FOCUS Investment Banking, along with their M&A Worldwide partners, Active M&A, Aeternus, MBA Capital and Morgen Evan ICAPE LLC, assisted in the pitch process in the key global markets for metal products manufacturing, providing feedback on the information memorandum and helping in the active marketing phase. Several other M&A Worldwide members rounded out the global coverage for this transaction.

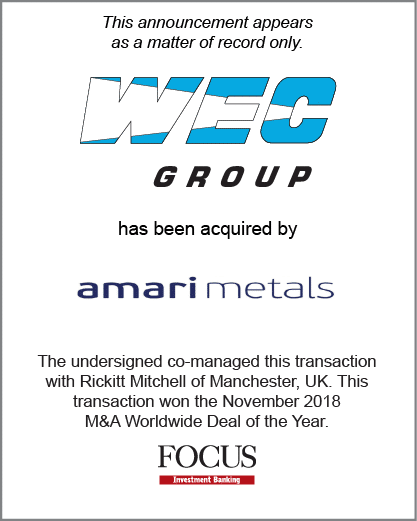

With over 900 staff across Lancashire, Merseyside, Yorkshire, Lanarkshire and the West Midlands, WEC Group comprises 15 manufacturing companies specializing in individual areas of engineering and fabrication.

Amari Metals provides customizations in steel and stainless steel products, copper and nickel alloys and aluminum semi-finished products.

According to John Slater, FOCUS Partner and Advanced Manufacturing & Automation Team Leader, “FOCUS created a robust target list of US strategic and financial buyers and pursued extensive networking efforts to expand the horizons of the search. Through this process we identified the ultimate investors behind Amari UK Inc. (a midwestern family office), providing the ideal buyer for WEC. This enabled the current management team to remain in the day-to-day control of WEC while cashing in their investment in full. It was a win, win situation for all involved.”

Jorge Maceyras, FOCUS Principal, adds, “The experience gained from this combined effort will be applied to improve the M&A Worldwide approach to support significant cross-border sellside opportunities. A major goal of M&A Worldwide is for the Advanced Manufacturing & Automation Group to use these lessons learned to generate a coordinated approach for globally marketed sell-side and buy-side opportunities.”

“This transaction was a testament to cross border cooperation between M&A World Wide members,” remarked Doug Rodgers, FOCUS Managing Partner and CEO.

*These testimonials may not be representative of the experience of all clients; testimonials are not a guarantee of future performance or success.

About FOCUS Investment Banking LLC

With more than three decades of experience, FOCUS Investment Banking is a trusted name in M&A advisory services worldwide. FOCUS works to understand each client’s strategic and financial objectives, craft the best plan to achieve these goals, and deliver success. Whether helping to sell, buy, or raise capital, FOCUS strives to maximize the value of every transaction to the benefit of its clients. Securities transactions conducted by FOCUS Securities LLC, an affiliated company, registered Broker Dealer member FINRA/SIPC. For more information on FOCUS and its advanced automation practice, please visit www.focusbankers.com/automation.