MANAGED SERVICE PROVIDERS (MSP)

M&A Advisors To The Top Managed Service Providers

In today’s competitive landscape, strategic buyers and private equity firms are aggressively targeting MSPs with scalable infrastructure, cybersecurity capabilities, and industry-specific verticals. Our deep understanding of these value drivers, combined with tailored deal structuring and hands-on senior banker involvement, ensures our clients maximize value and minimize post-transaction risk. The right advisor isn’t just a facilitator—it’s a strategic asset that can elevate your outcome and set the stage for long-term growth post-acquisition.

FOCUS’ MSP Team, part of the Technology Services Group, executes on a customized strategy tailored to meet each client’s objectives. We work with equal ease on the sell-side and the buy-side, bringing deep industry expertise and years of transaction experience to every engagement.

Sell-Side

Buy-Side

Driving M&A Success

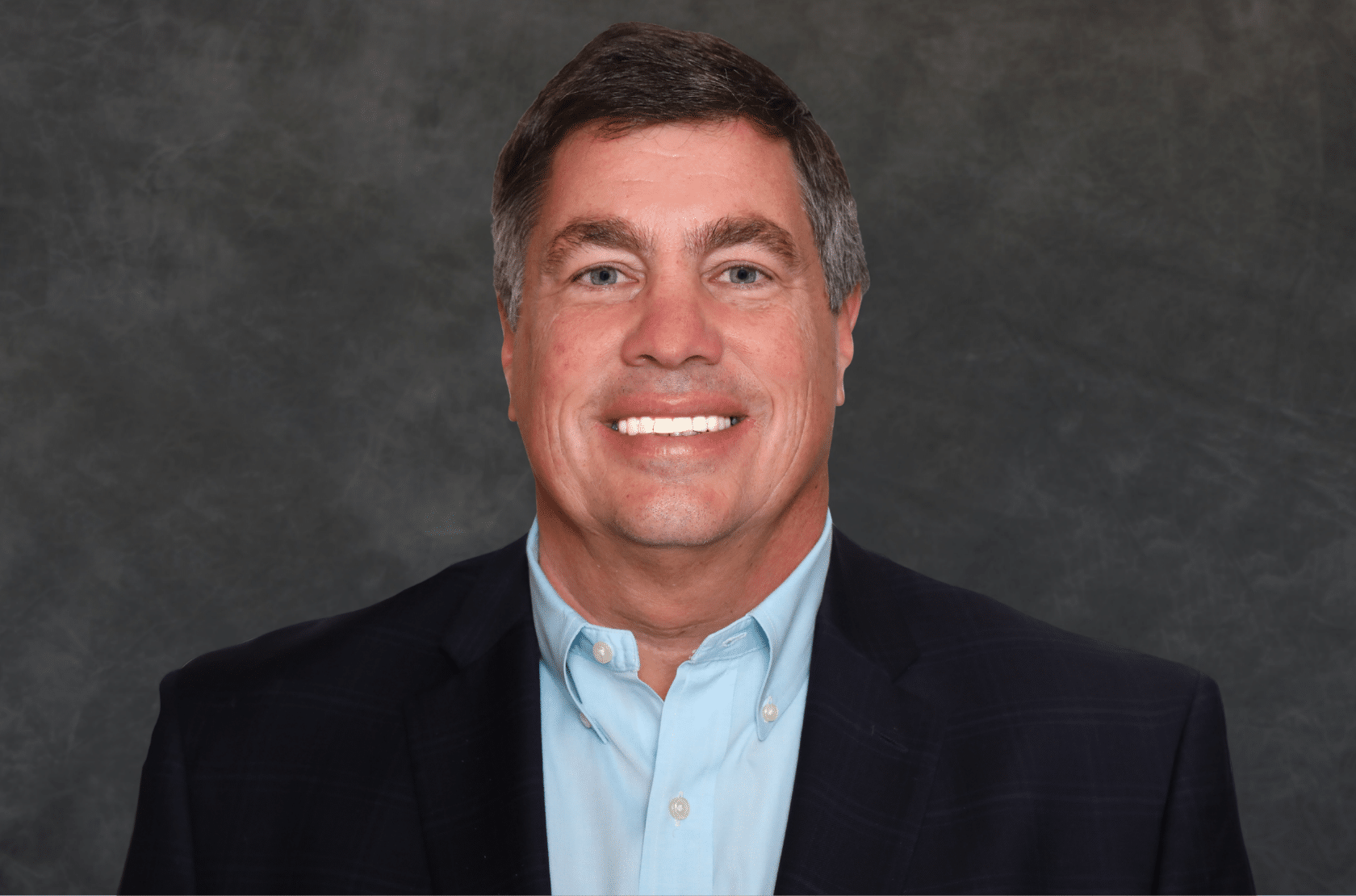

MSP Team

SUCCESS STORIES FROM OUR CLIENTS

Hear From Our Clients

“FOCUS’ MSP team has been extremely helpful in assisting us to our M&A growth goals. Abraham has really made an investment to understand our industry and assist either from the buy or sell side with all aspects of a transaction. I highly recommend working with FOCUS.”

Kevin Blake, Founder/President

Founder/President, ICS, a portfolio company of ClearLight Partners, LLC

MSP Team & Clients in the News

MSP Insights

SEE US IN ACTION

Videos and Podcasts

Frequently Asked Questions for MSPs

What unique challenges do MSP M&A transactions present?

M&A transactions in the Managed Service Provider (MSP) space come with a distinct set of challenges that require deep industry insight and careful navigation. For founders of privately owned MSPs, especially those with revenues between $10 million and $300 million, the stakes are high—and so is the complexity.

