Agribusiness & Food Industry: Animal Feed & Nutrition Spotlight

The animal feed & nutrition industry is driving scale, resilience, and value in an evolving global market.

- As consumer expectations evolve—driven by demand for higher protein and more sustainable food production—these pressures will continue to push the animal feed and nutrition industry to adapt as well.

- To remain competitive and responsive to evolving consumer demands, the animal feed and nutrition industry must prioritize enhanced animal health and environmental sustainability. Embracing scientific advancements and emerging technologies will be essential for this transition—and realizing this growth potential will require significant investment.

- Underpinning the recent M&A activity within the market has been strategic acquirers’ appetite for the acquisition of animal health businesses to support their investment in scientific and technology capabilities.

- The industry continues to experience a broad range of challenging headwinds; however, the ongoing volatile economic climate is the greatest threat to the market (geopolitical uncertainty – short term tariff turmoil and ongoing conflicts). This means that the most immediate attention for all market participants is to manage the scarcity of resources (raw materials & labor) which is driving up costs and affordability for customers.

Global trends affecting feed production

- Macroeconomic Conditions: The ongoing Russia-Ukraine crisis and U.S. tariff landscape continue to drive volatility in global supply chains for additives, ingredients, and essential grain inputs. Many operators face higher costs and lower margins, with further disruptions expected as trade policies evolve.

- Climate Sustainability: Climate change has significantly affected the animal feed & nutrition sector, with shifting weather patterns leading to more frequent droughts and floods in recent years. These extreme conditions have ultimately resulted in lower crop yields and reduced output, posing challenges for producers and supply chains.

- Consumer Driven Demand: In recent years, health-conscious consumers have increasingly prioritized nutrition and exercise. This shift has fueled demand for high-protein diets, driving growth in poultry, beef, and pork consumption.

- Technological Advancements: Scientific and technology advancements have enabled animal feed & nutrition producers to maximize output and improve efficiencies. Many operators have integrated technologies such as artificial intelligence (AI) and automation to streamline production.

Recent M&A activity within the market has been focused on investment in businesses with scientific and technology capabilities

THE MARKET

- In 2024, the animal feed and nutrition market was valued at €25.15bn and is forecasted to grow at a CAGR of 6.93% to reach €49.15bn by 2034. The market is influenced by increased regulatory pressures, volatile commodity markets, rising meat (protein) demand, and more sustainable environmental practices.

- As of 2024 there is currently 28,320 mills globally, Asia-Pacific is the largest producer, accounting for 43% of global production, followed by North America (27%), Europe (24%), and Latin America (6%).

