It’s a Mixed Outlook for Automotive Aftermarket M&A in 2023

Recession in ’23?

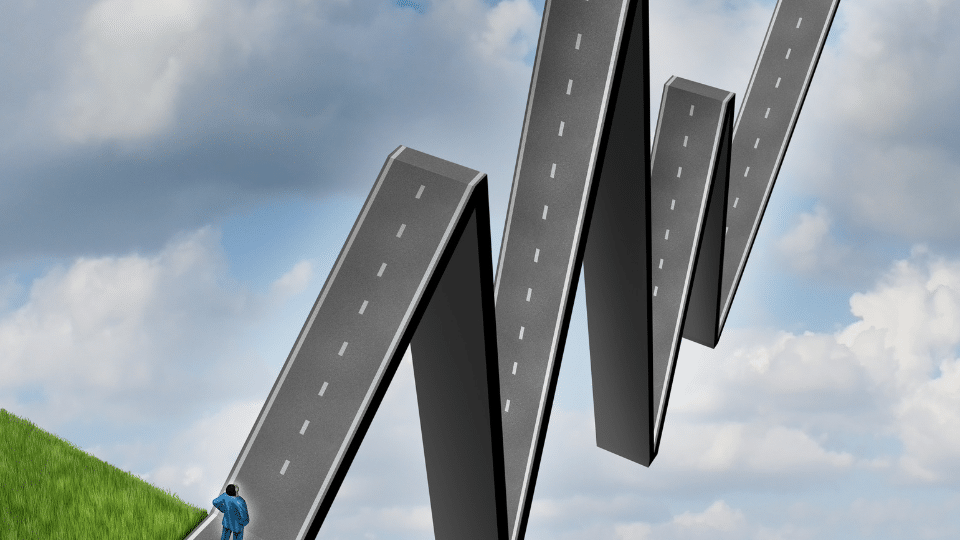

Uncertainty breeds caution. This is an understatement when it comes to mergers and acquisitions in the automotive aftermarket for 2023.

The Sword of Damocles hanging over all of our heads is the prospect of a recession in the US economy. Even talk of a recession can cause consumers with optimistic outlooks — the driving force behind the economy — to be more wary when it comes to spending. This caution trickles down to aftermarket manufacturers, distributors and service providers.

Buyer Sentiment and M&A

Recessions cause business buyers and investors to assess whether an M&A opportunity is recession-proof or not. Larger ticket discretionary purchases fall (think RVs), smaller ticket accessories and maintenance items stay level, and need items like tires and service can grow. Buyers and investors gravitate to businesses that meet their profitability threshold and have greater prospects for growth when the economy goes sideways. Business buyers and investors will think twice when assessing potential M&A opportunities and look for some assurance that any investment they consider will remain resilient throughout an economic downturn. They will focus their attention on businesses which deliver financial stability while also providing essential items such as tires or maintenance services.

What is causing the talk about a recession is the uptick in interest rates. After 10 years of keeping rates artificially low, the Fed has woken up to fight the larger foe of inflation. Since most M&A is funded by debt, higher rates lead to less lofty valuations. Owners of businesses start to think about timing their exit for the next valuation peak.

But all valuations tend to follow the major stock market indices. If a publicly traded company that was trading last year at 17 times EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) is now trading at 12 times EBITDA, then why should a smaller private company in the same space with less EBITDA be valued relatively higher than that? “Stuff rolls downhill” and in this case the smaller company’s valuation gets squashed.

Good news remains

Do not despair as all is not lost in the world. Unlike in past recessions, the amount of capital available on the sidelines to invest in private companies has never been greater. It is estimated to stand at $3 trillion. And the number of private equity companies in our database that focus only on automotive investments numbers over 300 potential buyers and continues to grow. Investors are seeing the automotive segment as a large and mostly recession resistant industry. While valuations may not be as lofty as 2021, the sheer number of investors and capital available makes the market stronger than one would expect. A large percentage of those funds and companies need to put that money to work as their investment time horizon for a new platform is five to seven years.

Also, if the recession comes early in 2023 and ends quick, and the leading indicators turn positive (primarily the stock market, job growth and the yield curve), then the activity level will definitely increase.

The types of businesses that will see more M&A activity will depend upon the segment that a particular business is in. If a lot of private equity has platforms in a particular space such as automotive parts and accessories, then we can expect to see more deals there. As a general rule, high margin, direct-to-consumer, EV-related and branded products will still be in demand and see more activity.

All in all, the outlook for M&A activity in the auto aftermarket industry for 2023 is cautious but promising. The wild card will be the US economy and whether or not we see a deep recession. If we do, it will cause buyers and investors to reassess which opportunities are worth pursuing. However, need-based items like tires and service are likely to continue growing even in a recession, so there are still plenty of opportunities out there for those who are willing to take them on.

Giorgio Andonian is a Managing Director in FOCUS Investment Banking’s Auto Aftermarket Group. With a lifetime spent in his family’s automotive business, he now advises and assists privately-held middle market auto aftermarket companies with mergers and acquisitions. He can be reached via e-mail at [email protected].

This article was previously published on Aftermarketmatters.com.