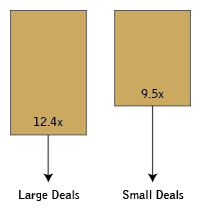

Deal Size—EV/EBITDA Ratio – 2015

Why does the differential persist? To begin, acquirers believe small deals are riskier than large ones. Small companies tend to have less product diversification, to lack management depth, and to tolerate more customer concentration, among other concerns. To compensate, an acquirer demands a greater projected return-on-investment, all things being equal.

The higher the rate-of-return requirement—the lower the upfront value becomes. Consider the following cash flow stream at two discount rates, and notice the diminished Net Present Value (NPV) at the higher discount rate (i.e., $83 million vs. $95 million).

Discounted Cash Flow Calculation (In millions)

| 1 | 2 | 3 | |

|---|---|---|---|

| Free Cash Flow | $10 | $12 | $15 |

| Terminal Value | — | — | 100 |

| $10 | $12 | $115 | |

| NPV—15% IRR | $95 | ||

| 20% IRR | $83 |

Compounding the situation for middle-market company owners is the law of “supply and demand.” The supply of small firms for sale is greater than that of large enterprises. As a result, the value multiples of small deals get pushed down, relative to bigger transactions.

As one illustration, consider the public trading prices of professional service contractors to the federal government. Firms with over $1 billion in market capitalization traded at a median EV/EBITDA ratio of 9.3x in November 2015. Smaller companies traded at a 7.6x median, a negative difference of 22 percent.

Over the last two years, M&A deals in that sector for which information was available, showed a negative difference of 10 percent between large and small transactions.

As another example, for the mobile solutions industry, the negative differences were 38 percent and 11 percent, respectively, in November 2015.

FOCUS consistently observes this disparity in its own advisory work, and we often remind business owners that attaining a premium value multiple relies, in part, on the operation achieving a particular size.

When considering the M&A process, middle market corporate owners—be they buyers or sellers—need to remember this dynamic and to approach deal pricing accordingly.