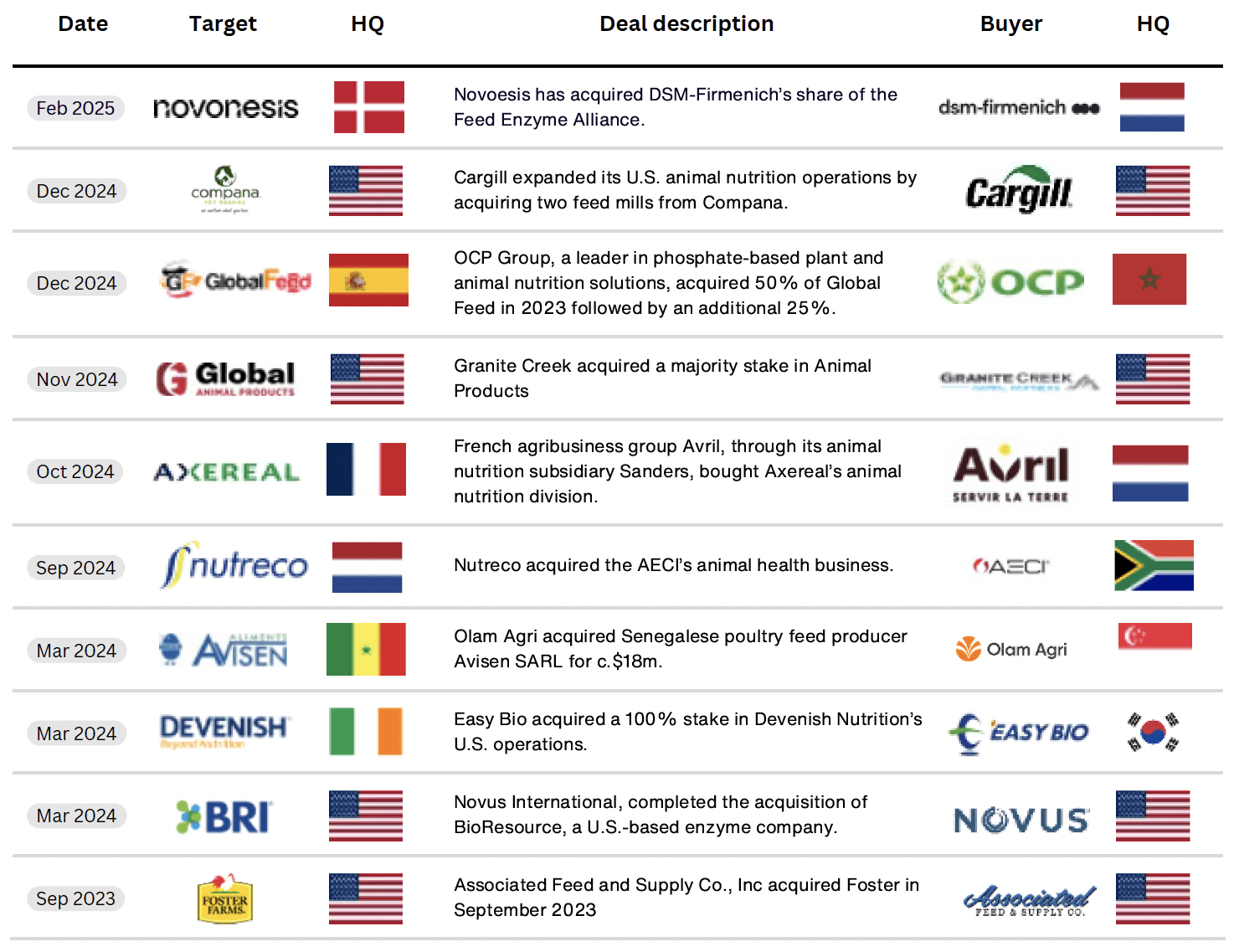

- A total of 175 M&A deals have been completed globally within the broader animal feed & nutrition sector between 2022 and Q1 2025. This activity has been driven by strong interest from strategic acquirers seeking access to animal health businesses. In recent years, private equity interest in the pet food sector has also increased, leading to some consolidation within this sub-segment.

TRANSACTION ACTIVITY

Global Volumes

Transaction activity in the animal feed and nutrition sector dropped from 71 deals in 2022 to 34 in 2024. This sharp decline reflects heightened market uncertainty, driven by commodity price volatility and geopolitical disruptions.

Global Volumes by Buyer Type

Strategic buyers dominate acquisitions of animal feed & nutrition businesses since 2022 and in the first quarter of 2025, this trend is even more prevalent.

M&A Transaction Volumes by Deal Type & Regions

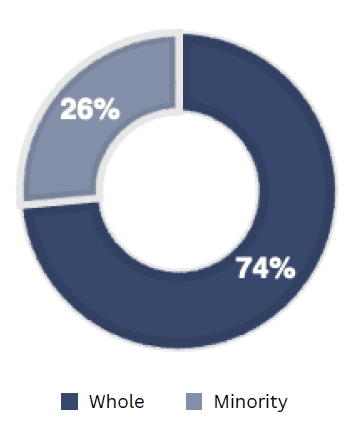

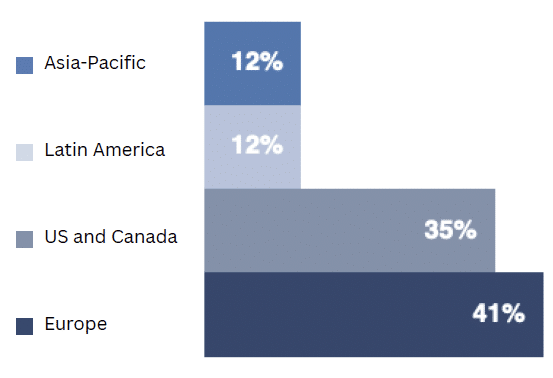

M&A activity is primarily driven by majority acquisitions executed by strategic buyers.

North America and Europe accounted for 76% of all global volumes followed by Latin America.

Recent Transactions

Key Players and Consolidators

M&A transactions have been primarily shaped by majority acquisitions from strategic acquirers aiming to expand product portfolios, strengthen core capabilities, and capture operational synergies. These buyers are targeting deals that deliver scale, brand equity and alignment with evolving consumer trends.

SEGMENT SPOTLIGHT: PET FOOD MARKET

The market is rapidly evolving, driven by premium & scientific based food trends

- The pet sector is evolving rapidly, driven by premium food trends, science-backed supplements, growing services, and shifting M&A dynamics.

- Pet owners treat pets increasingly like family, driving strong demand for human-grade and fresh food products. From 2020 to 2024, premium dog food sales rose over 40%, despite a slight decline in volume. The pet supplement market has grown nearly 20% annually as consumers seek vet-backed health claims, shifting toward preventative care over reactive treatments.

- Valuations in the pet sector remain strong, with companies like Chewy and Freshpet trading at high EV/EBITDA multiples—reflecting strong consumer demand and the category’s high-growth profile for premium pet food products.

- Investor confidence in the pet sector is driven by resilient growth, strong margins, and recession-resistant demand. As competition intensifies, consolidation is accelerating—especially among mid-sized premium brands seeking scale. The category’s stability and premiumization make it a standout for strategic and financial investors.

Download full article here.