Global M&A Private Equity Trends

Thriving US Middle Market Fundraising and Resilient Private Equity

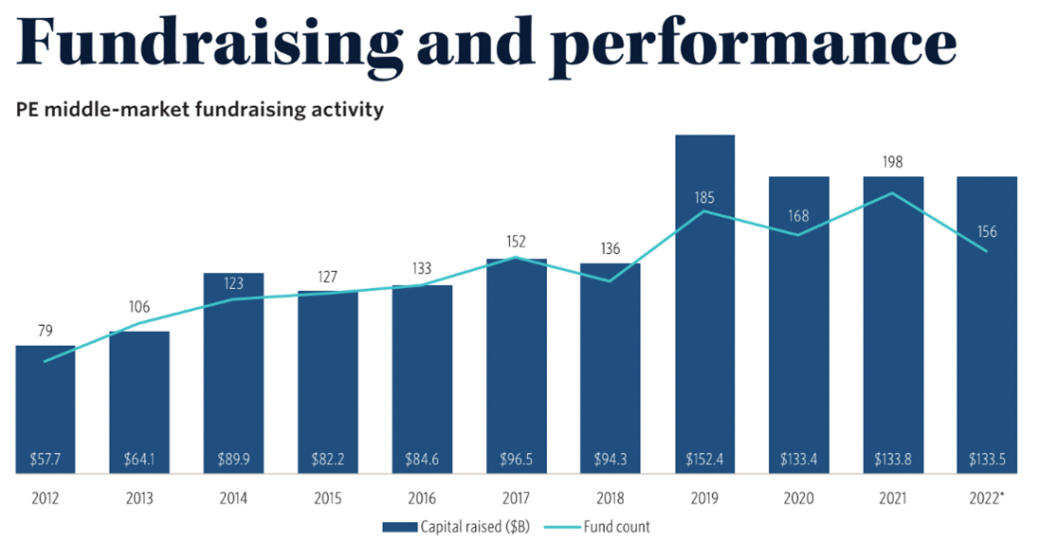

Regarding Global M&A Private Equity Trends, looking at the positive news, the US middle-market fundraising landscape remained stable throughout 2022, with 156 funds closing at an aggregate value of $133.5 billion, similar to the figures seen in 2020 and 2021. The top thirty middle-market vehicles accounted for over half of all capital raised. The sizes of funds across the private equity sector, including middle-markets, increased, with the median fund size rose to $503.0 million. The number of middle-market PE funds closed in 2022 reached a ten-year high, comprising 42.6% of all funds closed, indicating the middle-market’s dominance in the battle for capital.

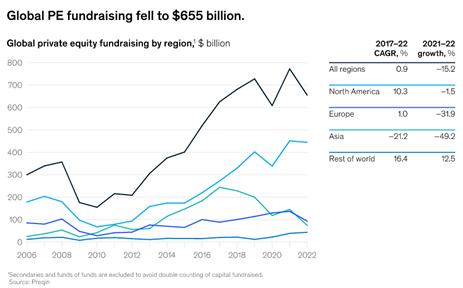

Regarding headwinds in Global M&A Private Equity Trends, after the boom year of 2021, world-wide M&A deal-making has hit reverse, with the second half of 2022 down 33 percent, the largest ever second-half swing since records began in 1980. The $3.6 trillion final tally for the second half of 2022 was concentrated in larger deals, with the number of transactions down just 17 percent.

Although second-half deal activity saw a significant slowdown, the first half of 2022 remained the second busiest year on record. Smaller add-on deals gained a larger share of total deals.

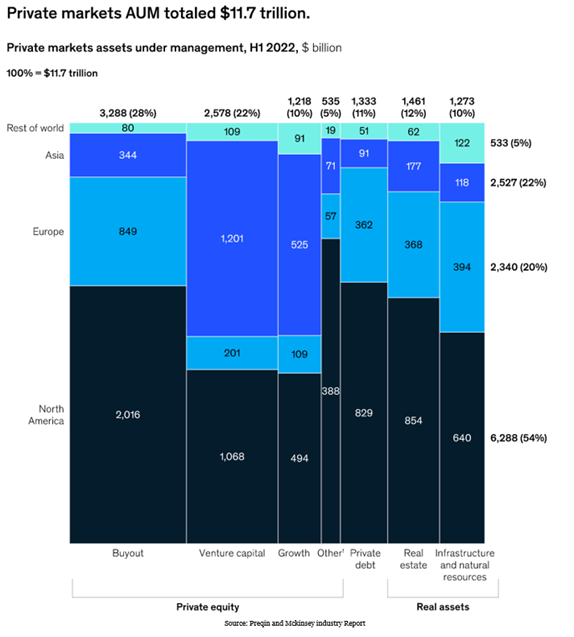

While fundraising and investment performance declined, the industry’s growth held reasonably steady, with assets under management increasing to $11.7 trillion as of June 30, 2022.

Inflation Turbulence in 2023

Inflation reached its highest level since the 1980s due to a combination of factors including supply chain issues, government spending, and the invasion of Ukraine. As a result, the Federal Reserve tightened their policies, causing financial losses for investors in both stocks and bonds.

Investors are advised to adopt a longer-term perspective. If a recession were to occur, it is expected to be mild, mainly because fiscal policy is likely to remain unchanged. Moreover, the Federal Reserve is anticipated to end their tightening measures early in the upcoming year, and inflation could start to ease by the close of 2023. Wage demands are expected to be moderated, and corporate margins will be stabilized. By 2024, the American economy could be on a comparable trajectory to that of the late 2010s. This scenario could have significant advantages for financial markets. All in all, there remains the possibility of financial markets making gains.

In particular, international equities could reap benefits from lower expectations and already low valuations. While average valuations in the U.S. are considerably higher, major regions like Japan, Europe, and China are all markedly below their long-term averages. Furthermore, investors should consider China as a prospective source of resurgence in the upcoming year, given that the country’s valuations are now similar to those seen in previous reform and regulatory cycles. With judicious investment decisions, 2023 may present an opportunity for financial markets to thrive.

Reference:

- https://www.refinitiv.com/perspectives/market-insights/steepest-ever-decline-in-world-wide-ma/

- https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/mckinseys-private-markets-annual-review

DOWNLOAD ARTICLE HERE.