The Impact of GLP-1 on the Food Industry

Rapid adoption of GLP-1s is reshaping consumer eating habits. For food companies, it’s an opportunity to innovate and cater to a growing market.

Introduction

- The rapid adoption of GLP-1 weight-loss medications such as Ozempic, Wegovy, and Mounjaro is reshaping consumer eating behavior – these drugs are increasingly used not only for diabetes management but also for appetite and weight control, influencing how people select, consume, and prioritize food.

- By controlling appetite and overall caloric intake, GLP-1s reduce demand for traditional snack foods, sugary beverages, and other high-calorie indulgent categories. These segments rely on frequency and impulse, so growth trends are vulnerable when consumers shift toward smaller, more nutritionally focused meals.

- Consumer spending has shifted toward nutrient-dense and functional products that support satiety and wellness. Categories such as lean protein, meal replacement, and healthier snack options have seen significant growth, while indulgent items like chips have declined.

- Large companies are responding by investing in R&D (such as product reformulations) and pursuing strategic acquisitions, targeting emerging brands and specialized players that lead with product innovation and reflect deep consumer trust.

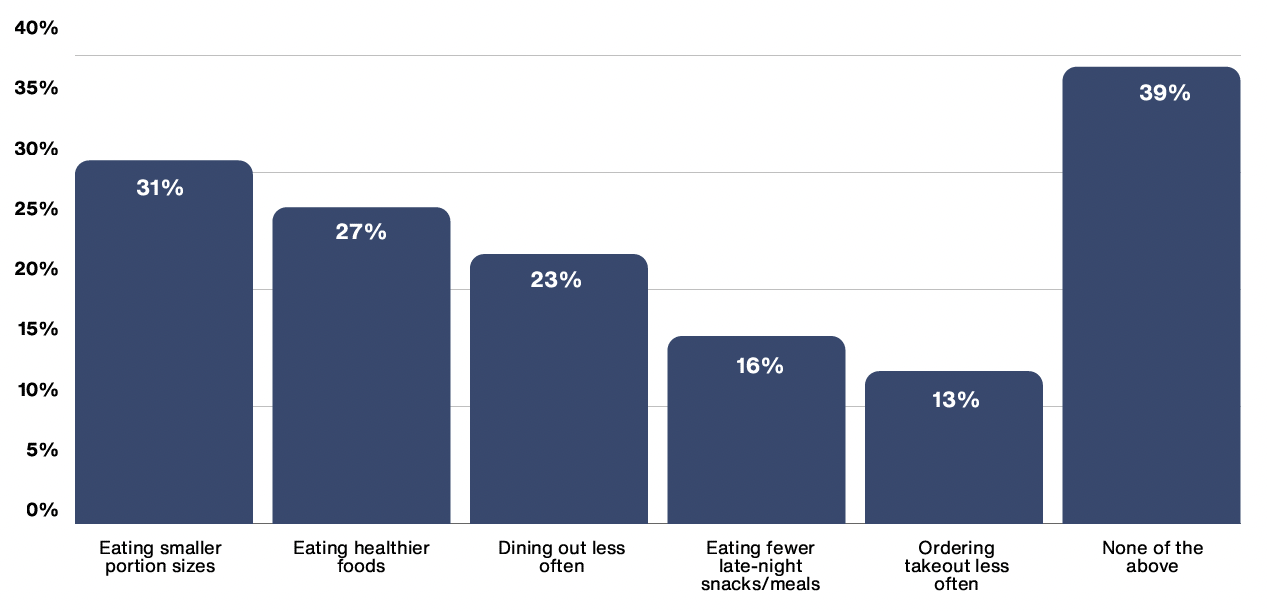

Change in Reported Dining Habits by GLP-1 Medication Users

In many ways, the impact of GLP-1s is reinforcing trends already in motion. Food manufacturers and retailers are reassessing traditional product lines, focusing on offerings that emphasize premium, indulgent snacking – think functional beverages, high-protein and high-fiber foods, and supplements that address GLP-1 side effects.

The GLP-1 Effect: How the Food Industry Is Evolving

How Food Manufacturers Are Adapting

In response to changing consumer tastes and needs, food and beverage manufacturers are rethinking products, marketing, and packaging.

- Product Reformulation and Innovation: Manufacturers are reformulating traditional snacks by reducing sugar, fat, and calorie content while maintaining flavor. Functional ingredients, such as high-protein blends, fiber, and satiety-promoting components are being incorporated to create products that align with the nutritional needs of GLP-1 users.

