Why private credit lenders can’t get enough of IT MSPs

Written by Claire McDonnell

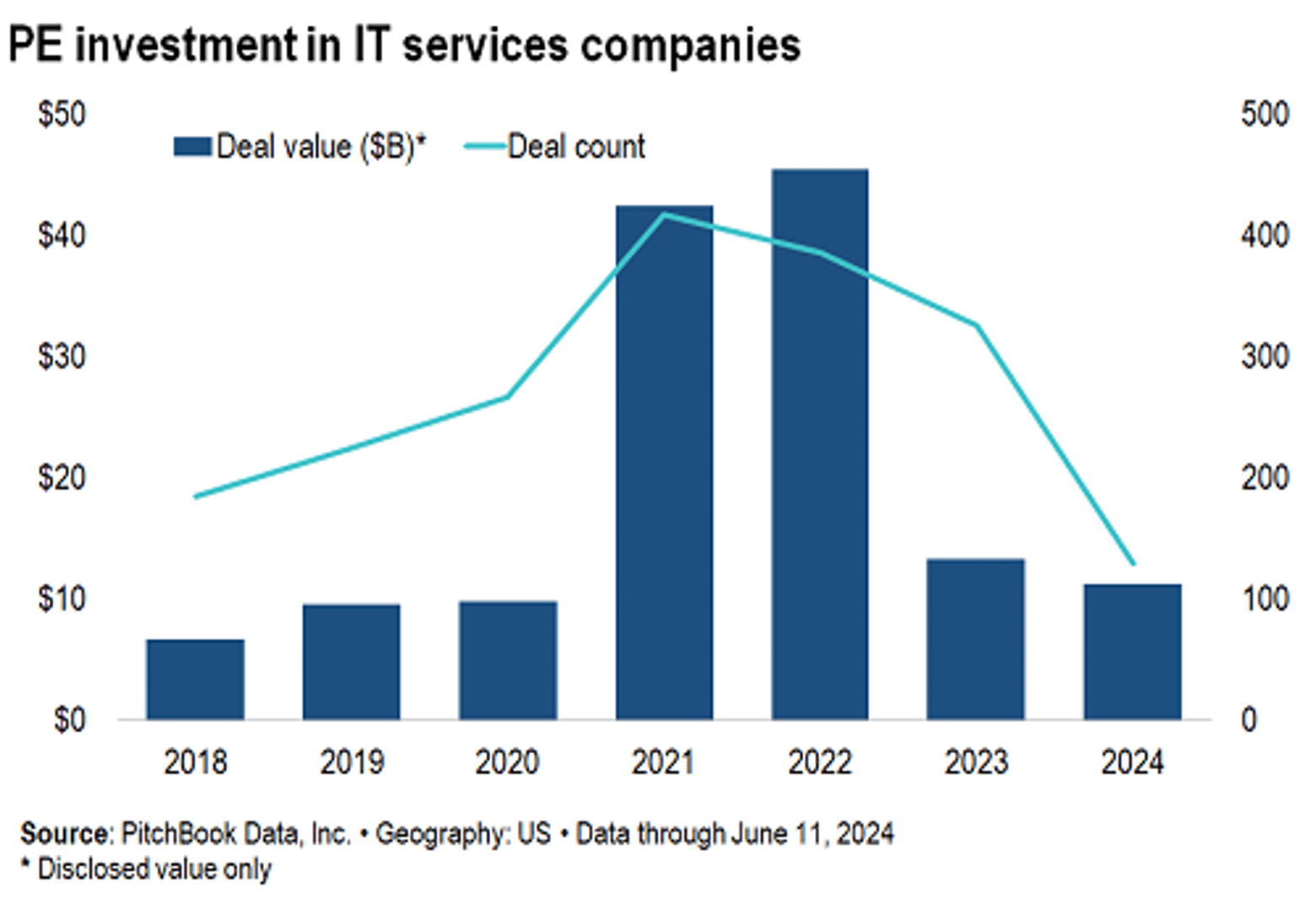

IT-focused managed service providers (MSPs) appear to be an ideal investment pick for private credit lenders and private equity sponsors alike. A flurry of activity in this space, including recapitalizations and repricing, may be around the corner, market participants say.

