The modern era has witnessed two great periods of transformation that radically changed the global economy and the very nature of human existence. The Industrial Revolution of the 18thand 19th centuries and the shift to a postindustrial economy over the past fifty years are old news. Today, the Global Economy is undergoing a third period of transformation into a new Digital Age that promises to be even more dramatic in its impact. In this article, we will address some of the forces driving this change and provide our predictions as to which industries and economic sectors will be affected first. For a video discussion of the topics covered in this email click here.

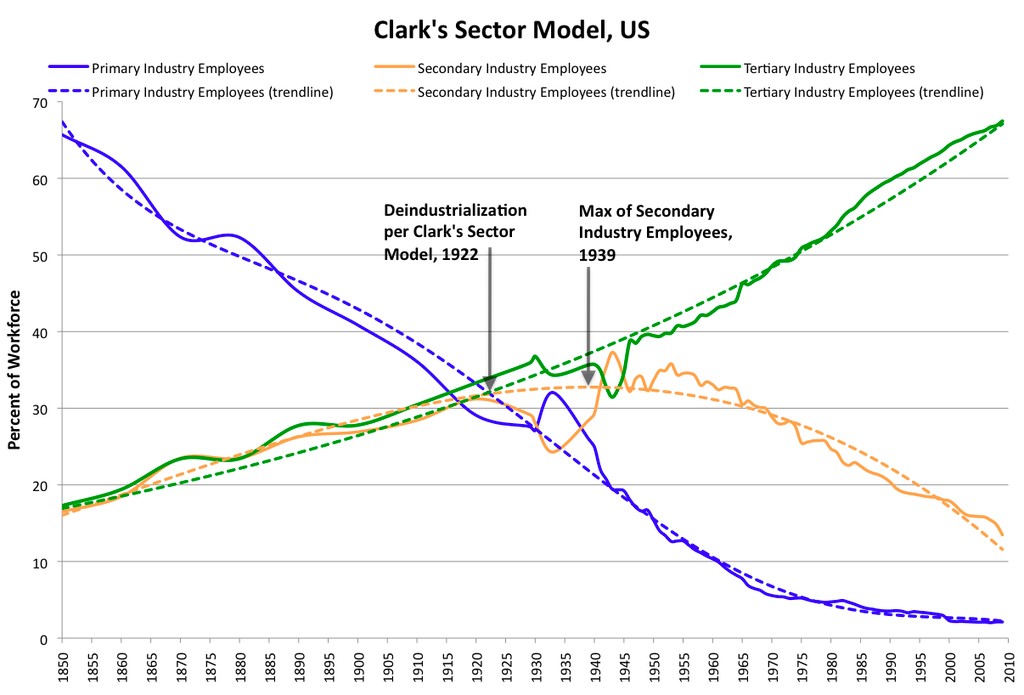

Manufacturing dominated the American economy for almost 100 years commencing in the late 1860s, but, beginning in the 1960s, manufacturing was rapidly eclipsed by a new services and trade based economy. A quick look at the chart below demonstrates how overwhelming that trend has been. From 1850 to 2010, primary and secondary manufacturing in the United States dropped from approximately 80% of the US economic output to its current level closer to 20%. Tertiary industries, Clark’s name for what we would today call services, finance, retail, and distribution grew from approximately 17% of the economy in 1852, to 70% today, with the most important portion of this transition occurring since the 1960s. While the Industrial Revolution took almost 150 years to fully play out, the shift to a services and trade based economy happened in less than half that time.

Source: Wikipedia

We have now entered a new era that will impact most sectors of the global economy. This new transition promises even more radical change. We are only in the early innings, but this game will play out far more rapidly than its predecessors. Driving this change are the maturing of digital intelligence and the global expansion of the Internet.