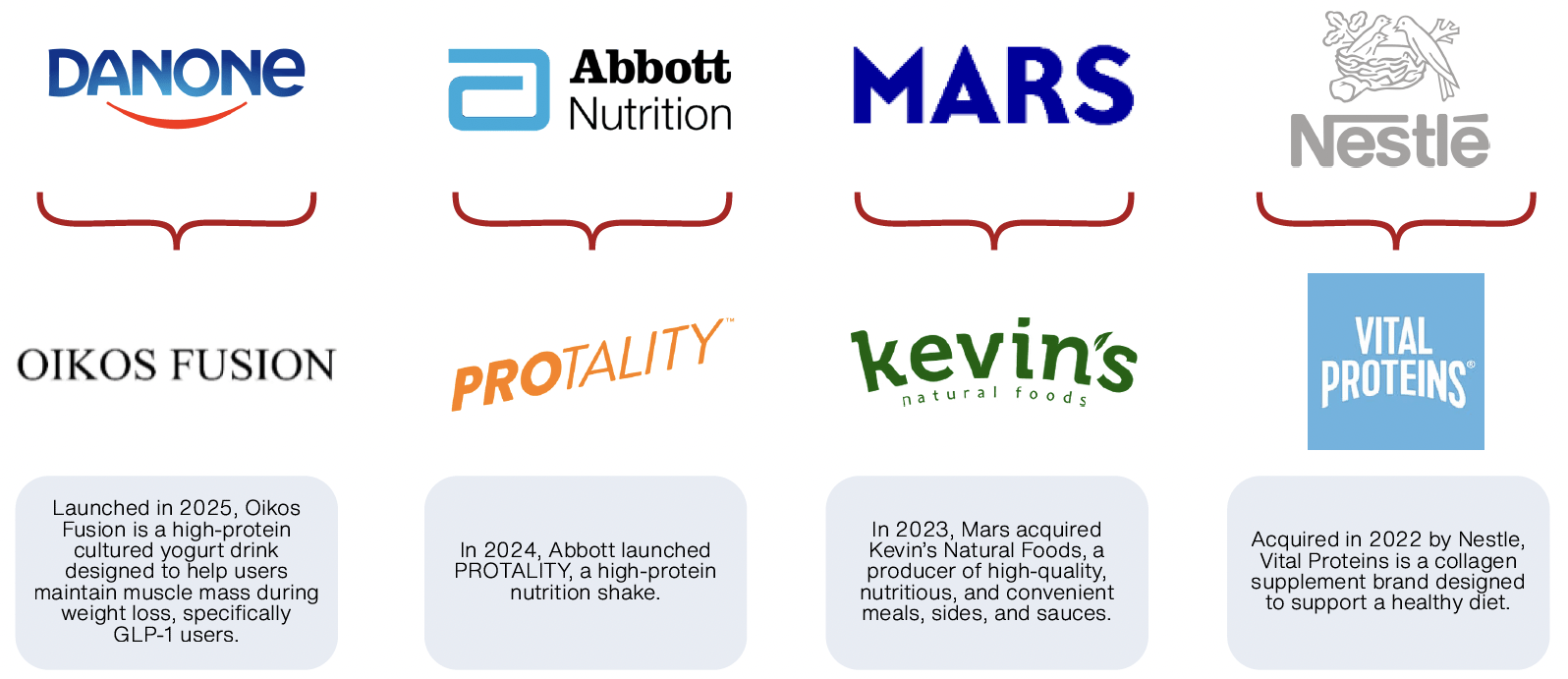

- Smaller Portions, Bigger Impact: Smaller portions and more purposeful ingredients are becoming standard as companies develop offerings that emphasize protein, vitamins, and fiber. Examples include Nestlé’s Vital Pursuit, a line of frozen meals designed specifically for GLP-1 users and others on weight-loss plans. Other examples include Danone’s Oikos Fusion and Boost drinks, which are designed to support satiety and nutritional balance.

- Clear and Targeted Labeling: “GLP-1 Friendly” or nutrient-focused badges help consumers quickly identify products that meet their dietary needs, while also reinforcing the brand’s commitment to health-focused innovation.

Notable Adopters

Private Label and Contract Manufacturers: Positioned to Benefit

Consumer-facing brands are often the focus when discussing GLP-1s and M&A activity. But when it comes to an attractive space for dealmaking, private label and contract manufacturing aren’t to be overlooked. Private label and contract manufacturers are increasingly attracting M&A attention and with the rise of GLP-1s, they stand to benefit from additional buyer interest. As critical partners to manufacturers, these companies serve as innovation engines, offer agility and speed to market, and can shift resources toward growth categories. From an M&A perspective, financial buyers see an opportunity to establish platforms and execute roll-up strategies. Strategics, too, are investing in and acquiring third-party manufacturers to strengthen supply chains and increase production capacity.

