Agribusiness & Food 3Q 2025 Report

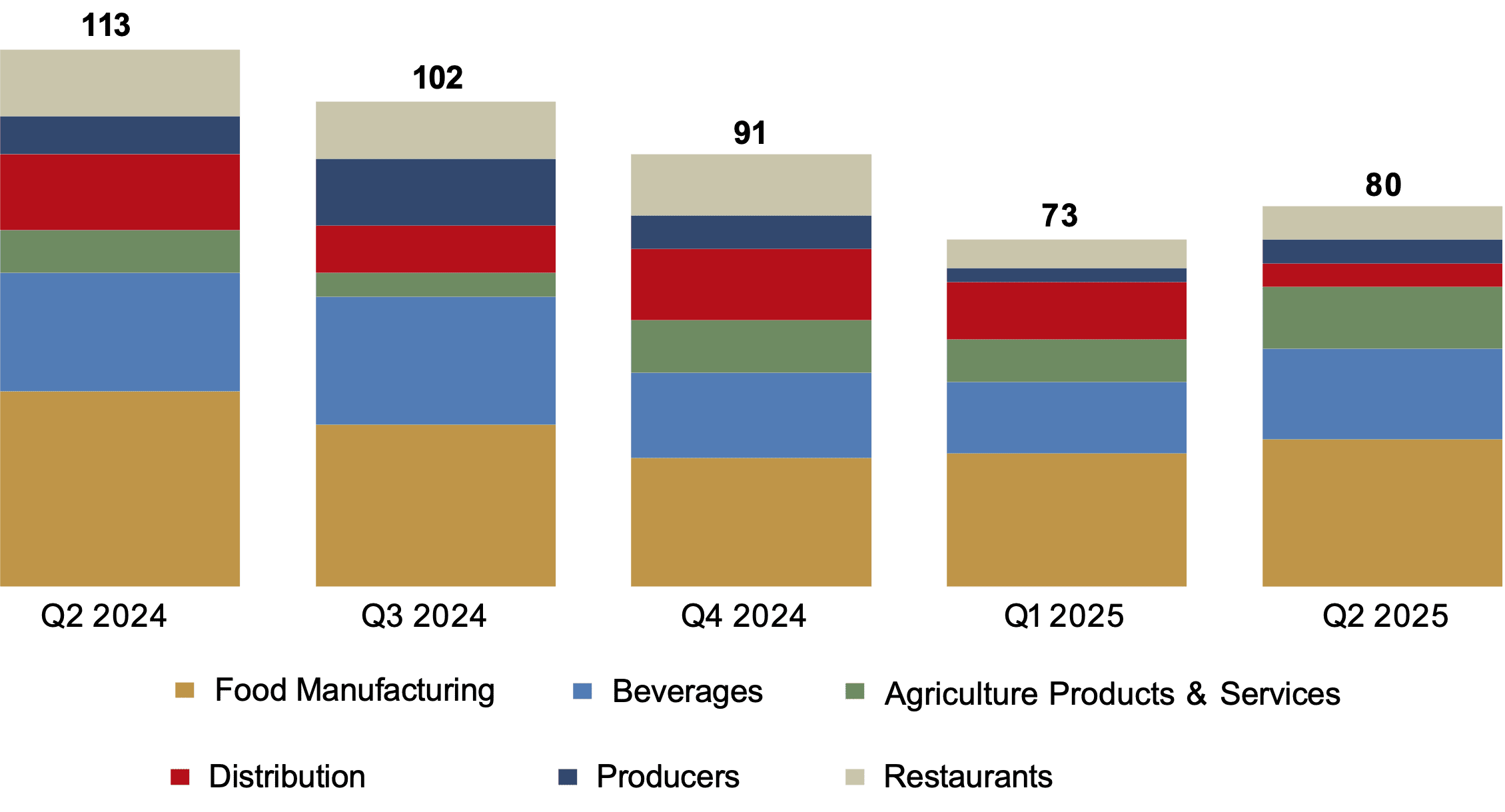

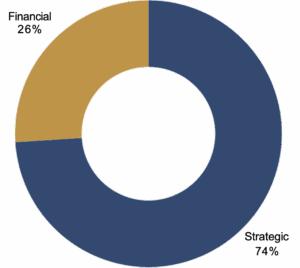

In Q3 2025, 80 transactions were announced or closed in the agribusiness and food sector, representing an 10% quarter-over-quarter uptick in deal volume. Year to date, M&A activity has remained resilient despite macroeconomic headwinds, however volumes are down relative to peak years. Strategic acquirers remain the dominant buyers as they look to M&A to expand product lines, benefit from economies of scale, and bolster supply chains. Private equity continues to be a key player, with firms focusing on smaller, bolt-on deals in high-growth areas like snack, premium, and health & wellness categories. These buyers are looking beyond consumer brands as well, focusing on B2B providers like private label manufacturers and ingredients formulators.

Over the third quarter of 2025, several notable deals closed, specifically in the packaged foods, beverages, and restaurants segments. Sweet foods maker Ferrero Group acquired cereal company WK Kellogg Co. for $3.1 billion (representing an 11x EBITDA multiple), giving Ferrero an expanded presence in the U.S. market. In the beverage category, Butterfly Equity-backed Generous Brands purchased kombucha brand Health-Ade for $500 million, adding to its portfolio of functional beverages. Rounding out Q3’s notable deals was c-store chain RaceTrac’s announced acquisition of sandwich chain Potbelly for $566 million (representing an approximate 16x EBITDA multiple), continuing a trend of convenience stores investing heavily in foodservice.