MSPs have traditionally been third-party providers of information technology infrastructure and end-user systems services — a subsector of the IT services industry. They most commonly provide off-site support for IT infrastructure, including connectivity, network monitoring, and security. MSPs can also provide outsourced human resources or marketing.

Private equity investors like IT-focused MSPs because of the potential of this large, fragmented market, which makes the industry prime for a buy-and-build strategy.

According to data from FOCUS Investment Banking, most MSP deals to this point have been mergers of equals. Now, due to growth of these companies, many may be due for recapitalizations. Larger sponsors, strategic buyers, and software companies are expected to be interested in the sector.

Private credit lenders have piled into business services in recent years. There may not be enough MSP deals to go around.

Private credit lenders like IT-focused MSPs due to their high switching costs and recurring revenue streams resulting from long-term software licensing contracts. Lending into a buy-and-build strategy via an IT MSP can be a good fit for private credit financing, such as a DDTL (delayed-draw term loan).

“There’s an oversupply of capital that would like to invest in MSP assets,” said Abe Garver, managing director and MSP team leader and FOCUS Investment Banking. “We could do 100 of these transactions per year, if we had the assets, but we will probably do closer to one per month.”

Garver estimates over 200 MSP platforms are coming due to be recapitalized by larger sponsors or competing platforms.

The Purple Guys is a prime example of transaction in the MSP space. The company was purchased in 2020 by Kian Capital Partners and ParkSouth Ventures. In April, it was sold to a larger sponsor-backed MSP platform, Ntiva.

Another example, Integris, a “merger of equals” between Domain and Tier One, was completed by private equity sponsor Frontenac in 2020. Deerpath Capital provided debt financing in the form of a revolving credit line and a senior debt facility in support of the transaction.

“It’s like the gift that keeps on giving for us,” said Mark Solovy, co-head of technology finance group at Monroe Capital, that has also lent to MSPs. “When we get into a new platform with a sponsor, we often understand the playbook is then to buy smaller MSPs and integrate them.”

“MSPs have been a great play for private credit, because the sponsors are looking for debt financing from lenders they know and trust, and who can scale with them to finance their platform through these add-on deals,” said Solovy.

Compliance, cybersecurity needs

Outsourcing IT services also makes perfect sense for small- to midsized companies facing increasing costs and regulation for tech services and data protection.

Despite aspects of this shared business service that are commoditized, it remains a high-touch business, with the ability of a provider to potentially add value, market participants say.

Consumers likely don’t know brands of even the industry’s largest operators: names like Kaseya or Datto. Yet these companies are integral to small- and midsized businesses who can benefit from shared business services.

“We like the space for several reasons: it’s a mission-critical service that any SMB (small-to-medium size business) needs, which means the TAM (total addressable market) is very large,” said Krum Dukin, managing director at Evolution Credit Partners. “It’s also really sticky because there are significant switching costs, particularly around software licenses, which are purchased under the IT services provider.”

The opportunity set for a private equity firm may be even better in the lower middle market than for larger deals. There, most MSPs that are smaller in size (<$10 million of EBITDA) and have never taken on institutional capital before, market participants say.

“The PE-backed IT managed services add value by professionalizing the highly fragmented mom and pop providers, enabling cross-sell of additional services, and implementing strategies to improve employee retention rates,” said Dukin.

Attractive financials, multiples

The average hold period for sponsor-backed MSP deals is 4.9 years, according to market sources.

With recurring revenues climbing north of 60% and average EBITDA margins ranging from 10-25% MSPs are an attractive target for institutional capital, market participants say. Companies with recurring revenue of at least 50% are considered “investable,” while the best ones have 80-90% recurring revenue streams.

Moreover, most MSPs have a diverse customer base, as they service customers across all industries, minimizing industry concentration risk.

Away from MSP IT providers are the companies that offer related software.

Among them, Kaseya’s $3.3 billion private credit agreement to support the purchase of Datto is possibly the market’s marquee MSP software transaction involving private credit loans. The financing commitment also included a $200 million delayed-draw term facility and a $200 million revolver. The lenders are Golub Capital, Blackstone Credit, Ares Management Credit Funds, Owl Rock Capital, Oak Hill Advisors, and Carlyle Global Credit. Kaseya is an investment of Insight Venture.