John Mauldin recently published an excellent article entitled “The Age of Transformation“, introducing the subject of transformation as a major driver in the global economy. The ongoing transition to a digital, white-collar economy promises to create both opportunities for those companies and industries that are able and willing to adapt and great danger for those that cannot. Mauldin says in part:

“I believe there are multiple and rapidly accelerating changes happening simultaneously (if you can think of 10 years as simultaneously) that are going to transform our social structures, our investment portfolios, and our personal futures. We have had such transformations in the past. The rise of the nation state, the steam engine, electricity, the advent of the social safety net, the personal computer, the internet, and the collapse of communism are just a few of the dozens of profound changes that have transformed the world in which we live.

Therefore, in one sense, these periods of transformation are nothing new. I think the difference today, however, is going to be the simultaneous nature of multiple transformational trends playing out within a very short period of time (relatively speaking) and at an accelerating rate.

It is self-evident that failure to adapt to transformational trends will consign a business or a society to the ash can of history. Our history and business books are littered with thousands of such failures. I think we are entering one of those periods when failing to pay close attention to the changes going on around you could prove decidedly problematical for your portfolio and fatal to your business.”

The exponential advance of digital technology promises to supplement or replace humans in many, if not most, routine white-collar tasks. Contract documentation, regulatory compliance, and the myriad of mind-numbing government forms and processes will increasingly be handled by intelligent systems. These capabilities will free many workers from numerous monotonous and time-consuming tasks, but the resulting efficiencies will inevitably result in a significant dislocation in white-collar labor markets. Millions (perhaps tens or hundreds of millions) of white-collar employees in the United States and other major world economies depend on their role in fulfilling these tasks to support themselves and their families. The ongoing Digital Transformation threatens to wipe out many of these jobs, which have been vital to prosperity in middle class America.

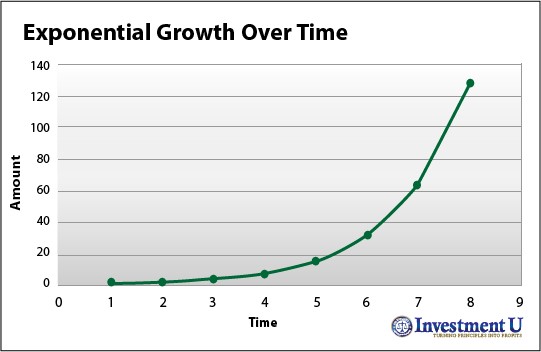

The catalyst for the Digital Transformation is the acceleration of computing power as represented by Moore’s law, which predicts a doubling of the number of transistors available to an integrated circuit every two years and which has accurately predicted the resulting geometric increase in processor capacity and speeds. A number of observers have found similar exponential growth curves are present in other areas of rapid technical change. For example, the networking of data was initially limited to large enterprises, but has increasingly become available to every citizen of the world. These effects have created global giants such as Facebook and Alibaba, which have enabled thousands of enterprises that could not exist without their reach.

The current impact of acceleration in the pace of economic change is best understood through the lens of the chart below.

The most striking aspect of this chart is how small the macro impacts of exponential growth are in its early stages and how, in the later stages, the aggregate impact of the growth curve becomes overwhelming. If you assume that the beginning date for this curve starts in the mid-1980’s, the period in which personal computers and networking began to seriously impact business users, and that the interval for a doubling of digital power and efficiency is five years, we are now thirty years into the digital revolution. Without assuming any acceleration in the overall pace of change, the next two doublings (2015 – 2025) will have a far greater impact on society and commerce than the combined impact of the change in the thirty years that precede them.

Imagine a great river like the Mississippi. If you view the river from my hometown of Memphis, the river is (comparatively) narrow and the current is fast. As you move south into Louisiana, left undisturbed the river fans out into a vast wetlands complex called the Atchafalaya Basin. Except in flood stage, the river at Memphis only affects things directly within its channel; as it moves south and the water spreads out, the water flow remains constant, but the water begins to impact many hundreds of square miles of geography. To date the technology revolution has been contained generally within the narrow confines of the tech sector. Moving forward the impacts will spread throughout most sectors of the economy. While the overall rate of technological change may not have increased, the rate of change in these specific industries will explode geometrically.

