How to Value A Business

Cracking the Code: Why Valuing Government Contractors Is One of Wall Street’s Toughest Puzzles

Government contractors sit in one of the strangest corners of the business world. On paper, they have the best customer imaginable—the United States Government, the single largest buyer on the planet. In practice, their operating model can be complex: prime and subcontracts intertwined, small-business and 8(a) set-asides mixed with full-and-open competitions, and a jumble of cost-plus, T&M, and firm-fixed-price agreements. Add in classified contracts with intelligence agencies and wildly different technology offerings—from basic logistics to cutting-edge AI—and you have a valuation exercise that’s as much art as it is science.

For investors, acquirers, and owners, understanding what these firms are worth isn’t optional. It’s mission-critical. Unlike public companies, where Wall Street spits out multiples by the minute, valuing a private contractor requires threading together market data, cash flow projections, and industry-specific quirks that can swing prices millions of dollars in either direction.

Market Check: What Have Others Paid?

Valuation begins with comparables. For public companies, EV/EBITDA ratios are published in every quarterly report. But private firms never trade at those glossy multiples. Middle-market contractors typically get discounted—sometimes by double-digit percentages—for their smaller scale, thinner liquidity, and higher risk.

Beyond public comps, acquirers comb through private deal databases like Capital IQ and GF Data. Who’s buying? At what multiples? Under what deal structures? These negotiated transactions are often the truest benchmark for what a contractor might actually fetch in today’s market.

The Green Visor Test: Cash Flow Models

Then comes the math. Bankers and analysts turn to the Discounted Cash Flow (DCF)—finance’s “gold standard”—projecting five to ten years of earnings, then discounting them back to today’s dollars. It’s a rigorous framework, but one that’s painfully sensitive to assumptions. Change the discount rate or terminal growth by a fraction, and millions vanish.

Private equity buyers often run a Leveraged Buyout (LBO) model instead, layering in debt. The use of leverage can boost expected returns—and therefore push valuations higher—but it also introduces risk. The LBO may act as the “high-side” test of what financial buyers might be willing to pay.

The Contractor Twist: What Really Moves the Needle

Government contractors don’t fit neatly into the spreadsheet. Their value is shaped by a set of industry-specific factors:

- Capabilities Offered – High-end skills like cybersecurity, cloud, AI, and advanced analytics command premium multiples. Routine services like logistics or training rarely do.

- Small Business vs. Full & Open – Contractors reliant on set-asides face valuation discounts; those winning full-and-open competitions prove scalability and command higher prices.

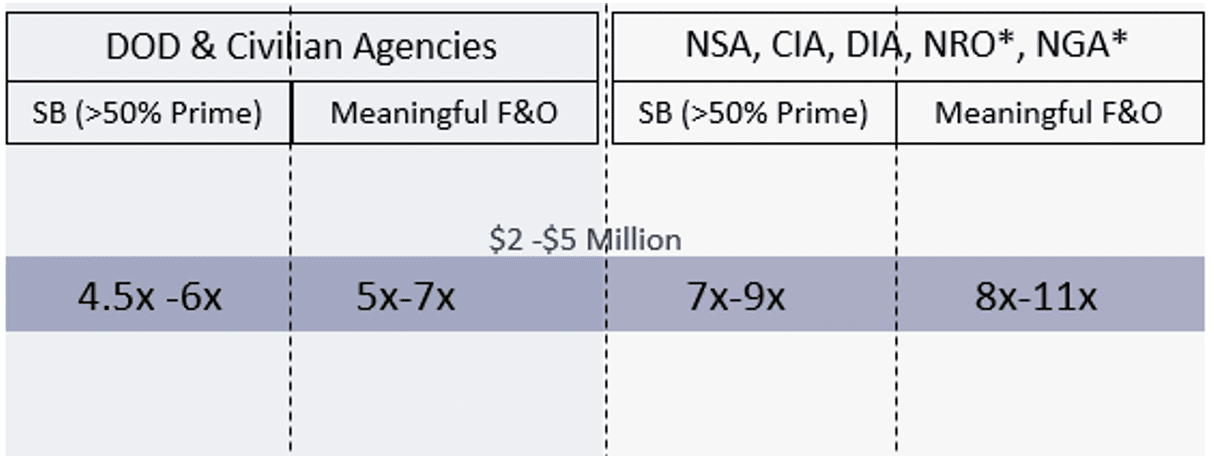

- Agencies Served – Civilian and defense work trades at moderate multiples, but firms inside the intelligence community’s walled garden often sell at eye-popping premiums.

- EBITDA Scale – Bigger is better. Larger contractors attract a broader buyer pool and higher multiples.

- Backlog – Contracts already inked for two or three years of revenue act as ballast, reducing buyer risk and pushing values upward.

The Bottom Line

Valuing a government contractor isn’t about finding “the number.” It’s about bracketing a range anchored in both hard market data and projected cash flows—then adjusting for the peculiarities of federal contracting. The winners in this space—the companies that consistently sell at the top of the range—are the ones with differentiated capabilities, scalable contracts, marquee agencies, strong EBITDA, and locked-in backlog. Everyone else? They risk being trapped in the lower tiers of the market.

For M&A dealmakers, this is the riddle of federal contracting: how to price a business that has both the world’s most reliable customer—and some of the most impenetrable obstacles to valuation.

This is just one slice of a comprehensive model we’ve developed at FOCUS. To find out what your company is worth, give us a call.

Mid-level capabilities:

- Software Engineering

- IT Enterprise Services & Modernization

- DevSec Ops/Agile Development

- SETA