Sixteen years ago, after David Roberts and his partner, Matthew Ohrnstein, founded Caliber Collision, he wrote a series of industry articles that were presciently accurate. His subject then? “Shop Consolidation: Is It Inevitable?” His answer was an emphatic “Yes.” Over a period of 8 years as Caliber’s Chairman, Roberts helped lead the initial capital raises and the acquisition of its first 37 shops. Now a leading investment banker in the Automotive Services industry with FOCUS Investment Banking, Roberts has a unique 20-year perspective on the industry. With the dramatic growth of the large consolidators as well as many regional and local MSOs, we asked Roberts to update our audience on consolidation developments, their impact on the industry and how consolidation continues to evolve. In this article, Roberts lays out the “numbers,” on acquisitions, valuations and markets. In subsequent articles, Roberts will discuss the strategies of the consolidators, the impact on smaller MSOs and the growth strategies that forward-thinking operators across the country are pursuing to stay in the game and remain relevant as well as topics on the M&A process specific to the collision repair industry.

Ownership in Transition

In the past 24 months, nearly $3 billion of sales volume in the Collision Repair industry has changed ownership – that’s 10% of the entire industry! The industry transition has not been limited to one type of buyer or seller; there have been a wide range of buyers and sellers involved. Consolidators have sold to large private equity firms, large family–owned businesses with 50-year histories have sold to strategic buyers, and a variety of large and medium size MSOs have been acquiring smaller players in hopes of creating attractive platforms for their own growth. This wave of acquisitions is dramatically changing the face of the industry.

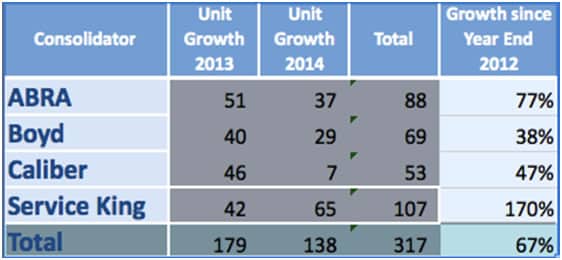

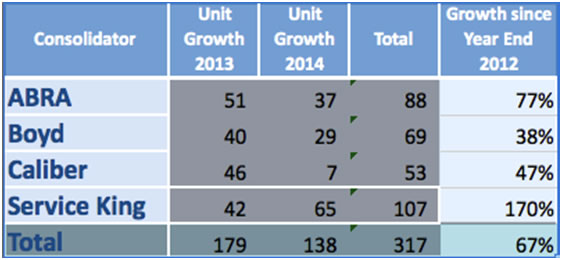

The Numbers: In the first five months of 2014, the 4 top consolidators have acquired or opened 138 shops (assuming the close of Sterling by Service King). This is on top of 179 shops acquired or opened in all of 2013.

Consolidator Growth from 2012-2014

Acquisition Acceleration

Why this sudden acceleration?

Bigger deals, rising prices and uncertainty about the future have combined to spotlight how consolidation is accelerating. But why now?

- Capital is cheap, especially for the consolidators. With Carlyle’s and OMER’s extraordinarily deep pockets, Gerber’s access to the public markets, and ABRA’s ability to attract additional investment seemingly at will, acquisition capital has been widely available at very attractive rates.

- Plenty of targets are available. There are more than 44 MSOs with $20 million or more in revenues with another 110 between $10 and 20 million. Many of their owners are taking advantage of the opportunity to realize a liquidity opportunity that may never present itself again in their lifetime.

- Insurers are rewarding size with volume. Large insurers have increasingly rewarded the best performing consolidators and large MSOs with more volume. Cars are repaired faster, with less hassle, and more predictable costs and quality. Customers are satisfied and score consolidators and larger MSOs well on almost every measurement of satisfaction over industry averages.

- Scale has rewards. For large operators, the increased volumes enable them to increase their margins, their total EBITDA and continue to make the investments that improve their performance for insurers. And as they improve, insurers send them more volume.

Conclusion: Consolidation rewards large consolidators and MSOs, investors, insurers and their customers.

When will it end? In our estimation, the current explosion of transactions will continue for several more years but volume and prices may taper off over time.

In a $31 billion industry with 34,000 shops, approximately 26% of that volume is concentrated in 2,500 shops owned by 170 entities. However, $23 billion is still produced in the remaining 31,500 shops! We expect the larger entities will be relentless in their growth because their investors want growth in volume, which leads to growth in EBITDA, which leads to higher values for their investments. While the largest consolidators will continue to acquire attractive MSOs, over time we expect to see more investment in brownfield opportunities. Once these larger players have established their platforms, management teams and DRP relationships in attractive markets, they will recognize that bringing their relationships, purchasing advantages and management skills to large, well-located brownfields will produce higher returns on capital. We expect they will then compete less aggressively for shops in more fully penetrated markets and valuations will likely decline.

The ten largest MSAs, such as Chicago, Los Angeles, New York and Atlanta, are so huge that the number of acquisitions required to have a significant impact is daunting for even the largest consolidators. Certainly, Caliber has significant penetration of Los Angeles and Dallas Ft. Worth while Gerber has significant penetration in Chicago and Atlanta. ABRA has deeply penetrated Atlanta and Seattle. While Service King is heavily invested in Houston and Dallas Ft. Worth, it is much more broadly diversified in other markets.

