Agribusiness & Food 2Q 2025 Report

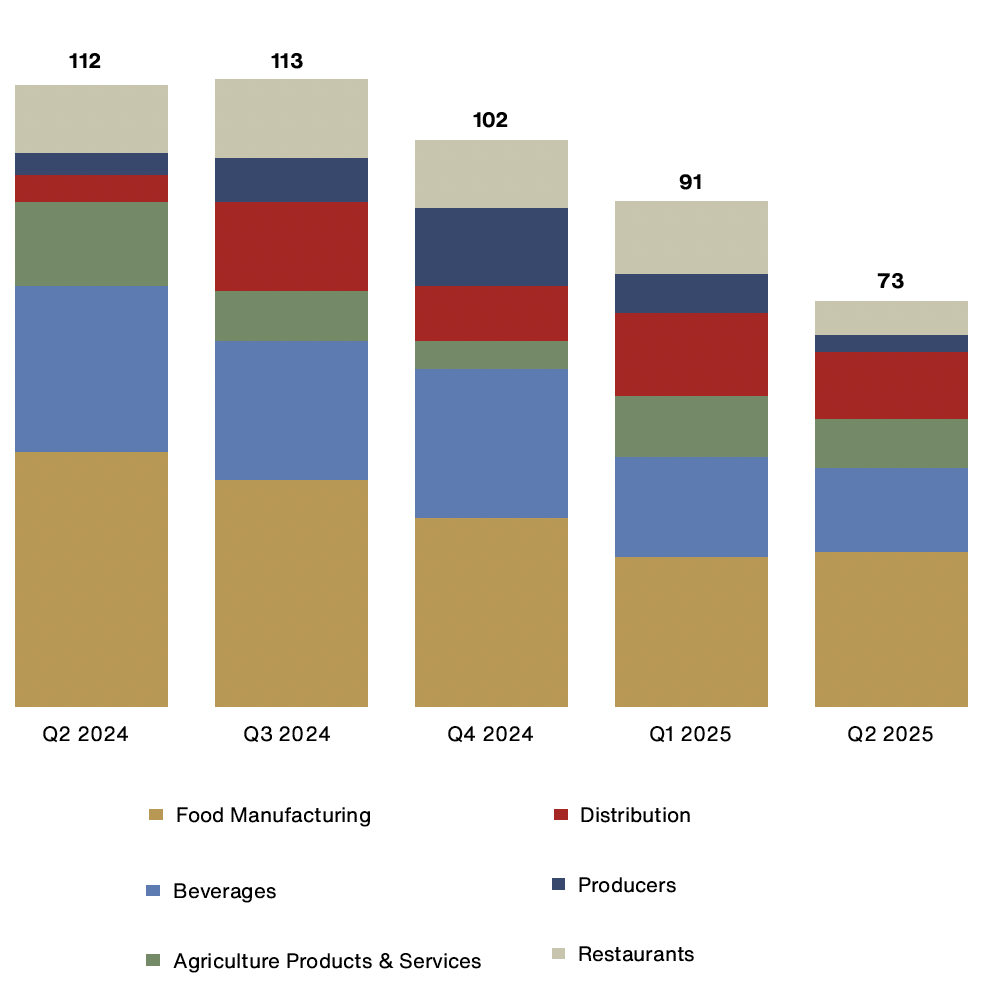

Mergers and acquisitions slowed in the second quarter of 2025, with a total of 73 deals completed across agribusiness, food, and beverage (AFB) segments tracked by FOCUS. Much of the slowdown occurred in April, as escalating trade tensions and broader economic uncertainty prompted buyers and sellers to hit pause. By May, M&A activity bounced back as trade tensions eased and the momentum carried into June, closing out a quarter that while down overall, still saw several notable transactions reach completion.

Despite the turbulence felt in Q2, buyers and sellers came together across core industry segments. Large strategics, looking to boost their portfolios and expand into high growth categories, were behind several deals during the second quarter. In May, yogurt brand Chobani acquired Daily Harvest, a maker of plant-based frozen meals and smoothies, for an undisclosed sum. The acquisition marks Chobani’s second high profile acquisition in recent years (following its $900 million purchase of La Colombe in 2023) and its entry into the fast growing frozen, ready-to-eat aisle. Divestment has also been a deal driver in recent months, as large manufacturers look to streamline operations and unlock value. An example of this is Conagra’s sale of Chef Boyardee to Brynwood Partners, a private equity firm known for reinvigorating CPG brands, for $600 million.

Private equity firms, drawn to the relative stability of the food and beverage industry, closed several transactions during the second quarter. In June, Swander Pace Capital acquired Maple Donuts, a family-owned manufacturer of frozen, private label donuts for retail and foodservice distribution. The Maple Donuts acquisition continues a theme of financial buyers taking an interest in the private label space, which FOCUS has covered in previous articles (seen here and here).

While much attention has been given to the Q2 slowdown in M&A activity, it’s important to recognize that turbulent markets often create opportunities. High-quality assets with strong cash flow and compelling growth trajectories continue to attract buyers. M&A remains a powerful tool—not just for expansion, but also for de-risking and strategic repositioning. Whether through acquiring new customer segments, strengthening supply chains, or entering adjacent verticals, well-executed deals can drive meaningful transformation. Looking ahead, companies that stay agile and opportunistic—prepared to both buy and sell—are better positioned to gain competitive advantage against the backdrop of uncertainty.

Deal Drivers in Q2 2025

- Strong consumer demand for Better-For-You Foods: Major food companies are strategically acquiring smaller, innovative brands that offer healthier options and appeal to the growing consumer focus on health and wellness

- Continued consolidation in the bakery segment: Both larger food companies and private equity firms are actively participating in deals, with acquisitions spanning offerings from private label manufacturers to specialty bakeries

- Heightened acquisition interest in U.S. cheese producers: Larger players are acquiring smaller, niche producers to expand their portfolios while private equity firms see an opportunity for growth and consolidation

Sector Highlights

- The packaged foods segment accounted for majority of M&A activity in Q2 2025 with a total of 28 deals. In the theme of health and wellness, notable transactions included the acquisition of Rowdy Mermaid, a maker of functional wellness beverages, by Next in Natural, a private equity firm that invests in Better-For-You CPG brands. The bakery segment, one of the most active for M&A, saw the formation of HC Private Investments’ Artisan Bakery, a platform created through the acquisitions of Snackwerks (a contract manufacturer of baked snacks) and Specialty Bakers (a commercial bakery that produces specialty desserts).

- Distribution remains an active segment for dealmaking. A total of 12 deals were completed in Q2, with GrubMarket continuing to be an active player – the company acquired Delta Fresh Produce, a distributor of fresh produce, as well as Coast Citrus Distributors, a wholesale distributor of fruits and vegetables.

- In the restaurant segment, strategic buyers and private equity are targeting scalable concepts that cater to consumers’ evolving tastes, from fast-casual, fresh forward restaurants to modern bakery concepts. In June, Savory Fund, a private equity firm that invests in restaurant brands, acquired Bonrue Bakery, a multi-location European-style patisserie known for its pastries, coffee, and lunch offerings. Read the full sector spotlight here.

Agribusiness, Food, and Beverage M&A Activity