Recent Market Activity

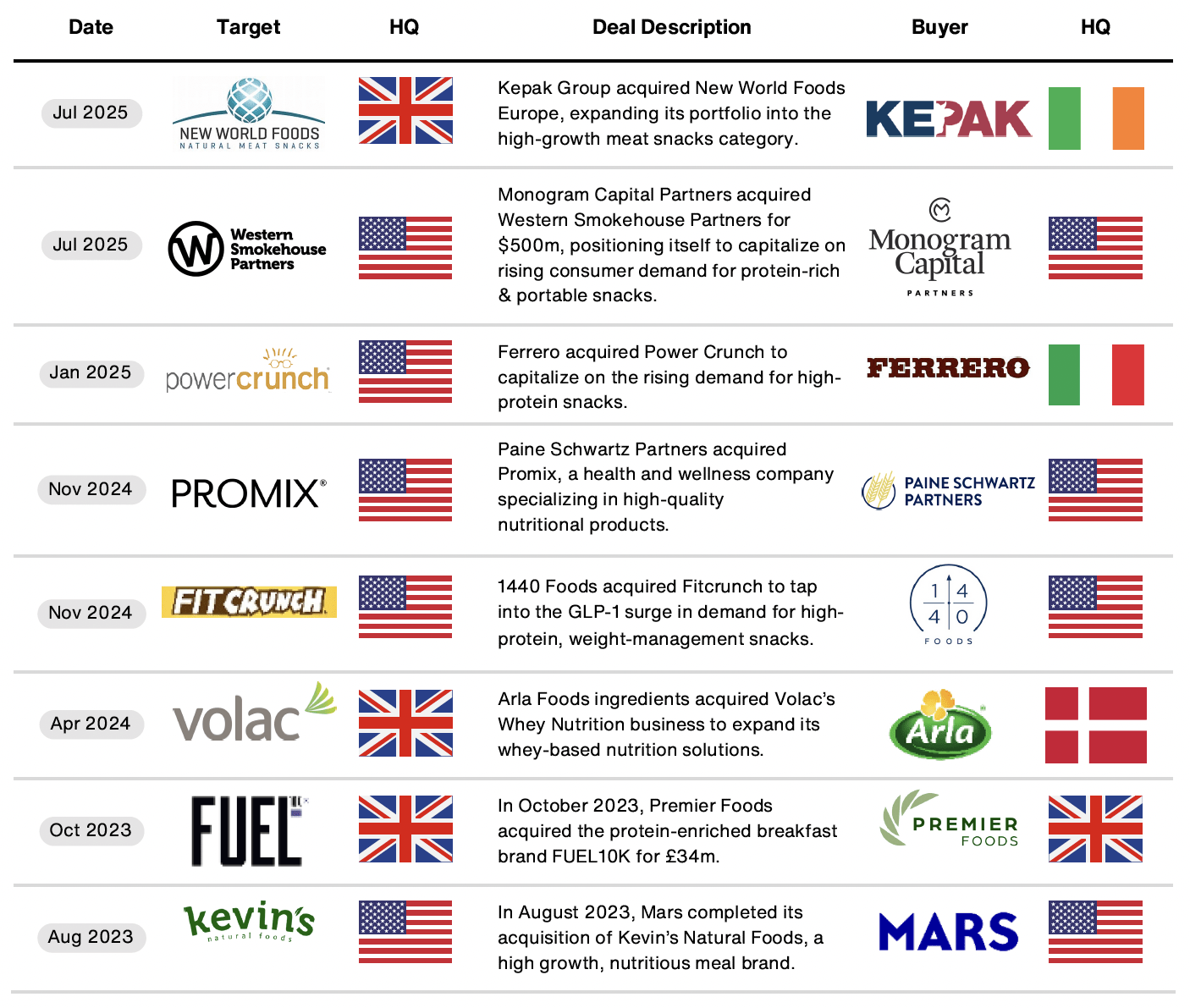

- Alongside investing in R&D, food manufacturers are responding with strategic acquisitions and portfolio realignment, seeking brands that cater to GLP-1 users. For example:

- Mars’ acquisition of Kevin’s Natural Foods gives the company access to a portfolio of high-protein, low-carb meals and snacks

- Kepak’s purchase of King West Pack strengthens its position in the high-protein, on-the-go snacking sector, expanding its reach across the UK and international markets

- Ferrero’s acquisition of protein snack maker Power Crunch reflects a move away from indulgent treats, giving the company a Better-for-You snack brand

The Opportunity Ahead

As GLP-1s continue to shape consumer eating habits, emerging brands and mid-sized players in hot categories will make for attractive acquisition targets. These companies typically have proven operations, supply chains, and customer loyalty, but still have room to scale. For large strategics, acquiring these companies can fast-track entry into new segments with differentiated products, without having to build something from scratch. For financial buyers, acquisitions of “GLP-1-friendly” foods can strengthen their existing portfolios in addition to offering exit potential to corporate acquirers. The bottom line? The shift from “volume-driven” to “value-driven” offers ample opportunities for middle market companies, from growth and expansion to pursuing an exit.