FOCUS Telecom U.S. Communications Service Provider Overview

Overview

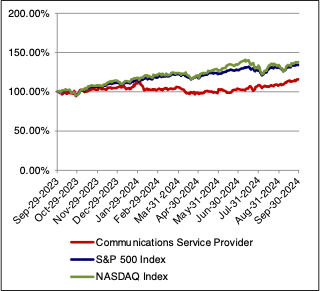

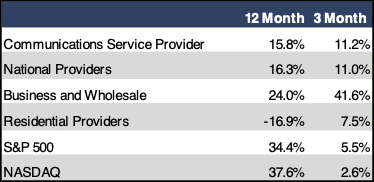

The FOCUS Communications Service Provider Index (CSPI) had an extremely strong fall reporting period with a three-month gain of 11.2%. This handily outperformed both the S&P 500 (up 5.5%) and the NASDAQ (up 2.6%). This period’s performance also increased the CSPI’s year-over-year gain to 15.8%. While strong, this performance still falls well short of the 34.4% year-over-year gain in the S&P 500 as well as the 37.6% year-over-year gain in the NASDAQ.Sector multiples are higher than they were at this time last year. The revenue multiple ticked up from 2.4x a year ago to 2.5x currently, while the EBITDA multiple jumped from 6.4x to 6.7x over the same time frame.

All of our three CSPI sub sectors posted positive returns over the past three months. The Business and Wholesale sub sector was far and away the top performer with a gain of 41.6% for the period. The main drivers for this were Cogent Communications (up 34.5%) and Uniti (up 93.2%). The National Providers sub sector also enjoyed a solid gain of 11.0% over the past three months. Lumen was the big story here as the stock rocketed up more than 500%. Lumen’s increase was due to several recent large contract wins and investor belief that the company is well-positioned to benefit from a surge in fiber demand as large companies deploy AI. Finally, the Residential Providers sub sector brought up the rear of the CSPI this period, but still managed to post a strong gain of 7.5%. Altice and Telephone and Data Systems both enjoyed double digit gains, but losses at Cable One and WOW served as a drag on overall sub sector performance.

