Manufacturing: Q3 2025 Report

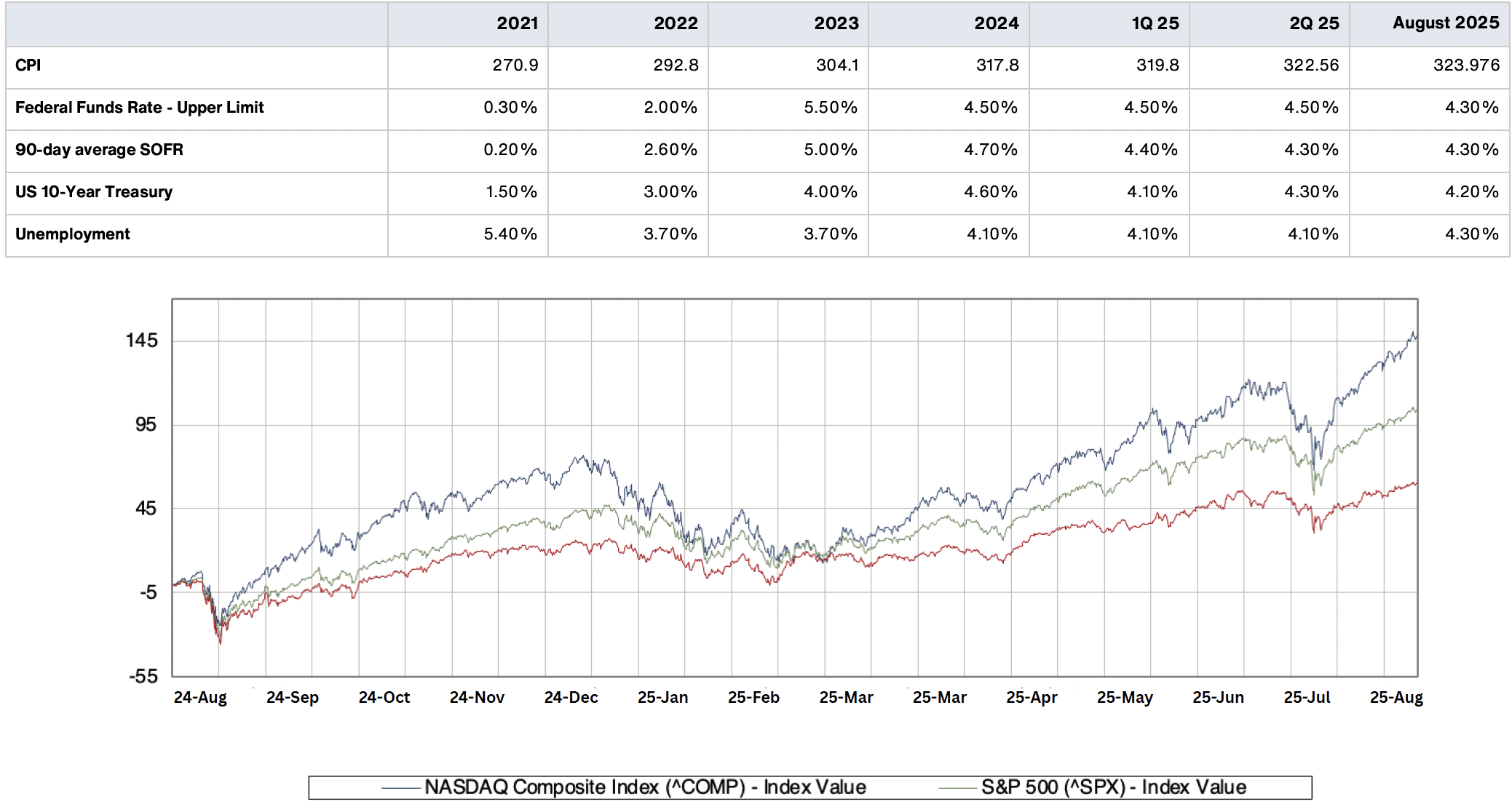

We are pleased to share our first FOCUS Investment Banking Quarterly Manufacturing report. The macro trends in the economy have been generally positive with a strong stock market and a fed that has started to ease a bit. Manufacturing production has held steady based on the fed industrial production and capacity figures.

It has been a tale of two cities across the manufacturing end markets. Higher growth manufacturing areas like aerospace, space & defense, data centers, energy and industrial technology have seen continued demand and good results. Some of the more cyclical Industrial markets such as capital equipment, off-road and heavy truck have not been as robust.

Macro trends like reshoring, a need for a more self-reliant U.S. supply chain and difficulty finding skilled labor have continued to drive the demand for new manufacturing technologies that rely on digital manufacturing and automation.

Despite coming into the year with optimism, M&A volumes have been down year to date with manufacturing following this trend. While the new Tariff policies may have helped contribute to this, lower energy costs and stimulus from making the tax cuts permanent and accelerated depreciation should offset this and we are seeing more optimism that M&A volumes should be picking up in the near and medium term. Valuation levels have largely remained consistent with “A assets” commanding large market premiums.

We are available to discuss any contents in this report. Also, we would welcome an opportunity to discuss potential financing and M&A options with you, whether there is a short-term need or you wish to consider your longer-term options. Please feel free to reach out directly.