The Internet as a Force of Global Transformation

Imagine that Einstein had been born in a rural village in India instead of in Germany. He might well have been forced to spend his days behind a plow rather than providing the intellectual basis for much of the scientific progress that took place in the 2Oth century. If tomorrow’s Einstein were born today in that same Indian village, she would have access on her cell phone to a cornucopia of educational resources and scientific knowledge formerly available only to the world’s intellectual and financial elites. Through home study, she would have the potential to excel in the entrance exams, attend an IIT, and change the world.

With smart phone access to information exploding globally, similar opportunities will come to millions of potential Einsteins, Henry Fords, and Thomas Edisons throughout Asia, Africa, and Latin America. It’s not hard to imagine the combined force of this brain power dramatically accelerating the pace of global change.

Creative Destruction

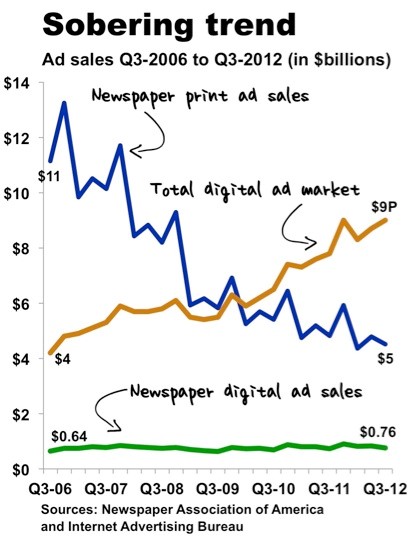

The chart below shows how radically destructive these changes can be for companies that fail to transform their business model to fit the digital future.

Newspaper publishers had a long, cozy run as the industry became increasingly monopolistic in local markets, but the business model was seriously flawed in part because of the vast amounts of paper that dominated their expense structure. As early as the middle 1990s, innovative web companies began to chip away at the newspaper monopoly. Even as late as 2006, these changes had had a nominal impact on the publishers. However, once the change came, it was devastating for the publishers and incredibly rapid.

Similarly in the past decade the music industry witnessed the virtual elimination of the CD (which had previously replaced the LP), replaced by more efficient digital downloading of individual songs or tracks for $.99 each rather than the $ 15 for an entire CD. Now ITunes has become old news as digital subscriptions on services such as Spotify are rapidly supplanting the need for downloads.

Disruption in Service-based Industries

Over the next five to ten years, we expect similar disruption in many, if not most, service-based industries. Among the next industries to feel the impact are those that depend on, or generate, large volumes of paper-based transactions and documentation such as insurance, money-management, and banking.

Disruption in the Healthcare Industry

Following soon after will be the healthcare industry, where products such as IBM’s Watson have the potential to change dramatically and improve the nature of healthcare services. Watson can access all published medical literature and scientific papers up to the minute. By comparing a particular patient’s symptoms with similar symptoms and outcomes, the computer has already demonstrated its ability to support physicians in making a far more accurate diagnosis than could be achieved by even the most skilled and knowledgeable medical professionals without its assistance. As more medical records go digital, Watson will be able to evaluate the efficacy of alternative treatments across thousands of patients and assist the physician in establishing an appropriate and effective treatment regimen.

Disruption of Paper-based Commerce

We’ve had the pleasure of working with a company that is a leader in the digital signature industry, a key enabling technology for the digitization of global commerce. As a result of this process, we have learned that, after decades of talk, the transition from paper-based commerce to digital commerce has now reached the takeoff stage. By the end of the decade, the majority of paper-based transactions will be replaced by digital documents. With strong authentication for the signers’ identity and intent and a superior audit trail than generally available for paper based documents, this technology will support significant improvements in document processing time and expense. This transition will have dramatic impact on mid-level white-collar personnel currently employed to support paper-based transactions, not to mention the copy paper industry.