PUBLIC MARKET SUMMARY

Twelve Month Index Returns

Sector and Sub Sector Returns

Sector and Sub Sector Revenue Multiples

Sector and Sub Sector EBITDA Multiples

M&A ACTIVITY

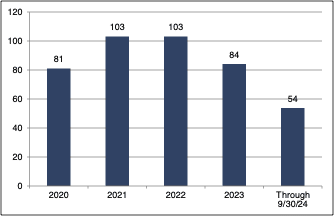

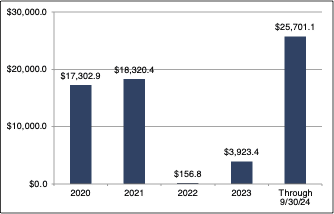

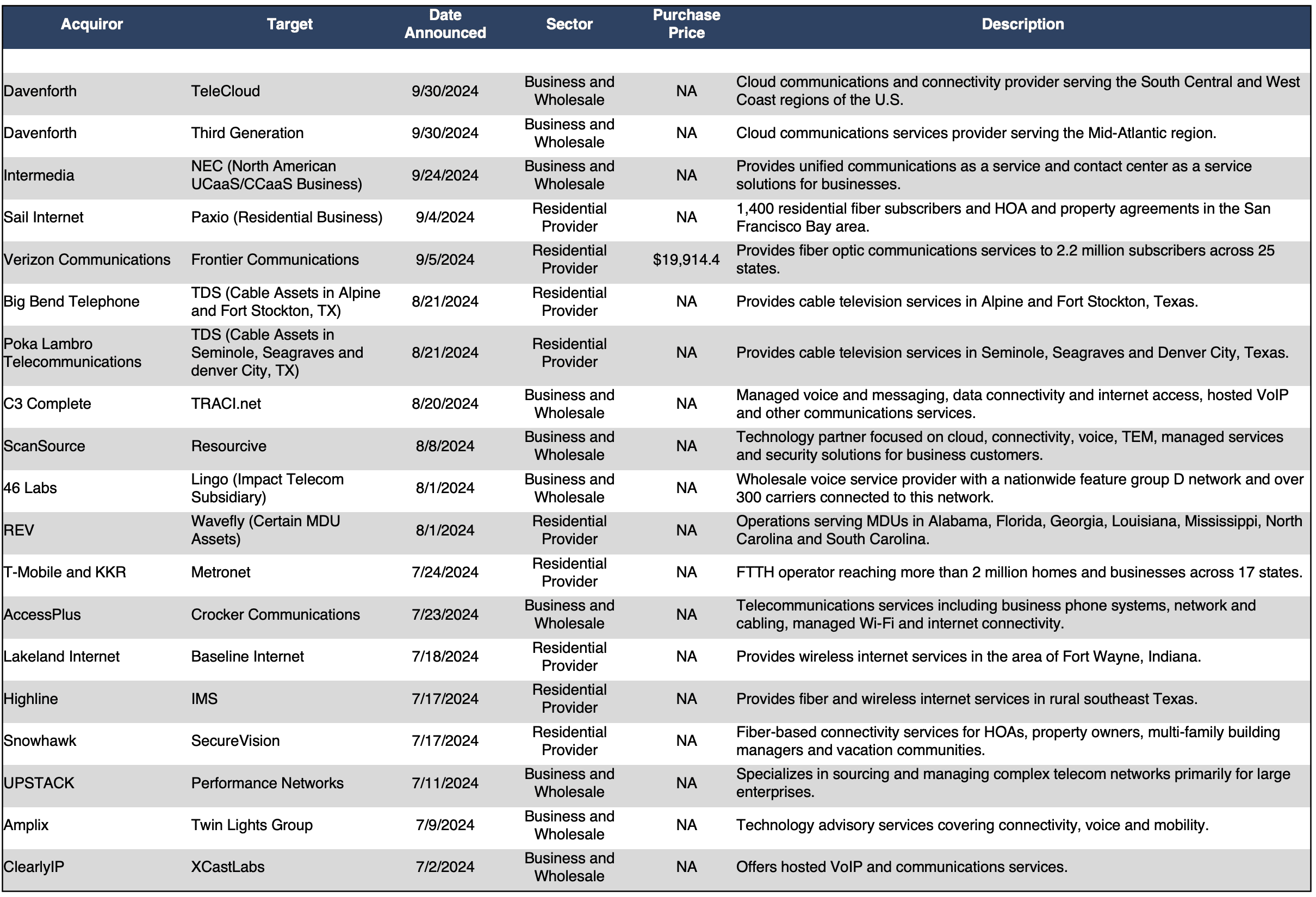

The Communications Service Provider sub sector saw a sharp spike in activity with 19 total transactions for the period. The total announced transaction dollar value of these transactions was also extremely high at $19.9 billion. Through September, the sector has had 54 transactions with a total announced transaction dollar value of $25.7 billion. This means that 2024 is shaping up oddly in terms of M&A trends. On the one hand, the number of announced M&A transactions is relatively low, and it appears highly likely that 2024 will see fewer M&A transactions than any year in the last five. However, with $25.7 billion in year-to-date total announced transaction dollar value, the year has already surpassed any year since 2016 based on this metric.

Clearly the transaction that garnered the most attention this period was Verizon’s announcement that it intends to acquire Frontier Communications for $19.9 billion. Not only was this the period’s largest transaction, but it is the largest transaction in the sector since CenturyLink’s acquisition of Level 3 Communications all the way back in 2016. We also noted with interest the acquisition of Metronet by T-Mobile and KKR. While no transaction dollar value was made publicly available, this was undoubtedly a large transaction as well In addition, it further reinforces T-Mobile’s interest in the fiber broadband space after last period’s acquisition of Lumos. While the Residential Provider sub sector had the larger transactions, the Business and Wholesale sub sector was more active, accounting for 10 of the 19 transactions this period. This activity included a new platform company in the sub sector as family office Davenforth acquired both TeleCloud and Third Generation.

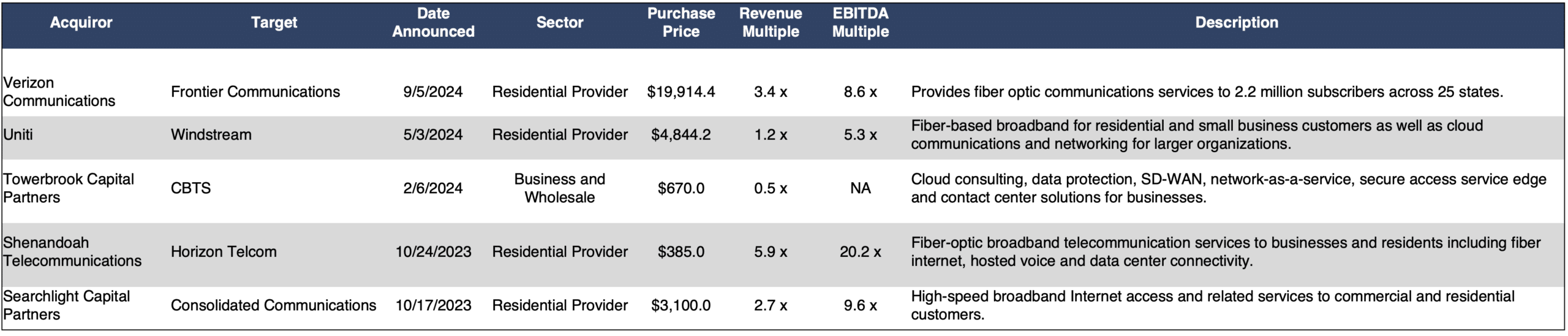

The only transaction with an announced multiple this period was Verizon’s acquisition of Frontier Communications. The multiples for this transaction were 3.4x revenue and 8.6x EBITDA.

Number of Transactions

$ Value of Transactions in Millions

Announced Transactions (7/1/24 – 9/30/24)

M&A Transactions with Announced Multiples (7/1/24 – 9/30/24)

DOWNLOAD THE FULL REPORT HERE.