Consolidators have found it easier to penetrate those MSAs below the top ten such as Charlotte, Nashville, Denver, Austin, and Seattle. We expect continuing acquisitions in all of the top 100 MSAs in the coming months and years. However, as these markets become more deeply penetrated by multiple consolidators and large MSOs, we expect acquisition activity will increasingly shift to smaller markets.

Acquisition Valuation Drivers

Ever since the Caliber acquisition by OMERS in November 2013, at an alleged 11x multiple of EBITDA, the industry has been awash in speculation about the prices being paid for MSOs by consolidators, by MSOs for independent shops and by independent shops for acquisitions of other independents. Operators are asking “What am I worth?” or “What should I pay for someone else?” The answer is more complex than one might think – or the proverbial, “it depends”.

Valuations of MSOs acquired by consolidators have been driven by five key characteristics of the acquisition targets:

- Total revenue and number of production locations

- Reconstructed EBITDA as a % of total revenue

- Geographic market size and attractiveness

- Market share

- Strength of management team

While these are the most important drivers of value for buyers, others important factors include production capacity, reinvestment requirements and DRP relationships.

At the larger end of the spectrum, consolidators focus on platform acquisitions (those with numerous locations) to enter attractive new markets. This allows the consolidator to quickly achieve scale within those markets and to add existing management teams capable of adapting to their cultures, systems and processes. In these instances, the Number of Locations and Market Share have much to do with the value placed on targets.

A prime example is ABRA’s recent platform acquisition of Wilburn’s in Charlotte NC. Charlotte is a fast growing, unconsolidated market of 2.3 million people with one Sterling shop and two Gerber shops. Wilburns’ 13 stores had a market share of roughly 25% of this $200 million market. While EBITDA margins, management and DRP relationships were average for the region, ABRA paid a reputed high but not startling multiple for a market-dominating platform with average store volumes of more than $3 million and substantial expansion capacity.

For large MSOs in the $20 million to $120 million range that are acquiring smaller MSOs and single shops, acquisition prices are substantially less. First, the availability of targets is greater and the sellers are more flexible. Many sellers in this category are looking for a retirement exit and are willing to help finance the sale. Smaller MSOs and single shop operators are also increasingly looking to merge their businesses with comparably entities in order to increase their scale, management capabilities and impact in their markets. Rather than pure buyouts, these deals are often combinations of entities with a variety of liquidity terms including long term leases, earnouts and consulting arrangements.

Value vs. Price

The actual price paid for acquisitions is dependent on the valuation drivers mentioned above, but nothing drives price more than competition among multiple potential buyers. The most noticeable example of this phenomenon was the competition to acquire Caliber. That transaction was extraordinary for a number of reasons – scarcity value, quality of management, total revenues, a disciplined expansion strategy, and a successful track record over many years. But perhaps the most important factor was an auction process that created multiple offers from private equity groups (PEGs). With more than 10 PEGs looking at Caliber, the highest bidder prevailed at a price much greater than anyone expected – because of competition!

Smaller sellers are beginning to engage in the same competitive process. In the past, many relied on their personal relationships with acquisition executives at the consolidators and other MSOs, resulting in “exclusive” discussions that prevented the sellers from creating any real competition. This is rapidly changing as quality sellers recognize their value is enhanced when they engage in a process to bring multiple buyers to the table at the same time. Although not every seller has the potential to attract multiple buyers, there is little downside to exploring the possibilities. Potential buyers don’t walk away from attractive sellers simply because they have some competition. They “sharpen their pencils” and stay engaged in the process.

Recent Prices

The actual prices paid are closely guarded by acquirers and sellers – for good reason. Acquirers don’t want the prices they have paid to drive up prices in the future. Sellers are bound by confidentiality agreements by their acquirers. These prices paid are often described in terms of multiples of EBITDA which are merely a yardstick for comparing different transactions.

Despite all the speculation about the stunning price that a consolidator may have paid for some platform MSO in a critical expansion market, deal prices have not been absurdly high. From our industry research and without disclosing any confidential information we can summarize activity in the past 15 months as follows:

- Highest prices paid are in the 6.5 – 7.5x reconstructed EBITDA range. These are very rare transactions and the targets are market-dominating platforms in attractive markets with high EBITDA % and management with senior leadership potential for the acquirer.

- Prices are closer to the 5.5 – 6.5x reconstructed EBITDA range for MSOs with significant market presence, high quality operations and significant tuck-in or bolt-on potential.

- Smaller one-off acquisitions are in the 3.5– 5.5x reconstructed EBITDA range, generally paid for single shops with limited market leverage, average quality operations but complementary to existing shops in the market.

- Asset value purchases, often at depreciated values, are usually single shops with little or no EBITDA, primarily acquired for their location, asset or capacity value.

So what is your business worth? And what should an acquirer pay for someone else’s business? Using these ideas as guidelines, the conclusion is still “It depends.”

It’s not just a multiple of EBITDA. It depends on how many bidders are vying for the business. It depends on the direction of the business’ performance. It depends upon the quality of its management, the amount of improvements an acquirer has to invest in its facilities, the number and quality of its DRP relationships, etc. “It depends.”

Next Month: Strategies and Activities of the Consolidators and the Large Regional MSOs

Originally published in Auto Body Repair Network, March 2015

Originally published in Auto Body Repair Network, March 2015