Mergers and acquisitions 101: Why they happen and what’s your worth?

The vehicle repair sector is always moving and changing, as are the businesses who operate within it. One thing that hasn’t changed is that larger shops and consolidators are always looking to grow and expand by absorbing existing shops. This makes it important for shop owners and managers to understand how mergers and acquisitions (M&A) work and the various elements that affect them. Particularly, you should be familiar with the “who”, “what”, “why”, “when”, “where”, and “how” of M&As within this sector.

Among the first questions asked by any organization is ‘Why should we buy another business?’ or “Why does this company want to buy my organization?’ Those questions can have many answers, but for those less familiar with M&A, in this article let’s explain why they happen and how they are calculated.

One common scenario is the business owner, or seller, wants to retire, but let’s think about it from a buyer’s standpoint. Buyers seek to purchase other businesses, large and small, for some of the following reasons:

Calculating worth

In my experience, most operators, or sellers, don’t know what their business is worth.

The worth of a business, or valuation, is primarily based on EBITDA (Earnings before Interest, Taxes, Depreciation, & Amortization). You won’t find this in your organization’s monthly or annual income statement because it’s not the accounting standard for U.S. companies, but it is how buyers in most industries determine the “true profitability” of any business. EBITDA focuses on profitability generated from the company’s core business operations by removing the noise around how a business is financed and the accounting decision it makes.

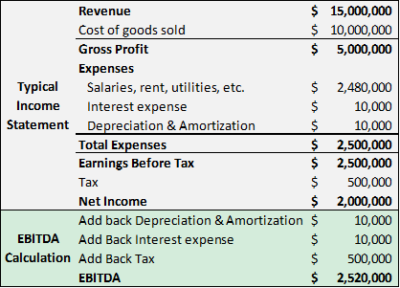

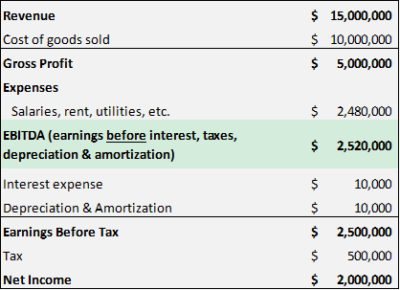

There are two main ways to derive the EBITDA, either after net income or before. Both involve finding your gross profits and subtracting expenses and taxes as outlined below.

Calculation After Net Income

Calculation Before Net Income

You may have also heard of adjusted EBITDA. An organization’s EBITDA is usually adjusted upwards by “adding back” above market owner’s compensation, personal travel on the company’s dime, one-time expenses, etc. In other words, a buyer won’t ding a seller’s EBITDA because of its current use of a private jet for business meetings.

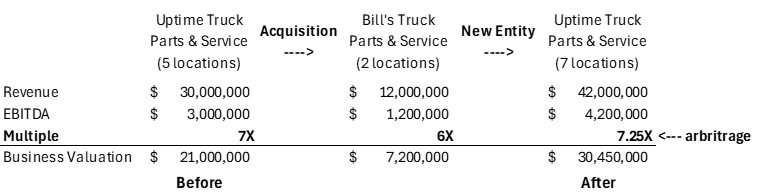

With the EBITDA calculation out of the way, here’s how valuation is determined, with a specific focus on valuation arbitrage. The key point here is that financial markets reward larger and more profitable businesses due to their ability to continue to scale and capture growth upside.

As you can see in the theoretical example below, Uptime Truck Parts & Service acquires Bill’s Truck Parts & Service and adds two more locations and more revenue to its business. Uptime was previously worth 7x EBITDA and now the business is worth 7.25x EBITDA, not based on any specific calculation, but because of a general increase in the EBITDA multiple because the market rewards larger and more profitable businesses.

In this M&A transaction, Uptime’s business value jumps from $21MM to $30.45MM. This is an increase in valuation of $9.45MM for Uptime although it only paid $7.2MM. In this scenario, Uptime created a valuation arbitrage of $2.25MM. One way to think about valuation arbitrage from only an EBITDA multiple standpoint is that there is no risk. In reality, acquiring another operation does come with risks such as the “key man” leaving, pending lawsuits, environmental issues, or systemic risk due to a general downturn in the economy. But there are ways to work with both the buyers and sellers to identify and reduce these risks.

In addition to EBITDA, there are other ways businesses contribute to their worth. They include:

Ultimately these types of things increase the multiple offered. Buyers, particularly larger players, seek profitable and de-risked businesses, even if means paying much more. Many of the bigger players have large amounts of cash on hand and the ability to take on and pay down debt for acquisitions. Across the entire automotive sector, we routinely see M&A transactions greater than $100MM, as they have access to significant amounts of capital.

I hope this serves as a good introduction, or refresher, on M&A and why they happen in the fleet maintenance and repair sector. There is a lot to discuss, including current M&A activity and what we are seeing in the market from an investment banking standpoint. I look forward to engaging with you and hopefully providing advice that you will find helpful as it relates to growing, buying, and exiting, as well as anything “M&A” related.

This article was previously published on Fleet Maintenance Magazine.