Selling Your Human Capital Management Business

Introduction

As a business owner, you are faced with a lot of decisions, and when the time is right to sell your company, you’ll have a couple more decisions to make. Do you hire a professional to help you or do you go it alone? And if you hire a professional, which type of firm do you choose?

My own career has had three distinct phases to it. In Phase 1, I utilized my accounting degree to work in public accounting (at KPMG) as a CPA and in private industry as a CFO. In Phase 2, I founded a software training business, did a hard pivot to online medical education/eLearning, and sold it 16 years later to a public company. Combining experience from the first two phases of my career, I’m now in Phase 3 as a licensed investment banker, helping other business owners sell their companies.

For several years now, the market has been highly favorable to sellers. There are more buyers than sellers, always a good thing for a business owner looking to exit. Another relatively recent development is private equity interest in acquiring lower middle market businesses. More and more PE firms are buying “addon” companies with $2 million to $4 million in adjusted EBITDA, due to the growth and scalability potential of these firms.

Unsolicited Offers

With the number of active buyers in the market, particularly in the Human Capital Management space where I spend my time, it’s not uncommon for owners to receive unsolicited offers from prospective buyers on a regular basis. I remember those days, and while it’s flattering to some degree, here are a few words of caution.

Buyers make unsolicited offers to avoid competition, and competition drives up valuations and improves payout structures. So don’t jump at the first offer. Selling a business is a complicated process, and experience matters. Lofty valuations may sound attractive, but the devil is in the details: cash up front, earn-out terms and targets, working capital pegs, escrow, employment contracts, non-compete agreements, etc. An experienced M&A attorney will handle the legal issues, but agreement on the business terms comes first.

Selling a business is a very time-consuming process and a major distraction to your most important role, which is running your company. Most buyers are pros; they acquire businesses on a regular basis. But most owners are amateurs—they will sell for the first and last time. It’s not a fair fight! That’s why you need a professional on your side, particularly one with experience in your specific industry.

The Value of Industry Experience

Why is industry experience so important in an M&A professional? By knowing your industry, they know the buyers and track comparable transactions. This allows them to create competition by marketing your business to a large pool of qualified buyers. And by being part of many transaction discussions in the same space, they understand what’s important to buyers and how to showcase their client.

For example, in addition to basic financials, contract staffing buyers want to know about your gross profit percentage, bill rates versus pay rates, and direct versus indirect revenue mix (i.e., selling directly to clients versus through vendor management systems (VMS) and/or managed service providers (MSPs)). Recruitment process outsourcing (RPO) buyers want to know about the number of recruiters on your payroll, the average length of assignment, and your billing model. HR Technology/SAAS buyers want to know how your company compares to the “SAAS Rule of 40,” an indicator of the balance between profitability and growth.

You can’t get the best deal if you can’t get the right buyers to the table who understand the value of your business. That’s where an experienced industry professional comes in – they know how to “talk the talk.”

Engaging a Professional

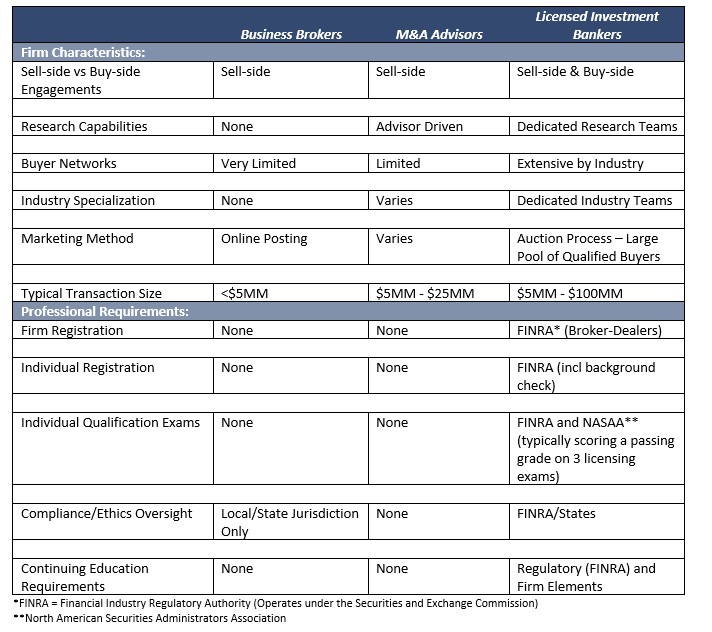

If you’ve decided to hire a professional to help you sell your business, you have another choice to make. There are three primary types of professionals: Business Brokers, M&A Advisors, and Licensed Investment Bankers.

Table 1 below summarizes the major differences between the three types of firms:

Table 1. Summary of Firm Characteristics and Professional Requirements:

Conclusion

Yes, I’m a little partial, since I’m a licensed investment banker working for a registered broker dealer and a member of FINRA/SIPC. But I’ve been through this process many times and from both sides of the desk. Whether you hire my firm or another firm, I strongly recommend that you choose a firm that knows your industry and is staffed with professionals that you can see yourself working with. Selling a business is a marathon, or maybe a half marathon, but it is not a sprint. As a business owner, you’ve put a lot of blood, sweat and tears into growing your company. The opportunity to sell your business comes along only once, and you need to make the most of it.

To learn more or speak with Bob Maiden please contact him directly at [email protected].