Smart Labels: Driving Innovation and Growth

Smart label technologies continue to drive growth within the wider packaging industry.

THE MARKET

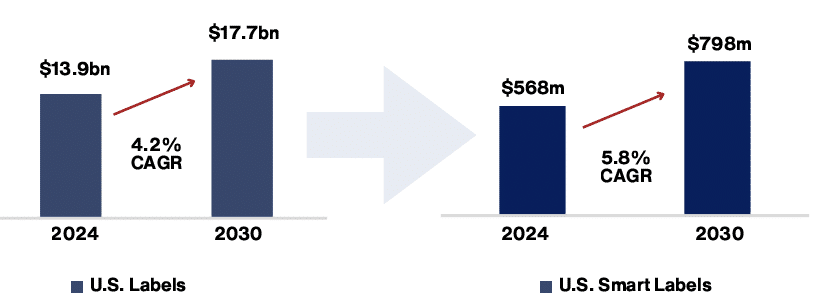

The U.S. smart label market is projected to grow at a 5.8% CAGR through 2030, outpacing the traditional labeling market estimated at a 4.2% CAGR over the same period, signaling a clear shift toward intelligent packaging solutions and technologies.

NOTABLE PLAYERS

Identiv and InPlay are developing BLE (‘Bluetooth Low Energy’) enabled smart labels for real-time tracking and sensing in cold chain, pharma, and logistics applications.

Avery Dennison Smartrac provides digital ID technologies that authenticate product history and enable tracking and inventory solutions, positioning it as a leader in smart labels.

CCL Industries acquired eAgile to strengthen its intelligent label offerings by integrating RFID into specialty packaging for product tracking, authentication, and supply chain visibility.

M&A IMPLICATIONS

Industry packaging players looking to stay competitive are seeking bolt-on acquisitions with smart label technologies that offer:

- Technological Differentiation: Traditional converters can integrate digital capabilities into their core offering, improving client stickiness and margins.

- Cross-Sell Potential: Smart labeling can be layered onto existing packaging products (cartonboard, flexible, plastic), unlocking incremental revenue from existing customers.

- Access to High-Growth Markets: Smart labels often serve high-regulation or innovation-driven industries (e.g. pharma, medtech), providing access to defensible, higher-growth end markets.

- Scalable Integration: Most smart label players are small-to-mid-sized with limited capex needs, making them ideal bolt-on acquisitions for industry leaders and private equity platforms.