Better-for-You Foods Are a Hot Space for M&A: What Does It Take to Get Acquired?

The rapidly expanding Better-for-You category is fueling M&A activity across the food and beverage landscape, from mega deals among major players to strategic acquisitions in the middle market.

Better-for-You Is Booming

- Consumers want products that are both flavorful and functional – products that support health and longevity, in addition to simplified ingredient lists, clean labels, and personalized nutrition solutions.

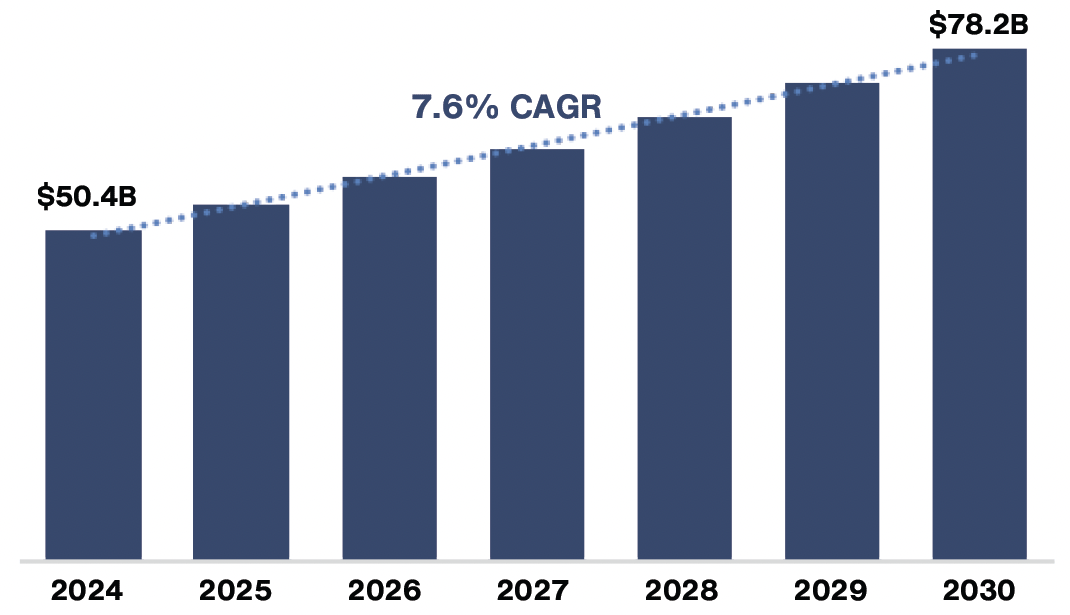

- The Better-for-You (BFY) snack market is projected to reach $78.2 billion by 2030 (7.6% CAGR), while BFY beverages are expected to grow to $484 million by 2034 (8.5% CAGR).

- Sitting at the intersection of health, sustainability and innovation, the BFY segment offers compelling opportunities for growth, product development, and strategic mergers & acquisitions (M&A).

Global Better-for-You Snacks Market

Drivers of M&A

- Strategic M&A is accelerating portfolio transformation: Food and beverage companies, from large corporations to specialized players, are actively acquiring high-growth, health-orientated brands to align with consumer preferences and diversify their offerings.

- Recent high-profile deals highlight investor appetite: Transactions such as PepsiCo’s $1.95 billion acquisition of prebiotic soda brand Poppi and Celsius Holdings’ $1.8 billion buyout of Alani Nutrition in 2025 underscore the premium placed on functional and BFY categories.

- Multicultural and wellness-driven expansion: PepsiCo’s acquisitions of Siete Foods ($1.2 billion) and full ownership of Sabra and Obela demonstrate how global players are targeting health-forward, culturally diverse, and ready-to-eat offerings to capture new growth segments.

- Tech-enabled experiences offer new growth avenues: Companies are leveraging direct-to-consumer platforms, personalized nutrition apps, and smart packaging to engage health-conscious shoppers, driving both top-line growth and strategic acquisition opportunities.