Prior to Datto being acquired by Kaseya in 2022, Datto reported adjusted EBITDA margins of 28% with subscription (recurring) revenue as 93% of total revenues as of year-end 2021, a 10-K filing dated Dec. 31, 2023, showed.

In another deal, SailPoint Technologies was acquired by Thoma Bravo in 2022 for $6.9 billion with a $1.6 billion loan led by Blue Owl, Golub Capital, Blackstone, and BlackRock.

Additionally, Thoma Bravo is seeking around $3.5 billion from private credit lenders for the refinance of ConnectWise’s existing debt and to support an add-on acquisition, Bloomberg reported this week.

Generally speaking, entry multiples for MSP deals in the smaller end of the market are typically between 6x-12x, with exit multiples ranging from 10x-15x or higher, depending on EBITDA size, market participants say.

This multiple expansion is mainly attributable to private equity sponsors’ multiple arbitrage efforts to the business, where they roll-up a number of smaller MSPs under one umbrella platform company.

“There’s so many of these smaller MSP players out there — either they focus on a particular service, particular region, or a particular set of customers,” said Solovy. “You can buy those for single digit multiples and get the appreciation to your platform value.”

New customer challenge

But there are challenges to the buy-and-build approach, which is not new.

While MSPs remain attractive investment opportunities due to their non-cyclical nature, potential stable revenue streams, and attractive margins, market participants note some caveats with these types of companies.

The market for MSP providers is saturated, with greenfield opportunities hard to come by. While potential for growth through M&A can be significant, organic growth for MSPs is hard to achieve.

MSPs typically don’t exhibit much organic growth under sponsor ownership, as most SMBs have contracts with an MSP in place, so winning new customers presents a challenge to these businesses.

Additionally, customer concentration can affect an MSP company’s value.

“The loss of a customer that hurts a business by $500k can result in a $2 million haircut on the total purchase price,” said Garvner from FOCUS Investment Banking.

AI tailwinds

“These businesses can typically support 5-6x senior leverage with 1-2x junior leverage, depending on scale,” said Dukin.

Pricing for MSP deals are based on market conditions, but typically fall between S+500 to S+600, market participants say.

Although MSPs have attractive margins and stable revenue streams, the lack of organic growth paired with high interest costs yields minimal free cash flow for these businesses to reinvest, thus requiring them to take on additional leverage for nearly all add-on activity.

“These businesses tend to have higher leverage levels and while the recurring nature of their cash flows is attractive, borrowing costs are high today,” said Reed Van Gorden, head of originations at Deerpath Capital, who lends to MSPs. Add-ons must be chosen carefully, he said. “Even with decent cash flow, there’s not a ton of free cash flow after paying debt service costs, and thus, many add-on transactions need to be financed through additional equity rather than a loan upsize.”

Artificial intelligence may play a vital role in the growth of the MSP industry, but that role has yet to be solidified, market participants say.

“There are a lot of tailwinds in the space, and AI actually makes things more confusing for the end customer… and so confusion in the marketplace from AI is actually another tailwind for choosing an MSP that may have some additional focus or knowledge in that space,” said Solovy.

“AI should be another growth vector for these kind of businesses in terms of consulting, implementing, and installations.” said Stewart Hanlon, co-head of technology finance group at Monroe Capital.

Moreover, the work from home wave provides tailwinds for MSP growth as SMB’s technology needs are constantly expanding.

With caveats

Furthermore, the switching costs are relatively high, so winning a new customer from a competitor is difficult as well, market participants say.

“For lenders, the stability in cash flow is attractive — substantial growth doesn’t increase the debt service payments to a lender.” said Van Gorden. “However, growth does of course greatly impact the equity value and ultimate return on investment for the owner. As such, if some of these MSPs can figure out what new services to offer to increase organic growth, that would be the holy grail. We just haven’t really seen that happen yet.”

In an environment where technology and business service multiples pull back, MSPs and other companies alike are at risk of exiting for around the same price they were purchased at, and without organic growth to supplement, sponsors aren’t left with much of a return.

The MSP industry remains a relationship heavy sector, and the best investments are the ones with the best relationship network, market participants say.

“The MSPs that prove out to be both good equity and debt investments are the ones that scale through roll-ups and consolidation,” said Hanlon. “That comes from having good relationships with customers, with vendors, and third-party partnerships.”

This article was originally written and published for Pitchbook.