Buying a company or selling a company is a major undertaking for all involved, including owners, shareholders, management, employees, and all other stakeholders. It is intense, time-consuming and can be costly if not done well. Additionally, it can take months or longer depending on the size of the transaction.

In a sell side engagement, to ensure maximization of value and key objectives being met, an investment bank and its team of trained professionals is retained. On the buy side, your team will also do their best to ensure your purchase provides you with the value you desire while going after your key objectives. This team will provide comprehensive financial analysis of both the company and/or targets, determine optimal valuations, prepare all materials needed during the buy/sell period. Additionally, your team will help in the interactions with the seller/buyer on the other side of the deal. The goal is to achieve an optimal mix of value maximization, terms, speed of execution, and certainty of completion on all aspects of the deal.

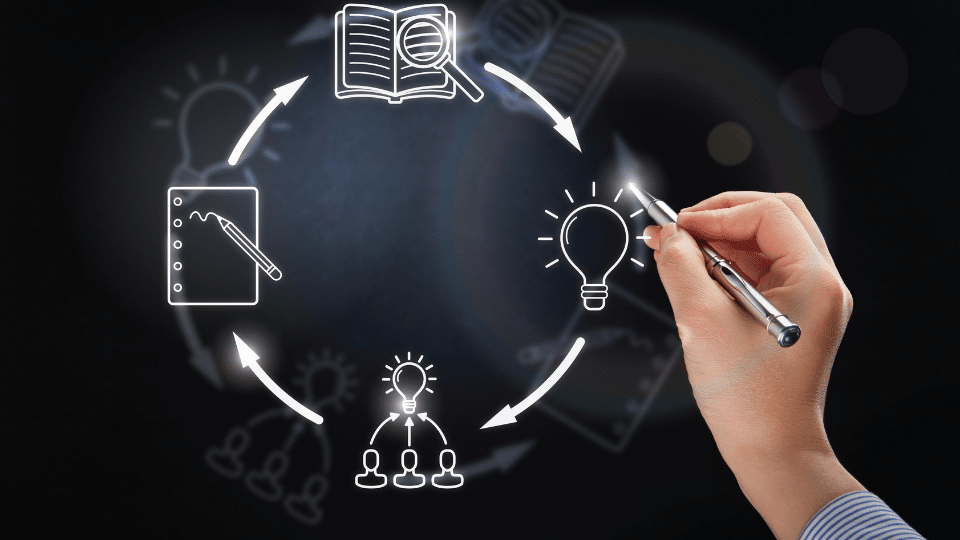

In general, the process will go through four stages. Each has a specific purpose and end game. All of them line up to achieve the main goal of buying/selling. To be very clear, whomever you choose to help you buy or sell, make sure they have a systematic, well managed, machine-like process that has been proven over time, industry, size, and market. Without such a process, something will be missed and that can be very costly both in time and money!

Part 3: Find Your Target (2-3 months)

Management Presentation: As stated above, this is the first time a prospective buyer/seller will meet with you. It usually is the formal start of the second round. The speakers and topics were determined in the go-to-market phase and the prospects will have their appropriate team members in attendance.

This is a very important meeting as it is the first deep dive the prospect or you will have into the intricacies of the deal. Not only does it give the depth of the company’s story, but it also is a chance for the buy side to see the management team they may be taking on. Prep and practice this presentation diligently if you are the side giving it!

Site Visits: While there are significant amounts of detail in the CIM and data room, there is an essential “eyeball test” that must be conducted as well. Usually, the management presentation and site visits go hand-in-hand. These are guided tours of the facilities done by key people who oversee the various areas. Again, this is a key time for the buy side to see what the sell side management team is like and to query the operations in detail. These are highly interactive visits, adding to the due diligence needed by the buy side team.

Data Room: Access to the data will be given to the prospects who have gone through or signed on for management presentations and site visits. This will be managed by your investment bank team. They will oversee who has access as well as who has investigated what material. This data set is key for the prospective buyer to understand synergies, opportunities, and risks. Your team will handle all questions and data asks that come from their side.

Final Bids: During this second round, your investment bank team will distribute a final bid procedures document and a Letter of Intent (LOI), an important, non-binding document regarding deal terms. The LOI is similar to the initial bid procedure letter in that it details timing for submitting a formal bid, the guidelines for submission, and all other legal items needed to create a binding offer.

Once the LOI is executed, either the buy side or sell side attorney will draft and distribute a Definitive Agreement (DA). The detail in this document is much more stringent as this is a final, binding agreement. The draft definitive agreement will be negotiated as to the exact terms and inclusions. The final definitive agreement is legally binding in detailing the terms and conditions of the deal.

FOCUS Investment Banking is a trusted name in M&A advisory services with a nationwide footprint and a global reach. Our experienced team of bankers have helped hundreds of business owners sell their company, expand via acquisition, or raise capital. Learn more about our experience.