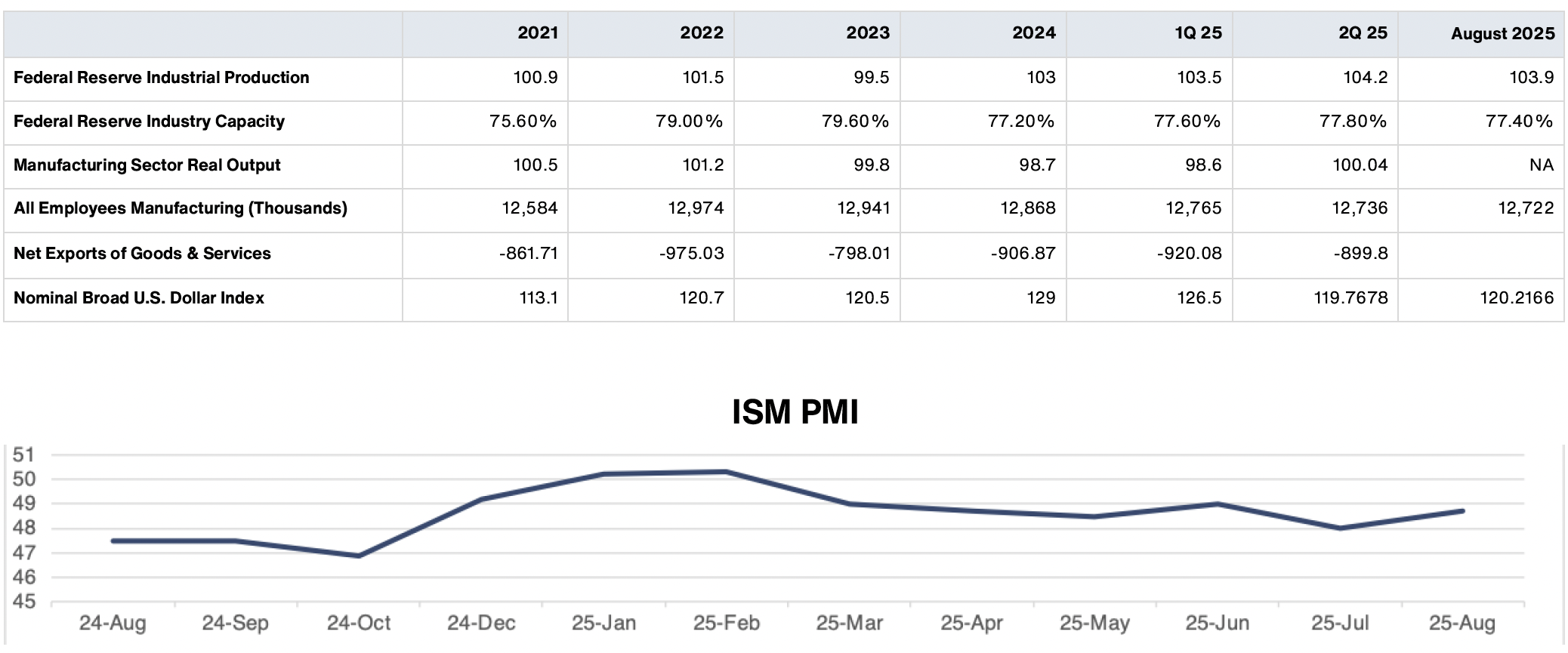

Manufacturing Data

Economic Data

Industry Trends

Tariffs

“Liberation Day” on April 2nd, 2025 introduced uncertainty into the Manufacturing Supply Chain. Since that time there has been some concessions received from countries in the European Union, Asia Pacific and others. The uncertainty surrounding tariffs has started to be absorbed and factored into business. Some middle market companies have benefited from new customers that have switched to avoid paying tariffs

Economic and Energy Policy

The recently passed “One Big Beautiful Bill” has many pro-manufacturing elements in it. This includes 100% immediate depreciation on capital equipment as well as making the favorable tax cuts from the 1st trump administration permanent. Additional stimulus comes from pro-energy policies that are lowering the cost of this important input into almost everything. The wider manufacturing ecosystem is likely to start to benefit from these shots in the arm.

Purchasers Manufacturing Index (“PMI”) has remained somewhat muted

While the PMI shot up over 50 earlier this year, the tariff policies muted some of this activity and has contributed to driving the PMI back. The PMI rose to 48.7 in August due in part to some of the early effects of the stimulus from the economic and energy policies. As some of the stimulus from economic and energy policy starts to have some influence on the supply chain, there are signs that this should increase. While certain end markets like aerospace, space & defense and data centers have been strong, we believe there is reason to be optimistic that many of the other manufacturing end markets will start to register more positive numbers.

Technological Innovation Continues to Have Big Influence on Manufacturing

The reshoring trends coupled with human capital shortages continue to drive additional automation demand. One evolution has been the continued expansion of more applications for high mix-low volume applications including growth in cobots and specific applications like automated welding. We witnessed this first hand at Fabtech in early September with an explosion of product offerings in this category. We also are seeing AI applications start to show up in quoting and other applications and expect this trend to continue.