Against a mixed macroeconomic backdrop, middle market transactions are expected to sustain M&A activity as buyers concentrate on smaller, targeted deals rather than “bet-the-farm” acquisitions. Add-on opportunities that expand geographic reach, enhance manufacturing or private-label capabilities, or fill portfolio gaps are likely to see strong demand. High-growth segments—particularly functional beverages, better-for-you snacks, and specialty ingredients—continue to attract attention from both strategic and financial buyers seeking to align with changing consumer trends.

Looking ahead, middle market businesses that demonstrate strong business fundamentals—scalable operations, differentiated product portfolios, and a presence in growth-oriented categories—will be prime acquisition candidates. We’ve said it before: even in periods of market uncertainty, the broader food industry remains a comparatively stable and resilient area for M&A. Buyers are actively pursuing high-quality assets and business owners who evaluate their strategic options now will be well positioned to capitalize on this momentum heading into 2026.

Sector Highlights

- Food manufacturing was the dominant sector for M&A in the third quarter. Activity was driven by acquisitions of brands and manufacturers aligned with health, wellness, and Better-for-You trends (covered in a recent article by FOCUS), as consumers increasingly prioritize functional, clean label, and nutritious products. Bakery continues to be a hot category for buyers. Premium pie and dessert maker Willamette Valley Pie was acquired by Bain Capital-backed Dessert Holdings and frozen pizza manufacturer Alpha Foods was purchased by MBC Companies, a portfolio company of private equity firm Entrepreneurial Equity Partners. Deal terms were not disclosed.

- Consolidation within dairy/cheese manufacturing was a driver of transactions in the producers sector, specifically in the high-growth specialty cheese category (e.g., organic, ethnic/Hispanic cheeses, or smoked varieties). These deals often involve both branded specialty cheese and private label capacity – specialty brands command premium margins, while private label gives volume. In Q3, Dairy Farmers of America acquired W&W Dairy, a manufacturer of private label dairy products that serve the Hispanic cheese market. Deal terms were not disclosed.

- Elevated production costs, policy uncertainty, and commodity pressure have dampened agribusiness dealmaking over the past few quarters. Interest rate cuts and ongoing trade negotiations should boost farmer sentiment and industry outlook going into 2026, supporting a more favorable M&A environment.

Agribusiness, Food, and Beverage M&A Activity

Strategic vs. Financial Buyer (Q3 2025)

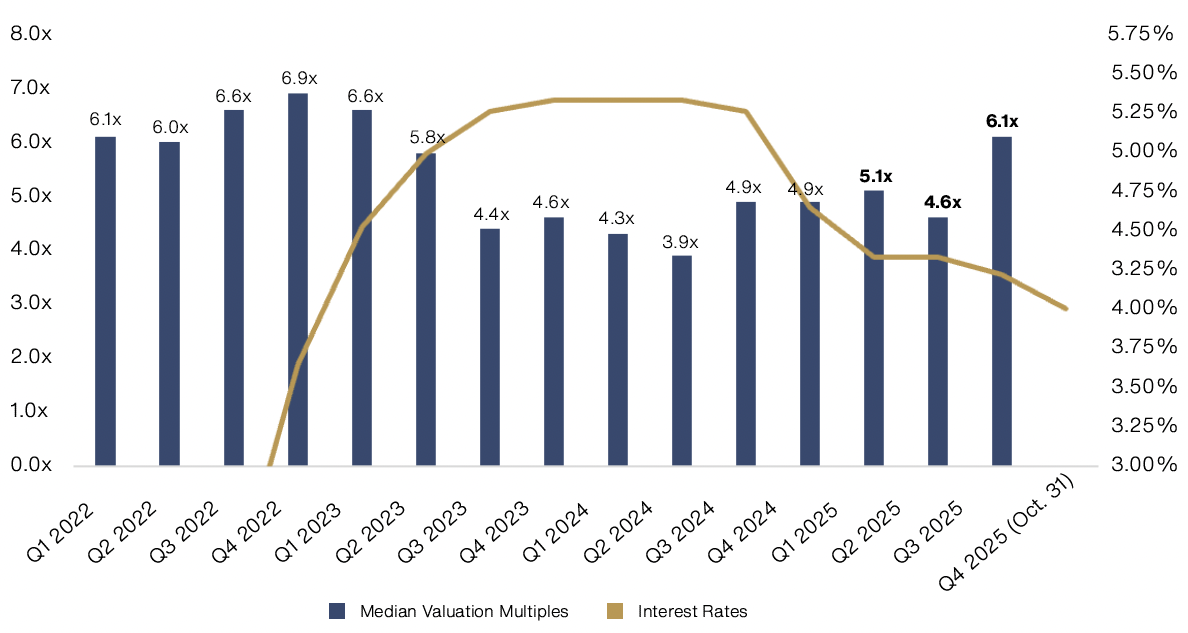

Lower Middle Market Valuation Trends: M&A Multiples on the Rise

- Financing conditions (interest rates) are allowing buyers to finance acquisitions for less, which often increases the buyer pool and in turn creates greater competitive tension. Lower cost of capital and more buyers can boost valuations for sellers.

- Historically, mid-market valuations have shown sensitivity to financing costs: for roughly every 100 bps (1%) decline in rates, EV/EBITDA multiples tend to expand by about half a turn. Strong businesses with a diversified customer base, revenue visibility, and available growth opportunities are well-positioned to benefit from this dynamic.

- Owners who prepare now will be ahead of others as the M&A market heats up – as supply increases, buyers will have more choices. Being early in a demand-heavy, finance-friendly period can yield more options for sellers and better negotiating leverage.