Why precision machining shops are seeing premium valuations right now

Precision machining shops—specialized manufacturers devoted to ultra tight tolerance metal and polymer components—are attracting premium valuations in today’s M&A environment. These businesses are enjoying multiples well above the broader manufacturing average, driven by tightly wound demand dynamics, technological sophistication, resilient margins, and an appetite from strategic buyers aiming to consolidate ‑high precision‑ suppliers.

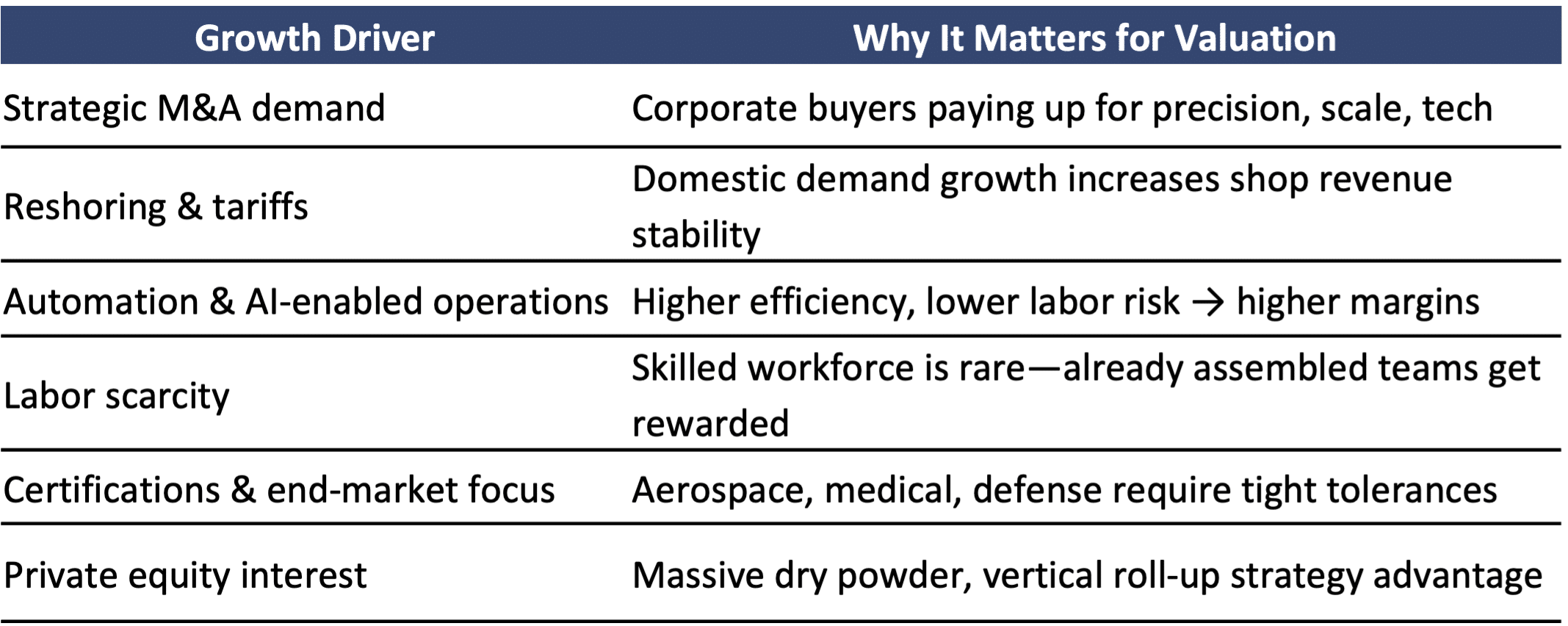

Market Trends: Why Precision Machining Commands Premiums

1. Strong M&A Tailwinds and Strategic Buyer Appetite

U.S. precision manufacturing M&A volume surged ~10% year‑over‑year in early 2025, with a striking 87.5% rise in private strategic deals compared to 2024*. Strategic acquirers—often OEMs or larger component suppliers—are paying up to gain precision technology, geographic reach, and supply chain control.

2. Policy Shifts & Reshoring Momentum

New border tariffs on imports—ranging from China to Canada and Mexico—are incentivizing U.S. companies to source domestically. This shift is channeling demand toward local precision shops, bolstering revenue and positioning them as attractive M&A assets under reshoring tailwinds.

3. Automation & Technology Premium

Sites investing in high-end CNC machines, lights‑out robotics, AI quality control, sensor integration, and predictive maintenance achieve scalable, repeatable precision work. Such firms trade at higher EBITDA multiples (10–12× as opposed to 6–8× for general mid‑market manufacturing) because they deliver superior profitability, resilience to labor constraints, and defensible competitive advantages.

4. Tight Labor Markets & Skilled Scarcity

Precision machining relies on rare talent—from toolmakers to multi-axis CNC programmers. With labor availability shrinking and costs rising, buyers are rewarding shops that already have the engineering bench and automation infrastructure to operate efficiently in this environment.

5. Structural Growth in Key End Markets

End markets like aerospace, medical devices, advanced electronics, and defense demand extreme precision, tight tolerances (±0.0001″), and rigorous certifications. Firms capable of delivering to these standards command premium pricing and long-term contracts—and buyers are willing to pay accordingly.

6. Valuation Landscape & Financing Optimism

Even while global M&A volumes fell about 9% in the first half of 2025, total deal value rose 15%, reflecting greater demand for high quality‑ businesses.* In manufacturing, technology-driven firms are achieving EBITDA trades closer to 10–12×, compared to broadly 6–8× for roll‑up targets.*

7. Private Equity Dry Powder and Vertical Deals

Private equity firms hold over $1.2 trillion in unspent capital and are selectively targeting platform and bolt-on acquisitions in sectors like precision machining—where consolidation, vertical integration, and scalability offer strong return potential in a favorable interest‑ rate‑ window.

What This Means for Sellers & Investors

- Premium Exit Opportunities — Firms with advanced certifications (ISO, AS9100, NADCAP), modern machine assets, automation, and precision tech typically command higher multiples.

- Buyers Are Paying Strategic-Upside Value — Corporate acquirers may value precision shops not just on earnings, but on strategic synergies, vertical integration and margin expansion plans.

- Prepare for Intense Due Diligence — Buyers scrutinize equipment capabilities, tolerances achieved, tooling quality, automation uptime, customer diversification, and backlog strength.

- Market Timing Is Key — With anticipated easing of financing costs later in 2025 and increasing industrial policy clarity, timing an exit amid still g‑reen deal flows can maximize valuation upside.

We understand that precision machining assets are currently trading at the intersection of industrial necessity, technological differentiation, and near-term policy tailwinds. This dynamic is driving valuations beyond typical manufacturing norms. If you’re evaluating the positioning or sale of a precision machining operation—or advising clients in the sector—now is a strategic moment to explore how these forces can be leveraged to generate value.

If you’d like to work through a valuation model or discuss comparable deals in precision machining, we’d be happy to serve as a resource.