Valuations in Food Distribution

- Direct, preferred relationships with producers that provide predictability and consistent delivery

- Diversified supplier base

- Robust portfolio of products that offer growth potential with customers across channels

- Established footprint in high-density market

- Capabilities to deliver value-added services

- Ability to integrate production and processing to deliver efficiencies, reduce costs

- Sustained volume growth (especially relevant in an inflationary environment)

- Diverse customer mix, supported by defined offerings and differentiators that drive loyalty

- Strategies identified/implemented to deliver operational improvements and drive margin expansion

Final Thoughts

Owners and operators of food distribution companies, like many in the Food & Beverage industry, bring their unique stories and histories to the business. Multi-generation family businesses have customer relationships spanning decades. They have direct relationships with their producers and know every detail of their products, whether it’s citrus from farmers in Texas or gourmet foods imported from Europe. They’ve optimized their distribution and logistics to ensure deliveries are made on time, week after week.

For owners considering an exit, pursuing a sale in today’s active M&A market is an opportunity to define their company’s future. A partnership with a buyer offers many benefits: opportunities to add new capabilities, incorporate current technologies, gain efficiencies, and create a long-term pathway for employees. While each deal looks different, owners that work with an experienced M&A advisor will be in a better position to negotiate favorable terms, maximize transaction value, and enjoy a successful closing.

Download the article here.