Recurring Revenue Scrutiny

Buyers place significant emphasis on the quality, visibility, and stickiness of your recurring revenue. Understanding how your contracts are structured, how churn is managed, and how upsell potential is tracked will heavily influence valuation and deal structure.

Client Concentration Risk

A common hurdle for MSPs is client concentration. If a large percentage of revenue comes from just a few accounts, it can raise red flags for potential acquirers. Proactive strategies to diversify your client base—or clearly articulate the stability of those relationships—are essential during a transaction.

Talent Retention & Culture Fit

Founders often underestimate the importance of people in the deal. Your technical talent, leadership team, and customer-facing staff are often just as critical to a buyer as the technology stack or EBITDA margin. Retention plans and cultural compatibility matter—especially if the founder is stepping away post-transaction.

Valuation Complexity

MSPs often operate with a mix of recurring, project-based, and resale revenue streams. Not all revenue is valued equally. Getting credit for the full value of your business requires a partner who understands how to position and defend your financial performance, customer KPIs, and growth levers in a language the market respects.

Integration Risk for Buyers

How does FOCUS differentiate itself from other investment banks?

For founders of privately held MSPs with $10 million to $300 million in revenue, choosing the right M&A advisor can be the difference between a good deal and a great one. At FOCUS Investment Banking, we differentiate ourselves in several key ways:

-

Deep MSP Industry Expertise: Our dedicated MSP team understands the operational, financial, and technological drivers that shape value in your space. We've completed over 75 MSP transactions in the past five years alone, including 12 platform launches for private equity—giving us real-time insight into what buyers want and what makes an MSP stand out.

-

Senior Banker Involvement from Start to Finish: Every deal at FOCUS is led by senior bankers with decades of industry and transaction experience. We don’t delegate critical stages to junior staff—our senior team is hands-on, ensuring execution quality and strategic guidance throughout the process.

-

Tailored, Founder-Focused Process: We know that MSP owners have built their companies from the ground up. That’s why our process is highly personalized—designed to preserve your legacy, align with your goals, and position your business to the right buyers, at the right time, for the right value.

-

Strong Relationships with Strategic Buyers and Private Equity: We maintain active dialogue with hundreds of acquirers—from leading private equity firms to strategic consolidators—and we know how to create a competitive environment that drives valuation and terms.

-

Proven Track Record of Success: Our results speak for themselves. We’ve helped dozens of MSP founders achieve exceptional outcomes—not only financially, but in finding the right cultural and strategic fit for their business and their people.

FOCUS doesn’t just advise—we partner with you to unlock the full potential of your MSP in the M&A process.

What makes MSPs attractive to acquirers today?

Managed Service Providers (MSPs) have become one of the most sought-after targets in today’s M&A market—especially those in the $10 million to $300 million revenue range. Here’s why strategic buyers and private equity firms are actively pursuing MSP acquisitions:

-

Recurring Revenue and Strong Cash Flow: MSPs generate high-margin, predictable monthly recurring revenue (MRR), making them financially attractive and easier to model for investors. This stability is especially appealing in uncertain economic environments.

-

Fragmented Market with Consolidation Potential: The MSP industry remains highly fragmented, presenting significant opportunities for roll-ups and platform growth. Acquirers are looking for strong operators they can scale quickly through tuck-in acquisitions and geographic expansion.

-

Mission-Critical Role in IT Infrastructure: MSPs serve as trusted advisors for businesses navigating digital transformation, cybersecurity, and cloud migration. This central role makes MSPs “sticky” with their clients and increases lifetime value.

-

High Client Retention and Long-Term Contracts: Buyers value MSPs with low churn and strong renewal rates. Long-term service agreements and embedded client relationships reduce revenue volatility and boost enterprise value.

-

Cybersecurity and Compliance Capabilities: As demand grows for cybersecurity, compliance, and managed detection and response (MDR) services, MSPs with these capabilities command premium valuations. Acquirers want access to talent and systems that address these critical needs.

-

Scalable Operating Models and Technology Stacks: Well-run MSPs with standardized tools, efficient ticketing systems, and centralized NOC/SOC capabilities are positioned for operational leverage and margin improvement post-acquisition.

In short, MSPs offer the rare combination of recurring revenue, sticky customer relationships, and scalable operations—all wrapped in a sector that’s growing faster than ever. For founders considering a sale, now is an opportune time to explore the market and capitalize on this strong buyer demand.

Does FOCUS Investment Banking work with international clients?

Yes—FOCUS Investment Banking has a strong international presence and deep experience navigating cross-border transactions, particularly in the MSP sector.

Through our integrated operations with FOCUS Capital Partners in Ireland, we serve clients across North America and Europe, helping MSP founders access a global buyer universe. This international reach is especially valuable as strategic buyers and private equity firms increasingly look beyond their home markets to acquire high-performing MSPs.

Our cross-border capabilities allow us to:

-

Source International Buyers and Investors: We connect U.S.-based MSPs with European and global acquirers—and vice versa—opening up new opportunities and increasing competitive tension in a sale process.

-

Navigate Regulatory, Legal, and Cultural Differences: With teams on both sides of the Atlantic, we manage the complexities of international dealmaking and help ensure a smooth and compliant transaction.

-

Execute Seamlessly Across Time Zones and Markets: Our global collaboration model ensures that senior dealmakers are always accessible and aligned, no matter where you or your buyer are located.

Whether you're a U.S.-based MSP exploring international interest or a global acquirer seeking expansion into the U.S. market, FOCUS has the network, experience, and cross-border expertise to deliver exceptional results.