OVERVIEW

Supply Chain Technology and Logistics M&A Report – Second Half 2024 – A Dramatic 115%Increase in Transactions Over 2023

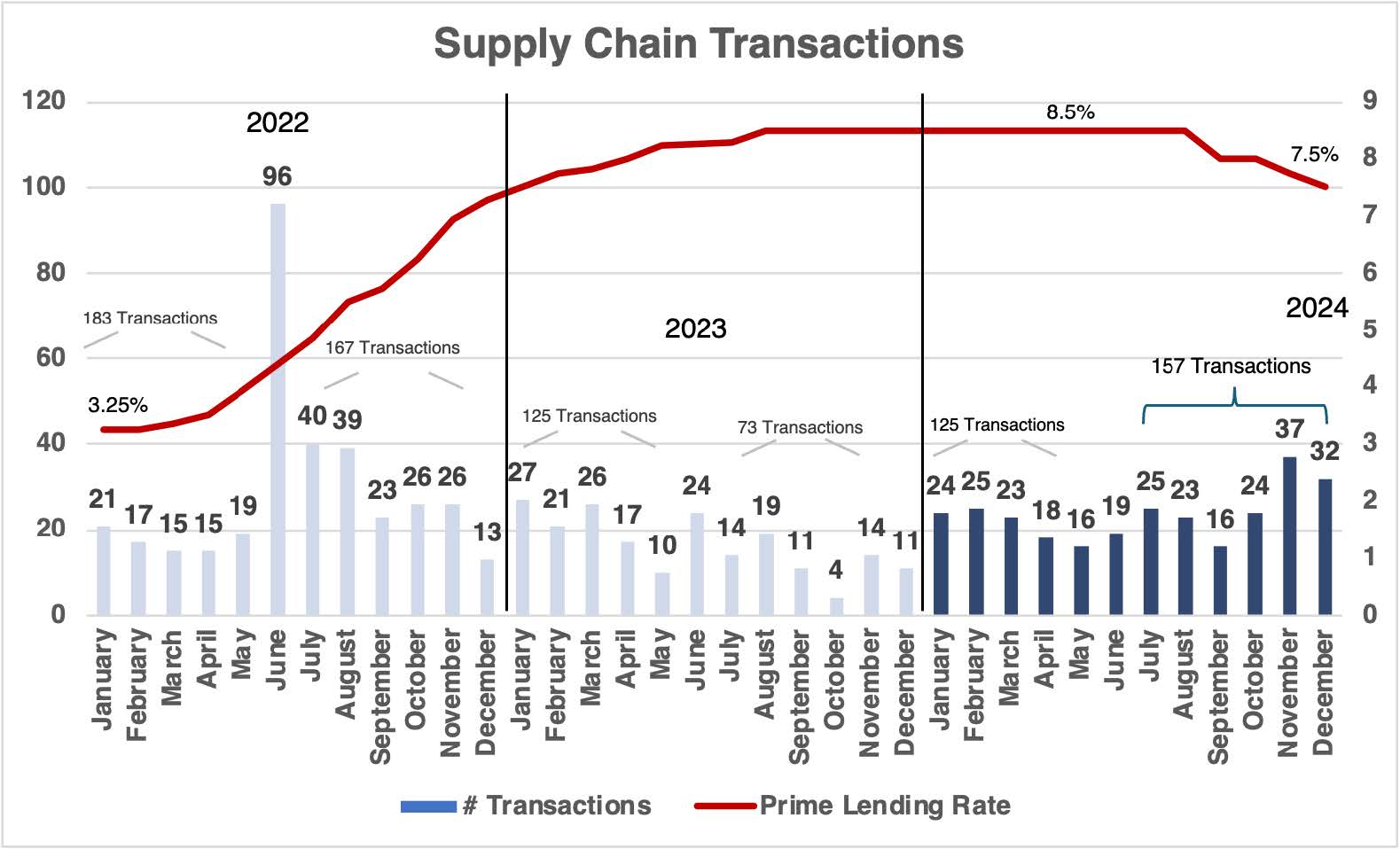

In our Second Half 2024 report we discuss some of the major trends we are seeing in the market, and report on the M&A activity in the overall Supply Chain market. Included in this report is the list of 157 North American Supply Chain M&A transactions. They are categorized into strategic, private equity, technology, and logistics backed transactions.