Exponential Change Impacts our Middle Market Clients

Our interest in exponential change is not about abstract sociology. If you’d like to further explore that aspect of the change, I highly recommend you read The Second Machine Age. We are focused instead on the impact of this revolution on our clients, middle market entrepreneurial businesses, though it is obvious these trends will have major impacts on publicly traded companies as well.

You don’t have to look far (think Mark Zuckerberg and Elon Musk) to realize that great fortunes can be made incredibly quickly by entrepreneurs who understand the forces of change and set out to aggressively transform the industry verticals in which they operate. The instant access to global markets made possible by the Internet means that ideas that are successful today can be scaled tomorrow globally, with revenue and profits growing accordingly. On the flip side, businesses that fail to adapt may be consigned to a slow death as their outmoded systems struggle to keep up with the requirements of the new technologies.

This era of exponential change will have a profound impact not only for the owners of these businesses, but also for the buyers. From the owner’s perspective, it is crucial that he realistically evaluates his firm’s ability to keep up with, or even help bring about, the coming waves of change. If the answer is anything other than a total commitment to the digital transition, he should consider selling now to a buyer with the commitment and resources to adapt.

Disruptive Technological Change vs. Historical Earnings

From a buyer’s perspective, this rising tide of change adds a new element to its evaluation of possible acquisitions. The M&A market, particularly private equity firms, engage daily in a white-hot market that is driven by highly competitive auctions, where the expected currency is high multiples of historical EBITDA. As we reported before, today’s valuations for middle market companies have surpassed even those of the mid-2000’s bubble and, with the surplus of capital available to potential buyers, competition may well drive prices even higher.

Historical earnings are often used to support these highly leveraged private equity transactions. Disruptive technological change may prove historical earnings to be fools’ gold. Rapidly changing industries, such as newspaper publishing, present great risks to private equity players who are often fond of highly leveraged transactions based on past financial performance of the companies. These changes are affecting even strategic players with more conservative tastes. We expect many Global 1000 companies to reevaluate their product/service lines and focus on core competencies better aligned with the new digital age. As a result, we see the beginnings of another round of corporate selling aimed at divesting noncore assets.

Going Forward

Our Digital Transformation team at FOCUS targets industries in the midst of transition/transformation. Over the past several years, we have closed a number of debt financing transactions for non-bank finance companies that are disrupting the small business lending market using digital marketing and underwriting support tools.

Earlier this year, we completed an equity recap for a leader in the technology-enhanced legal outsourcing industry; based on what we saw, the current approach to legal billing will change dramatically in the coming years, likely to the detriment of traditional law firm structures.

Separately, FOCUS closed a transaction for an e-discovery provider that plays a role in the disintermediation of legal discovery processes resulting in significant cost savings to the litigants.

Going forward, we are putting emphasis on those companies that are disrupting the transaction management space as well as financial services and specific aspects of the healthcare industry. There are additional industries that are feeling or will soon feel the winds of change. We are initiating conversations with business leaders whose companies are likely to be impacted by the Digital Transformation to flesh out a more comprehensive picture of the changes underway.

Action Items

We have substantial experience working with companies in the midst of rapid change. We have identified several critical steps to enhance your success in the Digital Age:

- Reevaluate the goals of your acquisition/disposition program. Acquisitions should be targeted to moving your company into better alignment with the direction the Digital Transformation is taking your industry. Strategic sales can be used to exit non-core businesses threatened by technology transformation.

- Digitize everything: eliminate physical document production and labor intense business practices, replacing them (and the associated personnel and related expenses) with simplified, SaaS based, process automation and digital intelligence.

- Expand your horizons. The best talent may not be in your company, or your country. Where acquisition is not an option, develop strategic partnerships with the best and the brightest talent and companies, wherever located. Target professionals committed to making business systems more efficient and effective through use of digital processes and provide them the software and communications tools needed for effective collaboration.

- Don’t wait until the train has left the station. If your business is not going to be a winner in the transformation game, exit now while M&A valuations are at all-time historic highs.

To refine your game plan in each of these areas, give us a call. We’d like to hear your story.

For a video discussion of the topics covered in this email click here.