Unlocking Higher MSP Multiples: How Peer Group M&A Outshines Conference Connections

Why 75% of Our Most Successful MSP M&A Deals Began—or Quickly Gained Momentum—Within Peer Groups

In today’s market, strategic preparation and relational equity matter more than ever. If you’re an MSP founder, don’t just ask what your company is worth—ask what it could be worth with the right partner. And if you are that partner, never underestimate the power of relationships built in the trenches of a peer group.

These relationships go beyond camaraderie and accountability. They often hold the key to unlocking significantly higher valuation multiples.

After a decade advising founders in the Managed Service Provider (MSP) space, I’ve spoken at countless conferences. I love these events—they’re energizing, high-visibility opportunities to meet potential partners. But when it comes to generating real M&A outcomes and transformative exits, conferences alone rarely deliver.

Instead, the most successful deals I’ve seen are born not in crowded ballrooms, but within peer groups—intentional, high-trust communities. And the data backs this up.

Peer Groups vs. Conferences: A Clear Winner

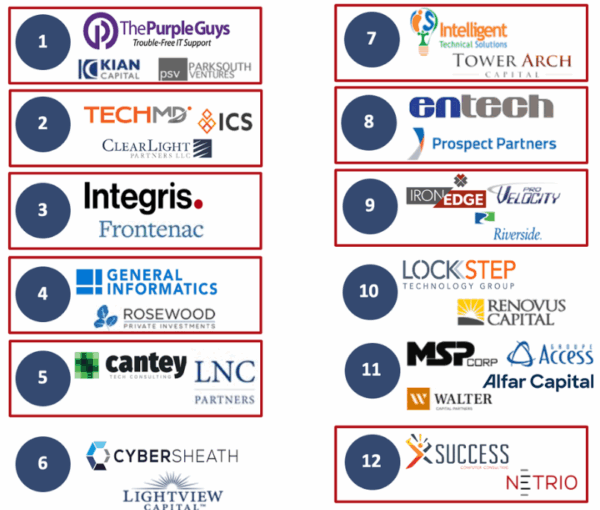

At FOCUS Investment Banking, 8 of the MSP platforms we’ve helped form—equivalent to 67%—originated as mergers of equals. In nearly all cases, the founding companies had strong ties built through peer group participation. These bundled deals consistently yield higher valuation multiples, stronger cultural alignment, and smoother post-close integration.

Compare that to deals sourced through cold outreach or fleeting introductions at conferences. Without the foundation of long-term trust, shared benchmarks, and consistent interaction, such deals are harder to structure—and even harder to close.

Institutional buyers increasingly prefer peer group-originated deals, and it’s easy to see why. Peer group members often already operate like partners:

- They’ve pressure-tested cultural compatibility

- Their financials are benchmarked side-by-side

- Their tech stacks and service delivery models are aligned

- They’ve built accountability over time

In effect, peer groups simulate post-merger integration before a deal is ever signed—and that’s a major win for buyers looking for lower-risk, high-confidence investments.

Peer Groups: A Clear Winner

Bigger Together: The Value of Bundled Deals

When two MSPs merge—particularly in the $1 million to $8 million EBITDA range—the resulting entity typically commands a 1x to 2x higher multiple than either business could achieve independently. This insight is grounded in Service Leadership valuation opinions issued from 2022 to 2024.

But it’s not just about scale—it’s about investability. Private equity sponsors are looking for businesses large enough to justify platform-level investments. Bundling enables founders to cross that critical threshold with confidence and credibility.

SIZE MATTERS – EBITDA MULTIPLES

This article is also available on Channel E2E, where Abraham Garver regularly contributes as an author.