Investment Banking and Advisory Services

FOCUS Investment Banking is a leading investment bank with specialized supply chain industry expertise, concentrating on providing highly tailored services to emerging middle market and larger organizations in this sector:

- Mergers & Acquisition Advisory

- Corporate Development Consulting

- Strategic Partnering & Alliances

- Capital Financing, Debt & Equity

- Corporate Valuations.

KEY TAKE AWAYS – TECHNOLOGY AND PE TRANSACTIONS CONTINUE TO INCREASE

Technology Transactions – 70% increase over the first six months and 174% increase over 2023

PE Backed Transaction – 59% of all transactions and a 600% increase over 2023

AI and Software Driven M&A Dramatically Increased in the Second Half of 2024

In the second half of 2024 there were 63 technology-based transactions which represented 40% of all supply chain transactions for that time period. That is a whopping 70% increase over the first half of the year and a 174% increase over the same period in 2023. This was driven by increases in software and SaaS companies addressing everything from supply chain risk to visualization software for vessel operations. Additionally, there is an increasing number of AI and autonomy company transactions. These transactions represented 25% of the technology transactions. This trend will continue to accelerate as new applications emerge and are adopted.

Looking Forward: AI and Automation progress should not be underestimated. We believe it will continue to play a larger role in M&A as firms decide they need to get in the game or accelerate their capabilities.

Private Equity Continues to Drive M&A

In the second half of 2024 there were 92 private equity backed or direct investments that represents 59% of all second half transactions and a modest increase of 4% over the first half of 2024. It is important to note that this is also an over 6x increase over the same time period in 2023. Private equity is increasingly realizing that technology and scale in the supply chain industry can drive solid investment returns as the world’s supply chains continue to change and increasing efficiencies are in demand.

These trends result in private equity firms continuing to target mid-sized logistics, distribution, and software companies for consolidation. In addition, PE-backed roll-ups will continue to be common in fragmented markets like freight brokerage, warehousing, and supply chain tech.

Vertical Integration for Resilient Supply Chains

Companies will continue to look to secure raw materials, manufacturing, and distribution assets through acquisitions. This trend is driven by geopolitical uncertainties, global supply chain disruptions, and inflationary pressures. We expect strategic buyers to continue to secure raw materials, manufacturing, and distribution assets through acquisitions.

Declining Interest Rates Help Spur Increase in M&A

The Federal Reserve initiated a series of interest rate cuts beginning in September 2024, reducing rates by a total of 100 basis points by December. This monetary easing aims to stimulate economic activity and reduce the cost of capital, making financing for M&A transactions more accessible and attractive.

Trends to Watch Out for in the Coming Turbulent Year

Investment Shifts: Businesses might reconsider investments in Mexico and Canada due to the heightened costs associated with tariffs, potentially slowing the momentum of nearshoring initiatives that had been gaining traction.

Reshoring and Inshoring: Companies may look to other emerging markets or consider reshoring to the U.S. to mitigate tariff impacts, altering the landscape of supply chain management and investment.

Investment Hesitancy: The unpredictability introduced by sudden policy shifts and tariffs may cause private equity firms to exercise caution, potentially leading to a slowdown in mergers and acquisitions within sectors heavily reliant on foreign supply chains.

Valuation Adjustments: Companies operating in affected regions might experience changes in valuations due to increased operational risks and costs, influencing deal-making decisions and investment strategies.

DOWNLOAD THE FULL REPORT HERE.